Market News

Trade Setup for August 19: NIFTY50 reclaims 20 DMA—can it fill the bearish gap?

.png)

5 min read | Updated on August 19, 2024, 09:22 IST

SUMMARY

After forming a base around the 24,000 zone, the NIFTY50 index has reclaimed its 20-day moving average after eight days. The index may attempt to fill the bearish gap created on 5 August, and a sustained close above the 20 DMA will result in a sharp up move to 24,800.

Stock list

The BANK NIFTY Index experienced short covering and bounced back after finding support at its 100-day moving average.

Asian markets update at 7 am

The GIFT NIFTY is up 0.3%, pointing to a positive start for the NIFTY50 today. Meanwhile, other Asian markets are trading mixed. Japan's Nikkei 225 is down 0.2%, while Hong Kong's Hang Seng Index is up over 1%.

U.S. market update

- Dow Jones: 40,659 (▲0.2%)

- S&P 500: 5,554 (▲0.2%)

- Nasdaq Composite: 17,631 (▲0.2%)

U.S. indices ended Friday's session on a positive note, with all indices posting maximum gains of 2024 after a sharp fall at the beginning of August. Following the strong rally, the S&P500 is now 2% away from its recent all-time high.

Positive sentiment on Wall Street was boosted by much stronger retail sales data, falling jobless claims and in-line inflation readings, bolstering hopes that the U.S. economy can achieve a soft landing and avoid recession.

NIFTY50

- August Futures: 24,585 (▲1.7%)

- Open Interest: 4,51,824 (▼2.0%)

Following a positive handover from Wall Street, the NIFTY50 rallied over 1% after an initial dip, breaking out of an eight-day consolidation. The index formed a bullish candle on the daily chart and regained its 20-day moving average (DMA).

In our blog on Friday, we pointed out that we would only implement and plan our strategies if the index broke out of this long consolidation of 8 days by reclaiming its 20 DMA or by breaking its 50 DMA. On 16 August, the index re-captured its 20 DMA, suggesting that fresh buyers are emerging.

In the coming sessions, the 24, 350 and 24,400 levels, which previously acted as resistance, will now act as immediate support for the index. Meanwhile, immediate resistance for the index is around the 24,700 and 24,800 zones, just above the bearish gap created on the 5 August. A sustained close above this zone will lead to further gains.

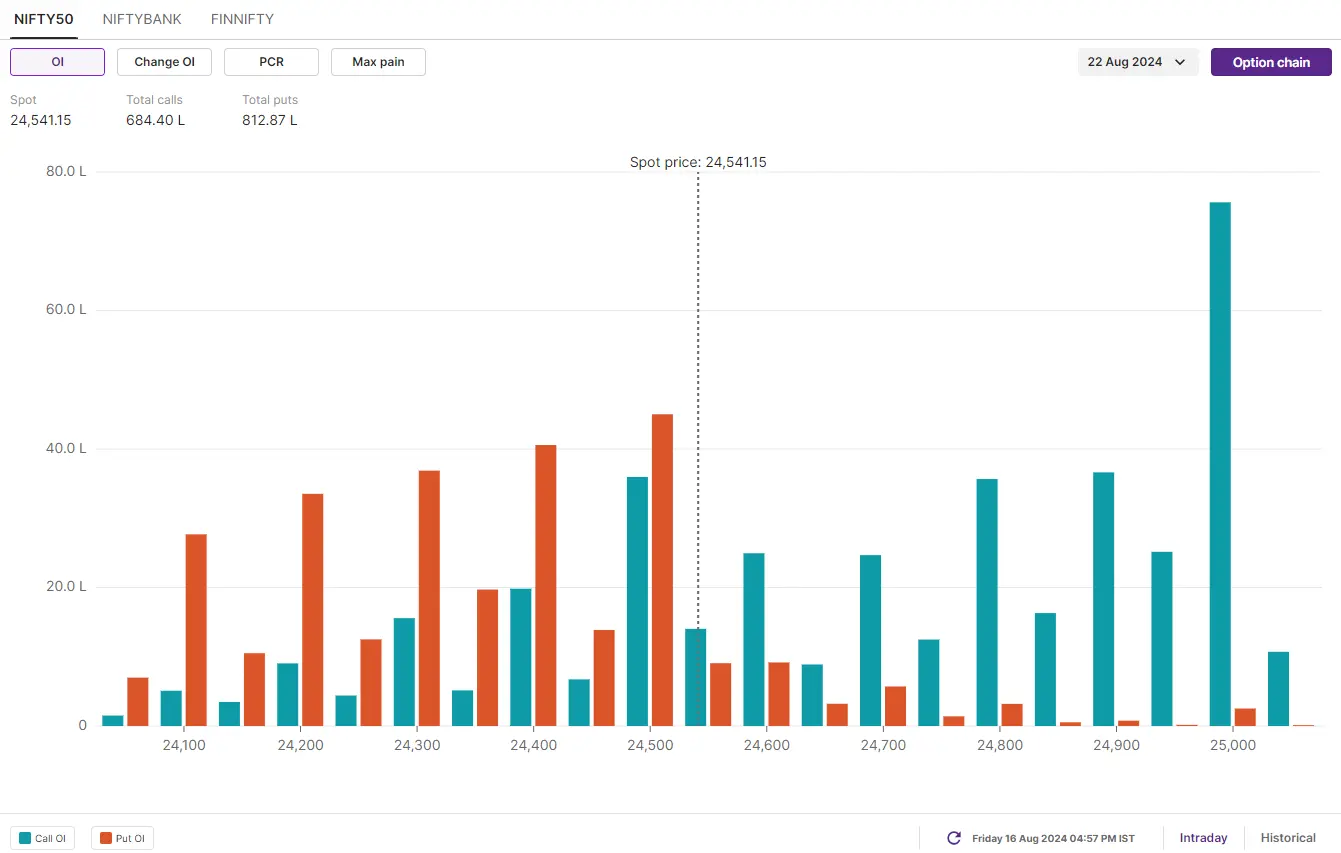

Meanwhile, the open interest build-up for the 22 August expiry witnessed significant put writing from 24,000 to 24,500, pointing at emergence of support at multiple levels for the index. On the other hand, the call base is established at 25,000, suggesting resistance for the index around this level.

BANK NIFTY

- August Futures: 49,955 (▲1.3%)

- Open Interest: 1,96,696 (▼12.9%)

The BANK NIFTY Index experienced short covering and bounced back after finding support at its 100-day moving average. The index formed a bullish candle on the daily chart, but still closed below the eight-day consolidation zone.

According to our trading setup for Friday, if the index breaks the immediate resistance zone of 50,700 and 50,800, it may attempt to fill the bearish gap and reclaim both the 20 and 50 DMAs.On the other hand, a close below 50,000 will indicate weakness. Traders can monitor these levels closely and implement strategies if they are breached.

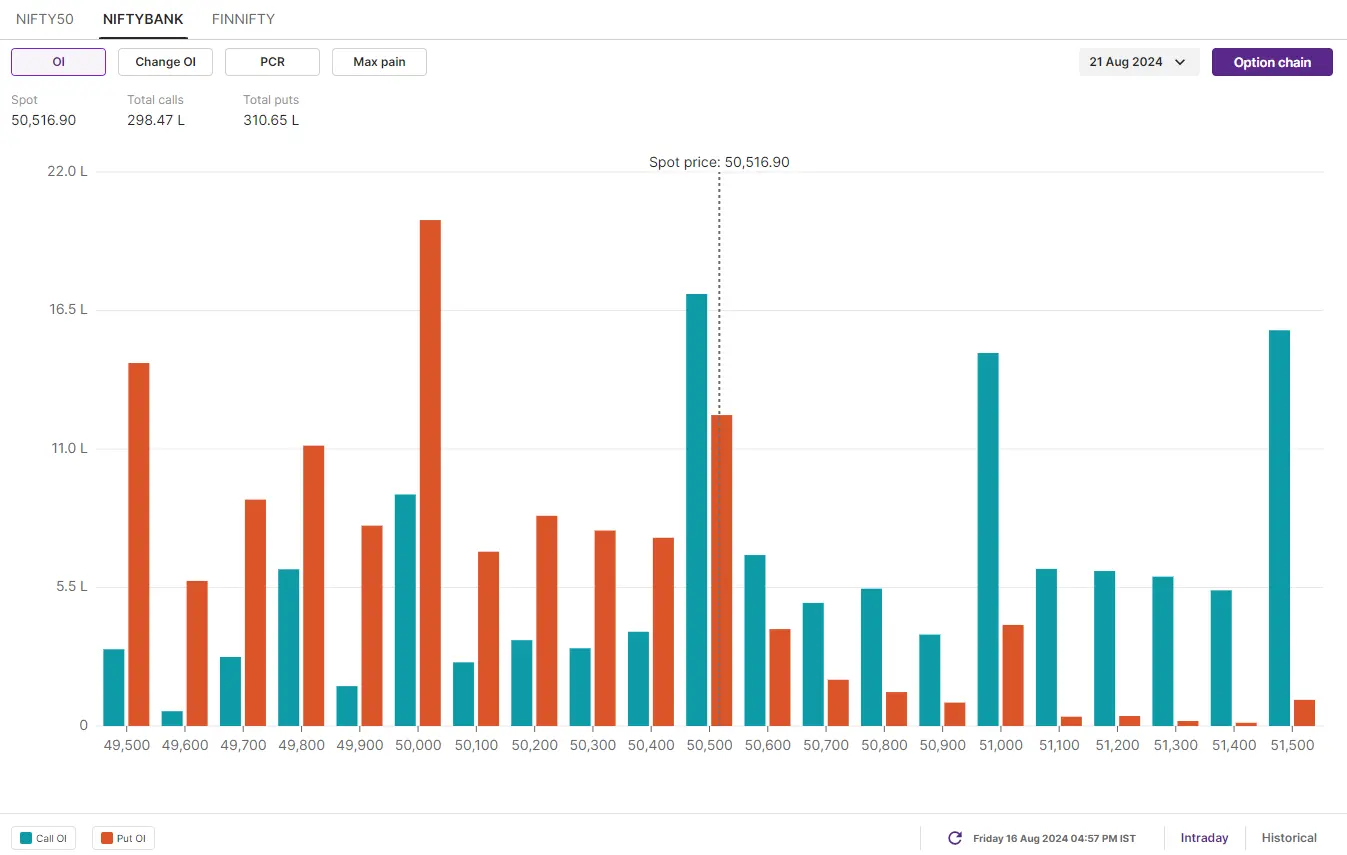

The positioning of the open interest for the August 21 expiry has seen a significant build-up of puts at the 50,000 and 49,000 strikes, making them key support zones for the index. Conversely, the call base is at the 50,500 and 51,000 strikes, which will act as immediate resistance for the index.

FII-DII activity

Stock scanner

Short build-up: Max Financial Services

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Bandhan Bank, Biocon, Birlasoft, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, India Cements, IndiaMART InterMESH, LIC Housing Finance, Manappuram Finance, NMDC, Piramal Enterprises, Punjab National Bank, RBL Bank, Steel Authority of India and Sun TV

Out of F&O ban: Aditya Birla Capital

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story