Market News

Stock market today: Key things to know before the opening bell on February 5

3 min read | Updated on February 05, 2025, 08:14 IST

SUMMARY

The FIIs were net buyers on Tuesday after 23 days of relentless selling in 2025. Global market cues remained mixed, as Asian markets traded in the red on Wednesday morning, and the US markets closed in green on Tuesday after Trump decided to delay the tariffs on Mexico and Canada.

GIFT NIFTY traded 67 points higher on Wednesday morning indicating a positive start for Indian markets.| Image Source: Shutterstock

US Markets

The US markets closed higher on Tuesday after the Trump administration decided to delay the imposition of tariffs by one month. Markets were also optimistic about US President Donald Trump's and Chinese President Xi Jinping's calls over the impending trade war. Following this development, the NASDAQ closed 1.3% higher, followed by the S&P500 (+0.72%) and Dow Jones (+0.35%).

Asian Markets

The Asian markets traded mixed on Wednesday morning. Japanese indices gave up all morning gains to trade in red, followed by Hong Kong, which lost 1.3% in early morning deals. The Japanese wages and services data indicate a more hawkish stance by the Bank of Japan in coming quarters. Following this development, the Japanese Yen hit a seven-week high of 154 against the US dollar. On the other hand, the Chinese composite PMI stood at 51.1 against 51.4 in December, indicating an overall structural slowdown of economic activity in the country.

Oil price

The global crude oil prices remained steady amid several headwinds for the sector. The Trump administration launched maximum pressure on Iran to reduce its oil exports to near zero in the coming days. In addition, the OPEC+ agreed to increase the output gradually from April and the US API data indicated a surge in oil inventories in the last week. The WTI crude oil prices traded below $73 per barrel, and Brent crude oil prices traded in red below $76 per barrel on Wednesday morning.

FII and DII data

After 23 sessions of relentless selling, foreign institutional investors bought Indian equities worth ₹809 crore, and DIIs sold Indian equities worth ₹400 crore. In the derivative segment, the FII reduced their short positions from 1.84 lakh contracts to 1.5 lakh contracts on Tuesday, thus restoring some optimism in the Indian markets.

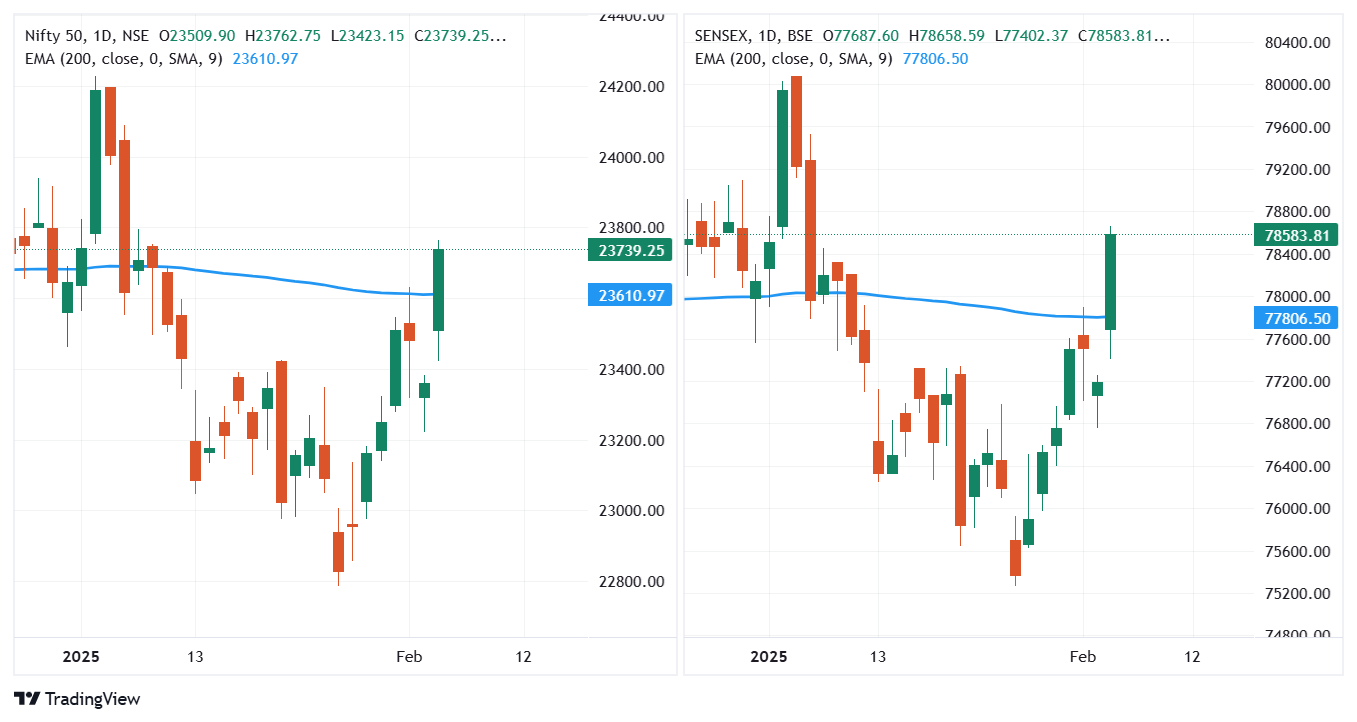

Chart check

The key benchmark indices crossed the important resistance of 200 DEMA on the NIFTY50 and SENSEX, indicating a reversal in the trend. Market participants expect the indices to hold the 200 DEMA levels on Wednesday, giving confirmation of trend reversal in the benchmark indices.

The key benchmark indices crossed the important resistance of 200 DEMA on the NIFTY50 and SENSEX, indicating a reversal in the trend. Market participants expect the indices to hold the 200 DEMA levels on Wednesday, giving confirmation of trend reversal in the benchmark indices.About The Author

Next Story