Market News

Stock market today: Key things to know before the opening bell on January 8

2 min read | Updated on January 08, 2025, 08:09 IST

SUMMARY

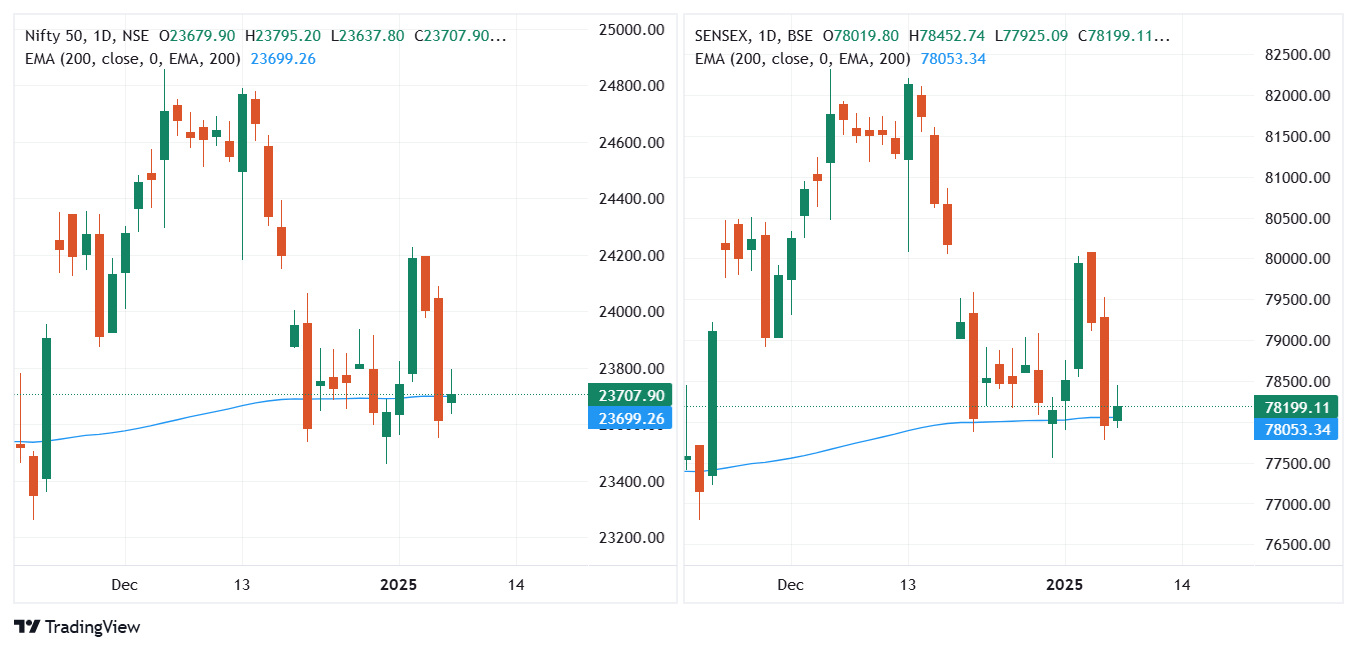

Indian markets took support at 200 DEMA levels after a steep correction on Monday. The FIIs continued their selling spree in the equity markets and held on to their short position in the derivatives market.

The GIFT NIFTY indicates a positive start for Indian markets on Wednesday.

US Markets

US markets snapped the two-day rally to close nearly 2% lower as tech stocks led by Nvidia dropped sharply. The NASDAQ fell nearly 2%, followed by the S&P 500 and Dow Jones, which fell nearly 1%. The services data indicates stronger job openings than expected in the services sector, and ISM service PMI also rose to 54, indicating strength in the economy. Stronger economic data prompts delays in rate cuts and thus impacts equity prices.

Asian markets

Asian markets traded mixed across the board, with Japanese indices trading 150 points lower on Wednesday morning. Meanwhile, Korean stocks jumped by 1.4% after South Korea’s acting president vowed swift action with the central bank and regulators.

Crude oil prices

Crude oil prices resumed their rally after US crude oil inventories fell on Tuesday. The Brent crude oil prices jumped 1.1% to $77 per barrel, and WTI crude oil prices crossed $74.5 per barrel mark.

FII and DII data

Tuesday’s trading session was no different for FIIs as they continued their selling streak with equity selling worth ₹1,491 crore. On the other hand, DIIs added equities worth ₹1,615 crore. In the derivatives market, the FII's position remained largely unchanged, with 2.2 lakh contracts on the short side of the index futures.

Tuesday’s trading session was no different for FIIs as they continued their selling streak with equity selling worth ₹1,491 crore. On the other hand, DIIs added equities worth ₹1,615 crore. In the derivatives market, the FII's position remained largely unchanged, with 2.2 lakh contracts on the short side of the index futures.Chart check

Markets held the support at 200 DEMA after a steep correction on Monday. The NIFTY50 closed slightly above its 200 DEMA at 23,707, and SENSEX closed nearly 200 points above the 200 DEMA mark of 78052.

About The Author

Next Story