Market News

Trade Setup for Dec 20: Bearish weekly candle – Will NIFTY50 hold 24,000?

.png)

4 min read | Updated on December 20, 2024, 07:20 IST

SUMMARY

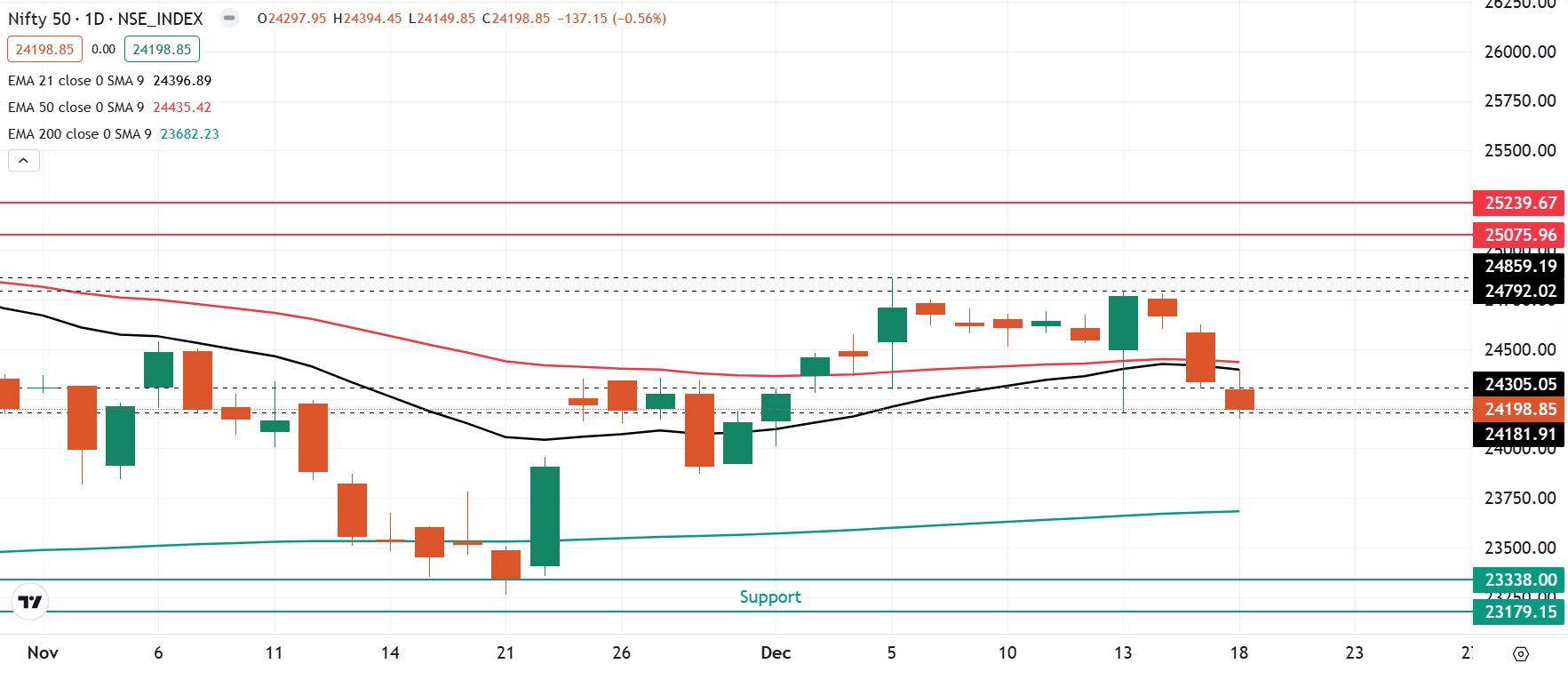

The NIFTY50 index is indicating a formation of bearish candle on the weekly chart, providing early indications of a close below previous two week’s low. In such a scenario, the index may extend weakness up to its 200 EMA. On the other hand, if index protects 24,000 zone on closing basis, then the trend may become sideways.

Asian markets @ 7 am

- GIFT NIFTY: 23,936 (-0.28%)

- Nikkei 225: 39,000 (+0.48%)

- Hang Seng: 19,697 (-0.28%)

U.S. market update

- Dow Jones: 42,342 (▲0.0%)

- S&P 500: 5,867 (▼0.0%)

- Nasdaq Composite: 19,372 (▼0.1%)

U.S. indices stabalised after sharp fall of Wednesday as the Dow Jones eked out minor gains and ended the 10-day losing streak, longest in 50 years. The sharp fall came after the U.S. Fed scaled back the number of rate cuts to two in 2025, down from four.

Meanwhile, the U.S. GDP estimate for the third quarter showed that the economy grew by 3.1%, driven by higher consumer spending and rising exports. Looking ahead, investors will be keeping a close eye on the core Personal Consumption Expenditures (PCE) report, the Fed's preferred measure of inflation. Street expectations are for a 0.2% month-on-month increase and a 2.9% year-on-year rise.

NIFTY50

- December Futures: 24,018 (▼0.9%)

- Open interest: 4,29,408 (▼1.9%)

The NIFTY50 index remained under pressure for the fourth consecutive day, closing below the key support zone of the previous week's low of 24,180, indicating weakness. The sharp fall of over 1% came after the U.S. Federal Reserve signalled two rate cuts in 2025, lower than the four previously highlighted.

As per the weekly chart, the index is currently trading below the low of previous two week’s, signaling weakness on the index. If the index ends below the low of previous two weeks low, then weakness may extend the weakness up to 23,400 zone, which coincides with the 50 weekly exponential moving average (EMA). Additionally, the index may also end the week below 20 weekly EMA.

However, if the index protects low of the previous two weeks and the high of the hammer candlestick pattern formed for the week ending 22 November, then the trend may turn sideways to bearish.

SENSEX

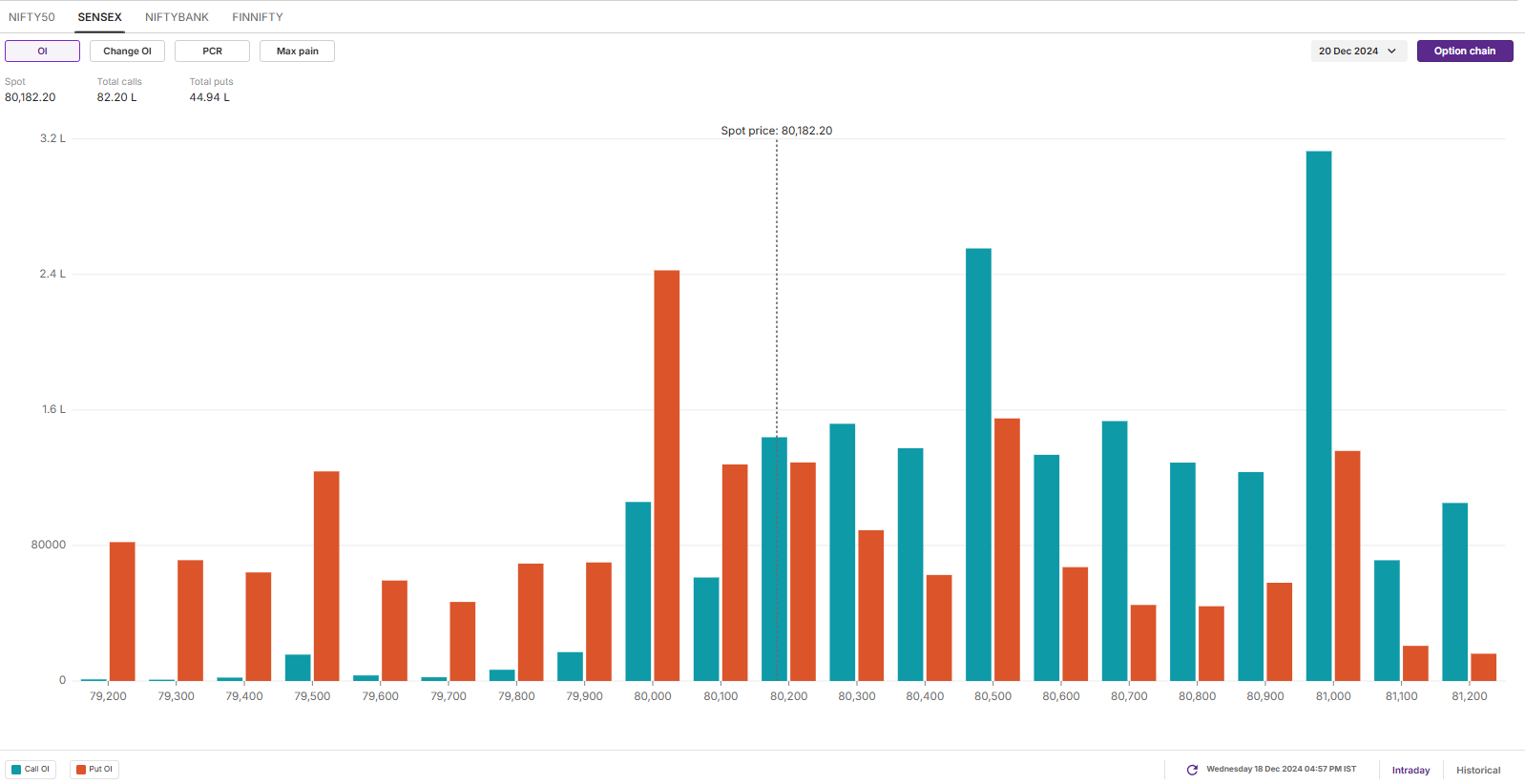

- Max call OI: 83,000

- Max put OI: 77,000

- (Expiry: 20 Dec)

The SENSEX also extended the weakness for the fourth consecutive session and ended Thursday's session below the crucial support zone of 80,000. The index is now placed between the crucial support of 200 EMA and the 50 EMA, indicating weakness and consolidation between this zone.

The technical structure of the index as per the 15 minute time frame looks weak with immediate support around 79,000 zones. The index consolidated around this zone during the entire session and if the index slips below this zone then it may extend the weakness up to 200 EMA. On the other hand, if the index rebounds above previous day’s high and fills the gap, then the trend may become sideways.

The open interest data for today’s expiry saw a significant call base at 80,000 strike, suggesting resistance for the index around this zone. Conversely, the put base was seen at 79,000 strike, marking this zone as the immediate support.

FII-DII activity

Stock scanner

- Long build-up: Dr Reddy’s Laboratories, BSE, Coforge, IPCA Laboratories, Lupin and Oracle Financial Services Software

- Short build-up: LTIMindtree, Jio Financial Services, Pidilite Industries and ICICI Bank

- Under F&O ban: Bandhan Bank, Granules India, Hindustan Copper, Manappuram Finance, NMDC, PVR Inox and Steel Authority of India

- Out of F&O ban: Chambal Fertilisers, National Aluminium and RBL Bank To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story