Market News

Stock market weekly recap: SENSEX, NIFTY plunge over 4% as FIIs take exit route

.png)

4 min read | Updated on October 05, 2024, 08:52 IST

SUMMARY

Indian benchmark indices witnessed relentless correction this week, making it one of the worst in over two years. The NIFTY50 and SENSEX closed over 4.5% lower for the week, marking the worst closing since 2022. The sharp correction was largely led by mammoth selling by FII's worth ₹40,000 crore in the past four days.

Indian benchmark indices close over 4.5% lower for the week.

- In four days, SENSEX plunged by 3,883 points, while NIFTY slipped 1,164 points to settle at 25,000 levels.

- Reliance Industries was among the lead NIFTY losers this week, sliding more than 9%

It’s that time of the week again. We are here with another weekly roundup of the financial markets.

The stock markets took a sharp U-turn in this holiday-shortened week, with the benchmark indices SENSEX and NIFTY50 closing at three-week low levels. In the four-day decline, SENSEX plunged by 4.68% or 3,883 points, while NIFTY50 slipped by 4.58% or 1,164 points to settle at 25,000 levels.

West Asia conflict and China factor

Rising tensions in West Asia amid the ongoing Israel-Lebanon conflict and flight of foreign institutional investors dented the market sentiment this week. FIIs moved funds to cheaper Chinese and Hong Kong markets following stimulus measures announced by China. Improving earnings by Chinese companies and low valuation of stocks favoured FII outflows from expensive Indian equities. The Chinese market jumped 22% last week.

Indian markets lagged the most global markets. Weak manufacturing PMI data and the key infrastructure output numbers also dampened the spirits.

Stock markets continued the downward spiral on Monday with SENSEX and NIFTY tanking more than 1.5%. Auto, realty and banking shares were worst hit amid across-the-board selling by FIIs. Investors lost ₹3.57 lakh crore in a single day.

Stock markets remained volatile on Tuesday as energy shares declined while IT and auto shares advanced.

SENSEX and NIFTY were down more than 2% on Thursday as Iran launched ballistic missiles at Israel, sparking fears of an escalation in the war. The SENSEX then slipped a further 1,769 points, which was its sharpest single-day decline since June 4. NIFTY declined to three-week lows of 25,250.

Investors suffered more than ₹9 lakh crore blow in a single day.

Benchmark indices continued to decline for the fifth straight day on Friday due to sustained FII selling. Investors adopted a sell-on recovery strategy amid rising tensions in West Asia.

SENSEX plunged 808.65 points or 0.98% to settle at 81,688.45. NIFTY shed 235.50 points or 0.93% to close at 25,014.60. In the broader market, the mid-cap index lost 3.1% and small cap by 1.8%.

NIFTY losers: Reliance Industries, BPCL, Asian Paints, and Bajaj Auto

Reliance Industries was among the lead NIFTY losers this week, sliding more than 9% amid crude oil supply concerns due to the ongoing conflict in West Asia. Asian Paints, Bharat Petroleum, Axis Bank, Bajaj Auto and Bajaj Finserv fell by more than 7% each. Hero MotoCorp, Eicher Motors and Shriram Finance also plunged more than 7% this week on FII selling.

JSW Steel bucked the trend gaining 3.22% this week amid reports that Chinese stimulus measures will benefit steel makers.

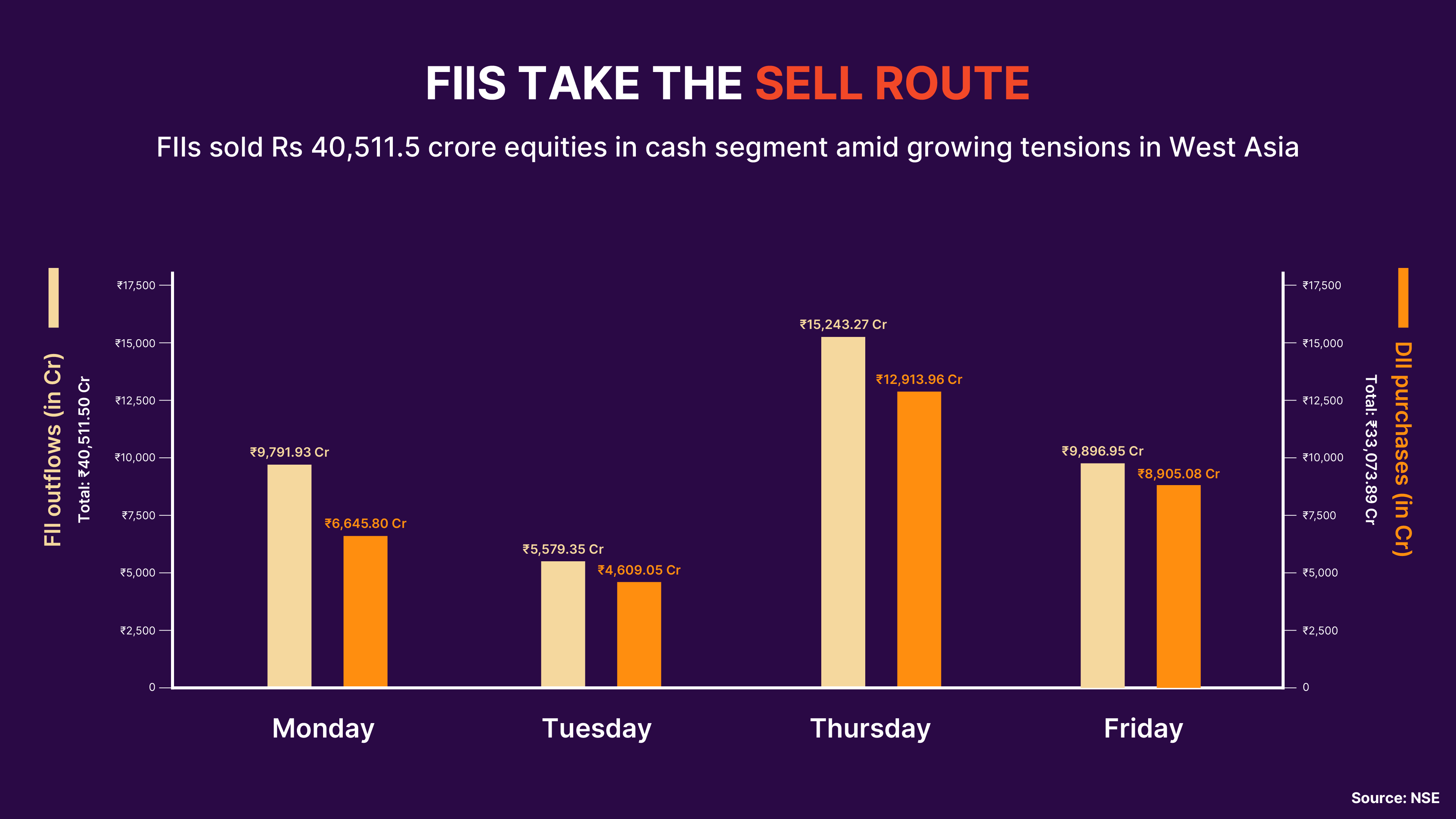

FIIs pull out over ₹40,000 crore in just 4 days

FIIs turned net sellers this week amid growing tensions in West Asia and stimulus measures by the Chinese central bank. By Friday, FIIs sold equities worth ₹40,511.5 crore in the cash segment. DIIs, on the other hand, turned into net purchasers of equities in the cash segment. DIIs bought shares worth over ₹33,000 crore in four days.

Oil shares decline as crude oil rebound

State-run oil marketing companies HPCL, BPCL and Indian Oil Corporation Ltd fell sharply by up to 6% on Thursday due to a rebound in crude oil prices. Brent crude rebounded to ₹78 per barrel from ₹70 per barrel at the start of the week as Iran joined the Israel-Lebanon conflict by firing missiles on Tel Aviv.

RPower hit new 52-week high, jumps 112% year-to-date

Reliance Power shares hit a fresh 52-week high of ₹53.65 this week after the company announced its debt-free status and more inroads into renewable and green energy segments. RPower shares jumped 5% on Thursday, which was its 15th straight day of gains. The stock, however, dropped 5% on Friday but still ended the week higher by 9%.

What lies ahead

The ongoing Israel-Lebanon conflict and spiralling crude oil will have a bearing on stock markets next week. Earnings season is starting next week which will decide the movement of the key indices.

About The Author

Next Story