Market News

Trade Setup for Dec 31: NIFTY50 breaks 200 EMA support, eyes further declines below 23,500

.png)

4 min read | Updated on December 31, 2024, 07:21 IST

SUMMARY

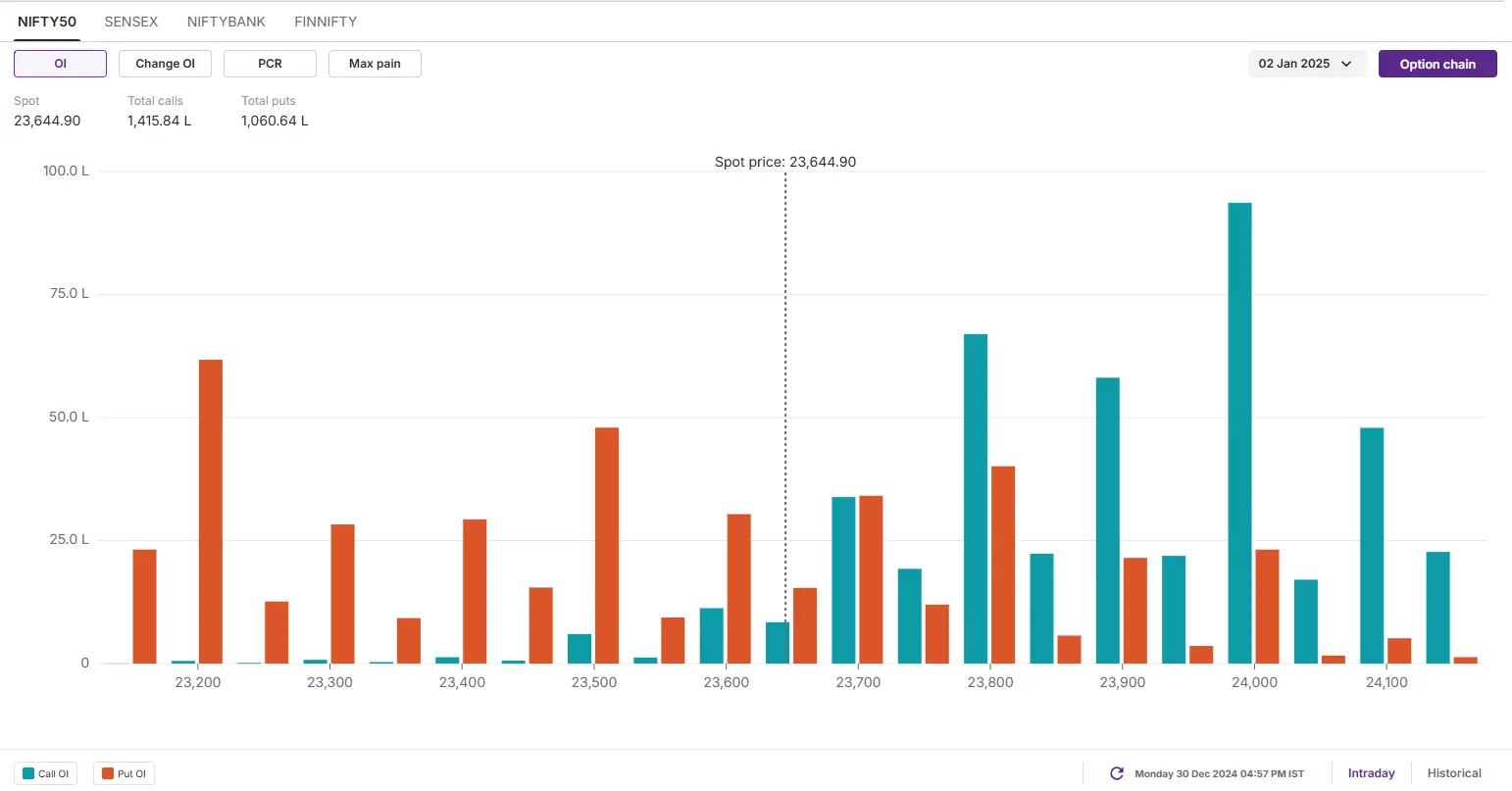

The options data of the NIFTY50’s weekly expiry saw a significant addition at 24,000 call strike, indicating the arrival of fresh sellers around this level.

Stock list

The NIFTY50 index started the week on a negative note and closed the day below the lows of the previous four days.

Asian markets @ 7 am

- GIFT NIFTY: 23,656.50 (-0.75%)

- Nikkei 225: Closed

- Hang Seng: 20,003.36 (-0.19%)

U.S. market update

- Dow Jones: 42,573 (▼0.9%)

- S&P 500: 5,906 (▼1.0%)

- Nasdaq Composite: 19,486 (▼1.9%)

U.S. indices fell on Monday before the second last trading session of the 2024 during the holiday-shortened week. The sharp fall in the indices was due to profit-booking in the technology stocks. Meanwhile, the shares of Boeing also fell over 2% following the Jeju Air Crash in South Korea which prompted an inspection of all its 737-800 planes.

NIFTY50

- January Futures: 23,816 (▼0.6%)

- Open interest: 4,94,940 (▲5.8%)

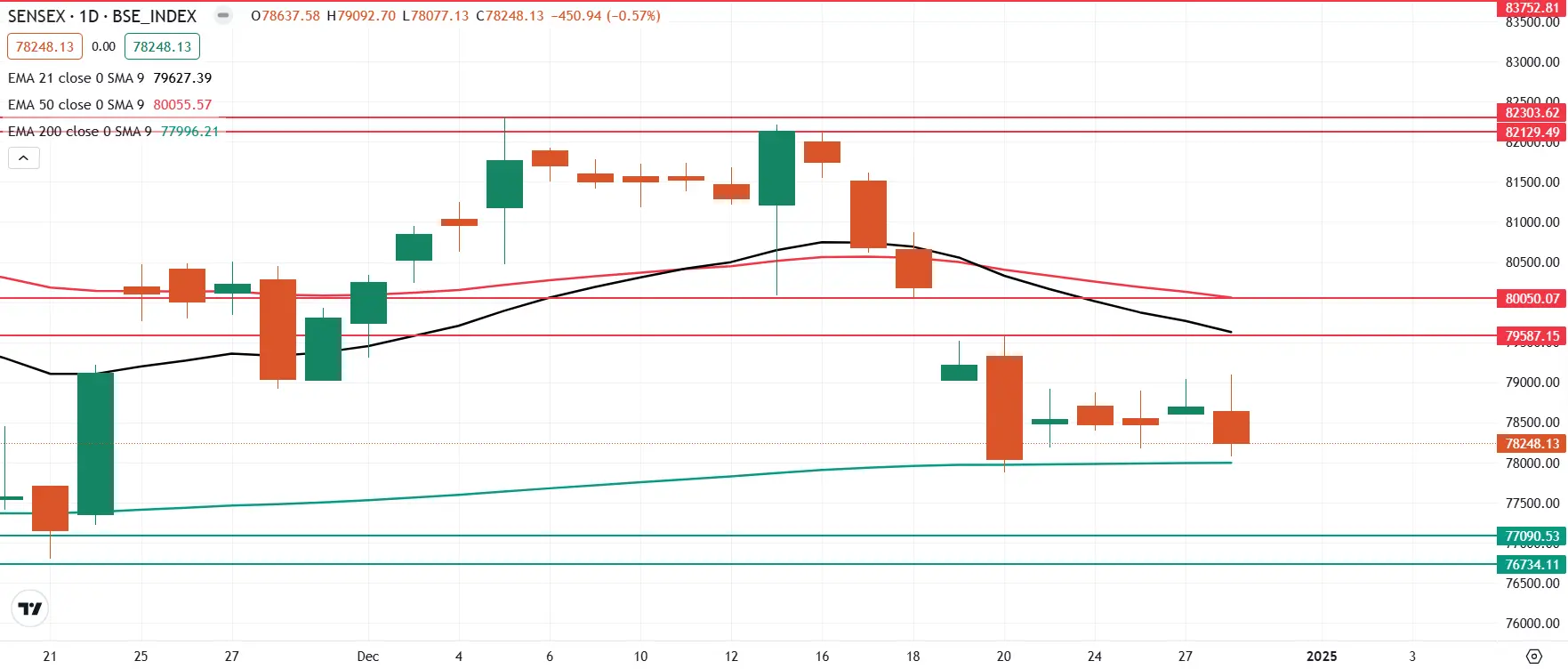

The NIFTY50 index started the week on a negative note and closed the day below the lows of the previous four days. The index formed a negative candle on the daily chart and closed below its 200-day exponential moving average (EMA), indicating weakness.

From a technical point of view, the NIFTY50 index has run into resistance around the 24,000 level and has been rejected in this zone for the second day in a row. On the flip side, if it slips below the 20 December low (23,537), it may extend weakness to 23,200 zone.

The open interest data for the 2nd January saw a significant addition at the 24,000 strike, suggesting that the index is around this zone. On the other hand, the put base shifted from 23,500 strike to 23,200 strike, suggesting support for the index around this level.

SENSEX

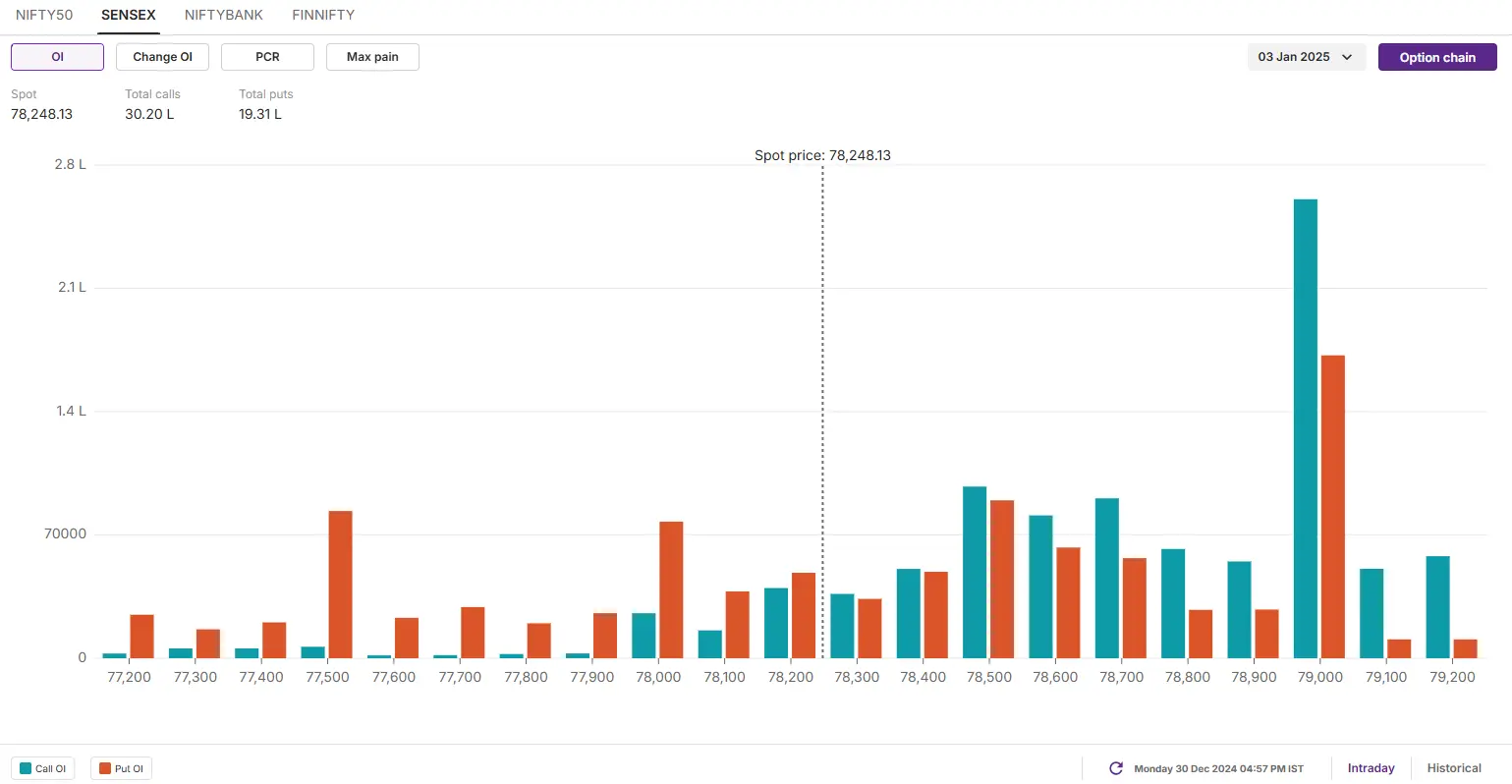

- Max call OI: 79,000

- Max put OI: 75,900

- (Expiry: 3 Jan)

The SENSEX began the week on a subdued note, encountering resistance near the 79,000 level after an initial rebound. It ended Monday’s session in negative territory, marking its lowest close in four sessions.

On the daily chart, the index is placed at a crucial support juncture of its 200 day exponential moving average. The SENSEX has protected the pscyhologically crucial level on a closing basis and a close below it will signal weakness. On the other hand, the immediate resistance of the index is around 79,000 zones.

The open interest data for the 3 January expiry has significant call build-up at 79,500, indicating resistance for the index around this area. On the flip side, the put base was seen at 78,000 and 77,500 strikes, with relatively low volume suggesting support for the index around this zone.

FII-DII activity

Stock scanner

- Long build-up: Adani Enterprises, Indian Hotels and Indraprastha Gas

- Short build-up: Macrotech Developers, Power Finance Corporation and Cummins India

- Under F&O ban: Nil

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story