Market News

Trade setup for 15 July: NIFTY50 breaks out of consolidation, 24,000 emerges as key support

.png)

4 min read | Updated on July 15, 2024, 08:51 IST

SUMMARY

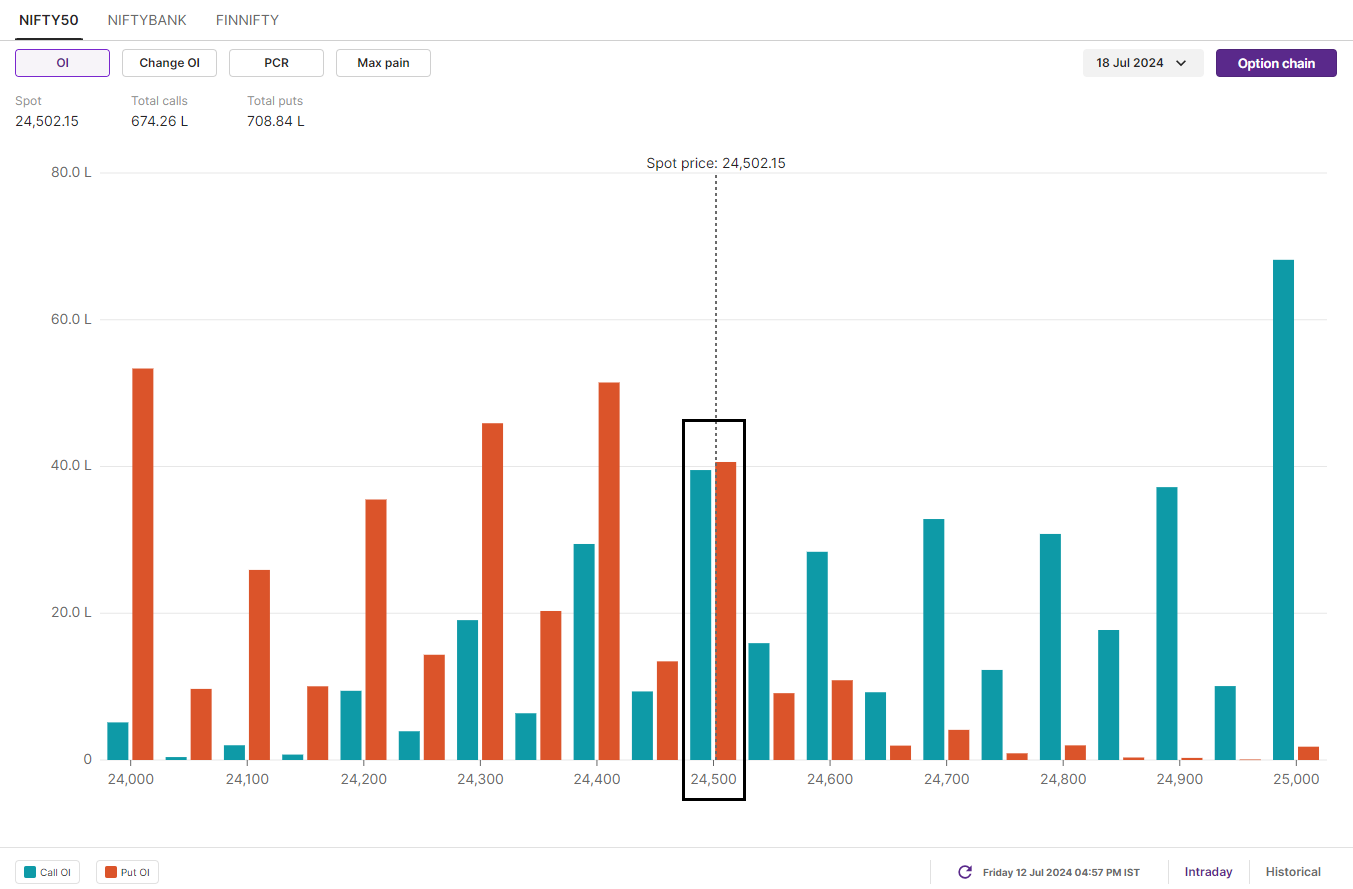

Based on the options data, the NIFTY50 index has highest put open interest at 24,000 strike. This level may act as crucial support for the index for 18 July expiry. Until the NIFTY50 closes below 24,450, the trend of the index’s may remain bullish.

Stock list

Despite negative cues from Wall Street, the NIFTY50 index began Friday’s session on a positive note, surging past the resistance zone of 24,450.

Asian markets update at 7 am

The GIFT NIFTY advanced 0.3% compared to Friday’s close, indicating a positive start for the NIFTY50 today. Meanwhile, major Asian markets are trading mixed. Hong Kong’s Hang Seng index is down 0.4%, while South Korea’s Kospi is flat and Japan’s Nikkei 225 is closed due to public holiday.

U.S. market update

- Dow Jones: 40,000 (▲0.6%)

- S&P 500: 5,615 (▲0.5%)

- Nasdaq Composite: 18,398 (▲0.6%)

U.S. indices hit reached a fresh all-time high on Friday, 12 July, ending the day in green. The rally was led by Wall Street banks, which reported mixed second quarter earnings. JP Morgan Chase and Citigroup’s investment banking arms had a strong quarter, while the lending busines of both banks fell short of expectations on net interest income.

Meanwhile, shares of Wells Fargo slipped over 6% after it posted drop in profit and missed net interest income estimates.

NIFTY50

- July Futures: 24,521 (▲0.6%)

- Open Interest: 5,56,414 (▲2.0%)

Despite negative cues from Wall Street, the NIFTY50 index began Friday’s session on a positive note, surging past the resistance zone of 24,450. The sharp rally was driven by strong momentum in IT sector, which rose over 4%. IT bellwether Tata Consultancy Services spearheaded the advance, with its better-than-expected QoQ on revenue numbers pushed the stock up over 6%, providing the much-needed catalyst for the NIFTY50 index.

Moreover, the NIFTY50 index negated the early signs of a doji candlestick on the weekly chart and closed above the previous week’s high.This indicates strong buying support, which has established a key support level between the 24,200 and 24,000 zones. Currently, there are no sign of resistance on the daily chart. However, if the index closes below 24,450 mark, then it may become range-bound.

The open interest data for the 18 July expiry saw significant put build-up from 24,000 to 24,400 strikes, indicaiting immediate support for the index in this area. On the other hand, the call base was established at 25,000, which will act as a psychological resistance for the index.

BANK NIFTY

- July Futures: 52,366 (▼0.1%)

- Open Interest: 1,39,057 (▼4.2%)

The BANK NIFTY remained volatile for second consecutive day, forming a doji candlestick pattern on the daily chart. The index oscillated nearly 600 points in both the directions, creating sharp price swings on the intraday basis.

With the formation of two consecutive doji candlestick patterns reflecting indecision, BANK NIFTY’s trend remains range-bound. Until the index breaks the range of 52,800 to 52,000 on a closing basis, traders can plan for non-directional strategies. Once the index breaks this range, traders will gain clearer directional clues.

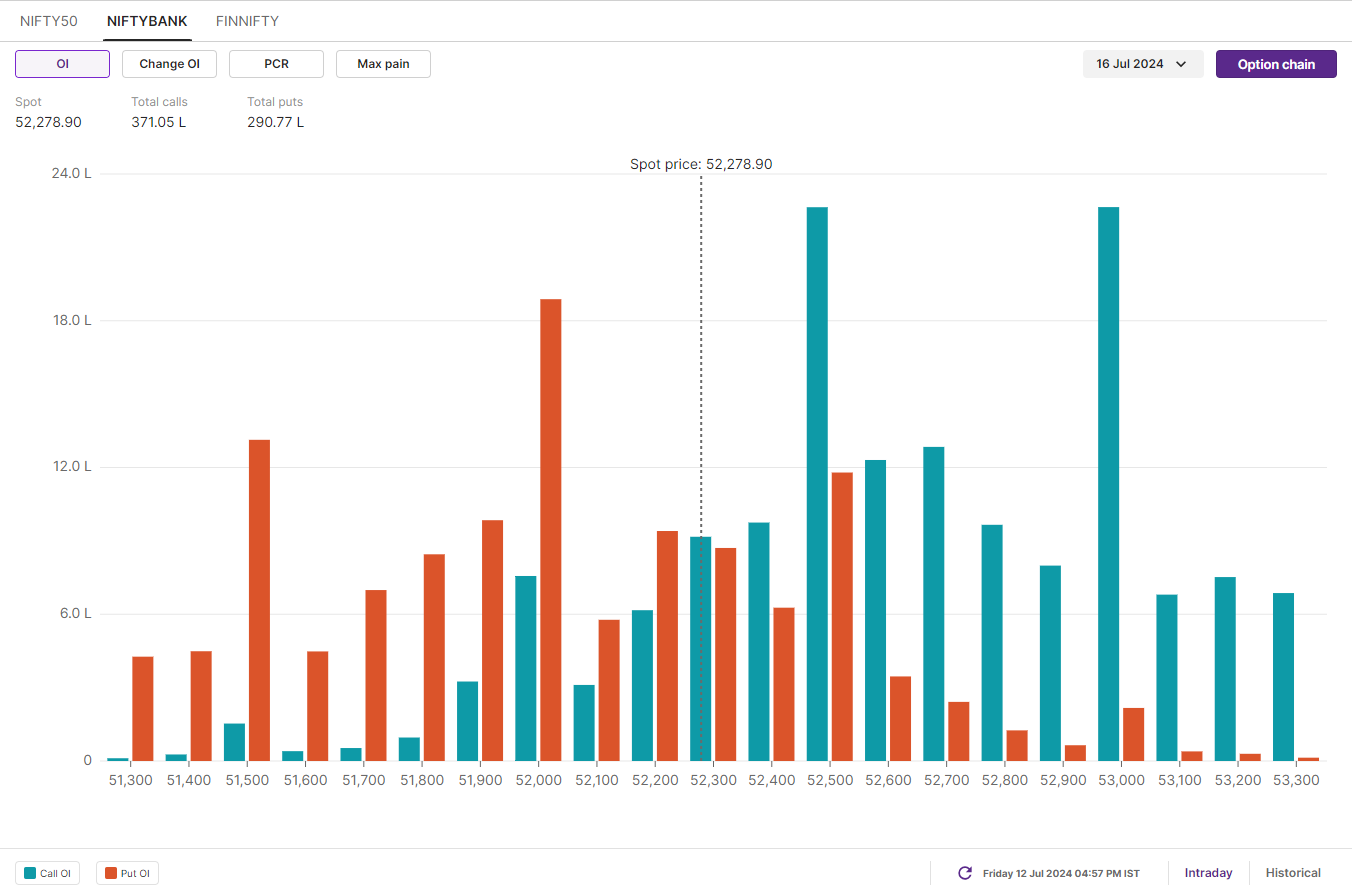

The open interest build-up for the 16 July expiry has maximum call base at 52,500 and 53,000 strikes. On the flip side, the maximum put open interest is placed at 52,000 and 51,500 strikes. Until the index breaks above highlighted range, the BANK NIFTY may remain range-bound.

FII-DII activity

Stock scanner

Under F&O Ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers, GMR Infra, Gujarat Narmada Valley Fertilisers & Chemicals, RBL Bank, Indian Energy Exchange, India Cements, Indus Towers and Piramal Enterprises

Out of F&O Ban: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story