Market News

Trade setup for Jan 13: NIFTY50 drops below 200 EMA – Will it hold 23,000 support zone?

.png)

4 min read | Updated on January 13, 2025, 07:19 IST

SUMMARY

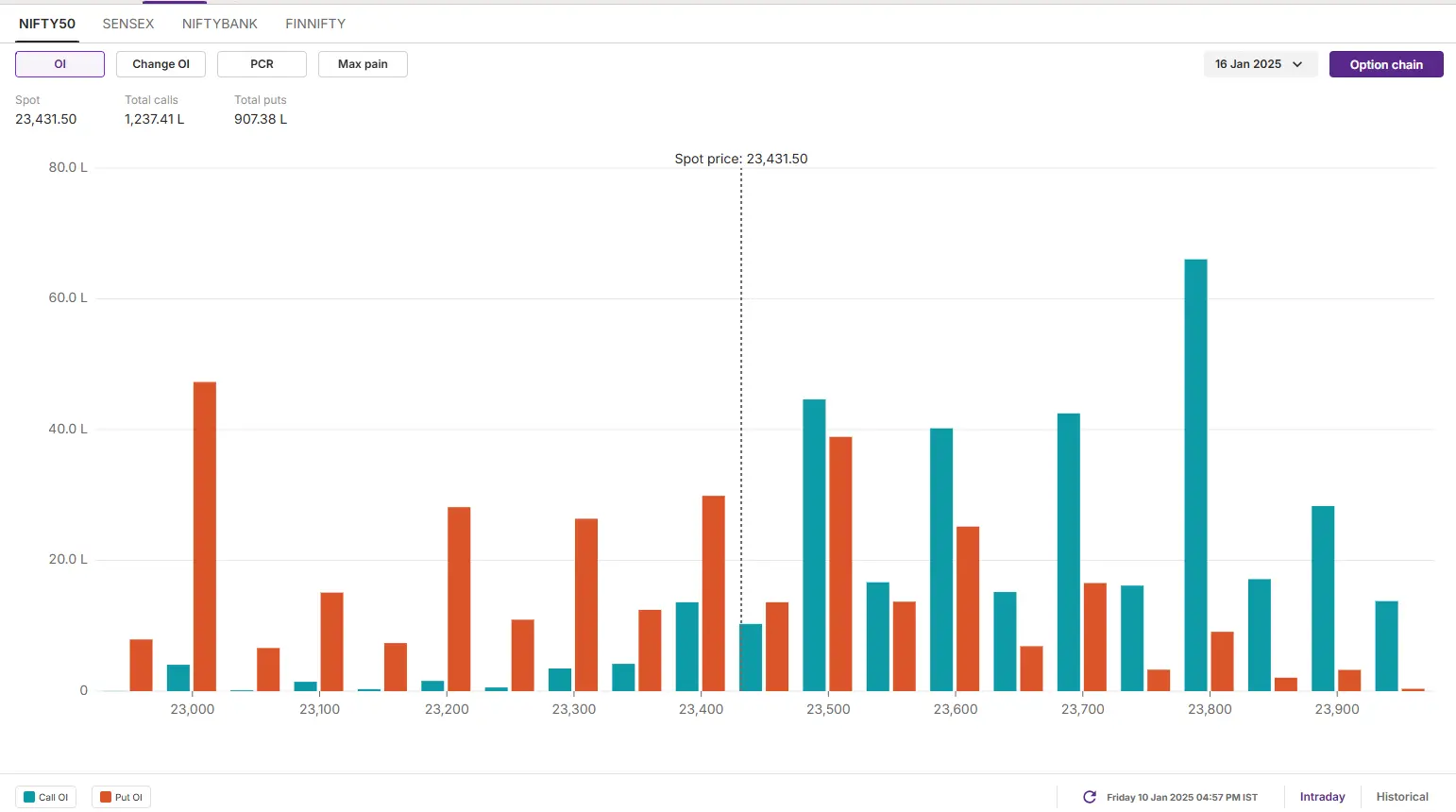

As per the open interest (OI) data of 16 January, the NIFTY50 index saw a significant call OI was placed at 23,800 strike. This indicates that the index will face resistance around this zone.

Stock list

As per the daily chart, the SENSEX is currently placed at a crucial support zone of ₹77,000 zone.

Asian markets @ 7 am

- GIFT NIFTY: 23,315.50 (-0.06%)

- Nikkei 225: Closed

- Hang Seng: 18,918.15 (-0.77%)

U.S. market update

- Dow Jones: 41,938 (▼1.6%)

- S&P 500: 5,827 (▼1.5%)

- Nasdaq Composite:19,161 (▼1.6%)

U.S. indices tumbled on Friday after labour market data for December came in much hotter than expected. This added to the investor concerns that the U.S. Federal Reserve will slow down the pace of interest rate cut in 2025.

The nonfarm payrolls report showed that the U.S. employers added 2.56 lac jobs in December, well above the estimates of 1.55 lac. The strong jobs report revealed that the latest evidence of continued strength in the economy.

NIFTY50

- January Futures: 23,500 (▼0.5%)

- Open interest: 5,41,733 (▼0.7%)

The NIFTY50 index extended its losing streak to a third consecutive session, closing below the 200-day exponential moving average (EMA) for the second day in a row. Additionally, it formed a bearish candle on the weekly chart, finishing below the prior week's low, signaling continued weakness.

As per the daily chart, the index has slipped in the crucial support zone of 23,200 and 23,300. This zone coincides with the crucial swing low of November and June 2024, the zone of general elections 2024. Meanwhile, the immediate resistance zone of the index is visible around 21 EMA (23,800).

The open interest data for the 16 January expiry saw significant call base at 23,800 strike, signalling resistance for the index around this zone. On the contrary, the significant put base was seen at 23,000 strike, signalling support for the index around this zone.

SENSEX

- Max call OI: 78,500

- Max put OI: 76,000

- (Expiry: 14 Jan)

The SENSEX also extended the bearish momentum for the third day in a row as the index slipped below the 200 EMA on closing basis for the second day in a row. Additionally, the index formed a bearish candle on the weekly chart, signalling weakness.

As per the daily chart, the SENSEX is currently placed at a crucial support zone of ₹77,000 zone. This zone has acted as a strong support in the month of November 2024 and June 2024. If the index slips below this zone on a closing basis, it may further extend the weakness. On the other hand, the immediate resistance is placed at 21 EMA (78,800).

Meanwhile, the open interest data of the 14 January remains scattered and doesn’t offer clear directional clues.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story