Market News

Stock market today: Key things to know before opening bell on December 12

2 min read | Updated on December 12, 2024, 08:23 IST

SUMMARY

Domestic markets are expected to open with positive momentum, following their global counterparts. The latest CPI reading in the US increased the rate cut probability to 100% for the upcoming policy meeting. Oil prices jumped over 2% higher on Wednesday after the European Union's sanctions on the Russian oil supply.

Global markets closed on buoyant note on Wednesday.

Indian markets are expected to open higher on Thursday, taking cues from buoyant global markets. The latest CPI reading in the world’s largest economy indicated more room for rate cuts in upcoming policy meetings. Following the favourable outcome, tech stocks across the US and Japan recorded strong gains. However, the domestic indices are also expected to remain cautious about inflation data for November, expected to be released by 4:00 pm on Thursday.

US markets

US markets closed higher on NASDAQ and S&P500 after the November CPI stood at 2.7% vs 2.6% in October, adding hopes for a 25 bps rate cut by the Federal Reserve in an upcoming policy meeting. The favourable outcome sent the NASDAQ to close to a new record high of 21763, up by 1.8%.

Asian markets

Following the rally in US tech stocks, Japanese markets jumped nearly 600 points on Thursday morning. The Chinese and Hong Kong markets traded slightly unchanged, with minor losses.

Crude oil

EU’s sanctions on Russian oil flows sent oil prices jumping 2.5% higher on Wednesday. The Brent crude oil prices traded flat at $73.1 per barrel, and the WTI crude oil traded above $70 barrel mark on Thursday morning.

FII and DII data

The trend in FII and DII remained mixed on Wednesday after foreign investors sold Indian equities worth ₹1,012 crore, while DIIs bought equities worth ₹2007 crore on Wednesday. The cheap money policy in the Western economies will prove to be positive for FII flow into the economy.

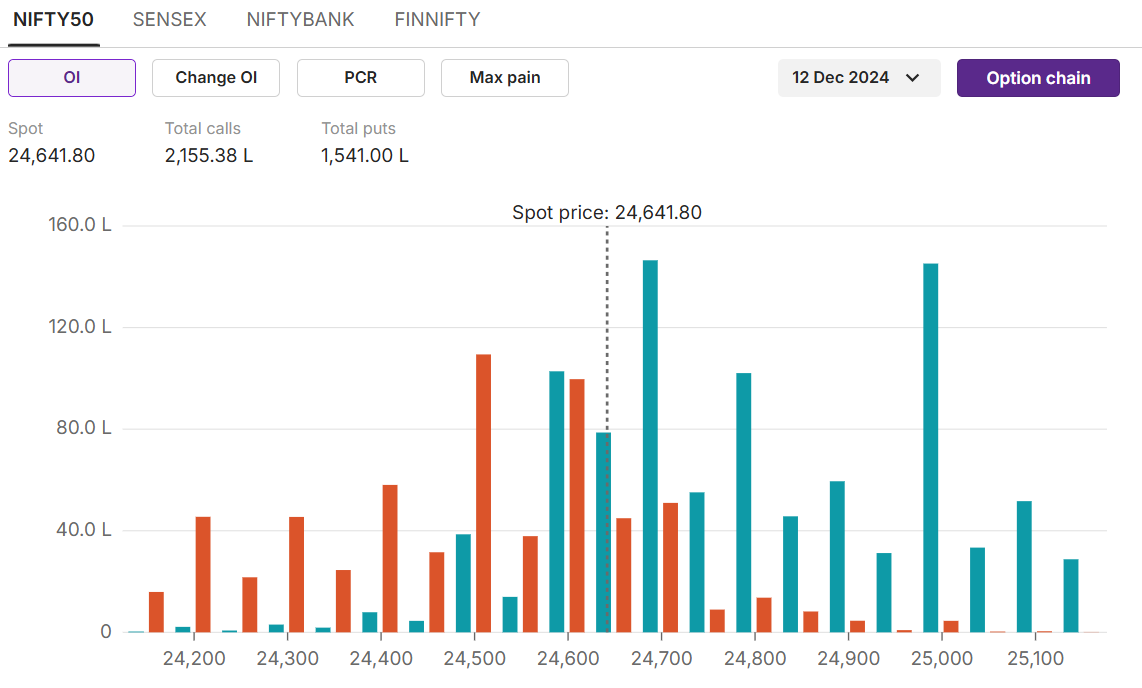

OI check

(Source:Upstox pro)

(Source:Upstox pro)NIFTY50 snapped a three-day correction spree to close marginally higher on Wednesday. The OI data indicates resistance at 24,700 levels as open interest stands highest on the call side at 146 lakh contracts. On the put side, the highest open interest stands at 24,500 levels, indicating support near the respective levels

About The Author

Next Story