Market News

Stock market today: All you need to know before opening bell on January 10

2 min read | Updated on January 10, 2025, 08:55 IST

SUMMARY

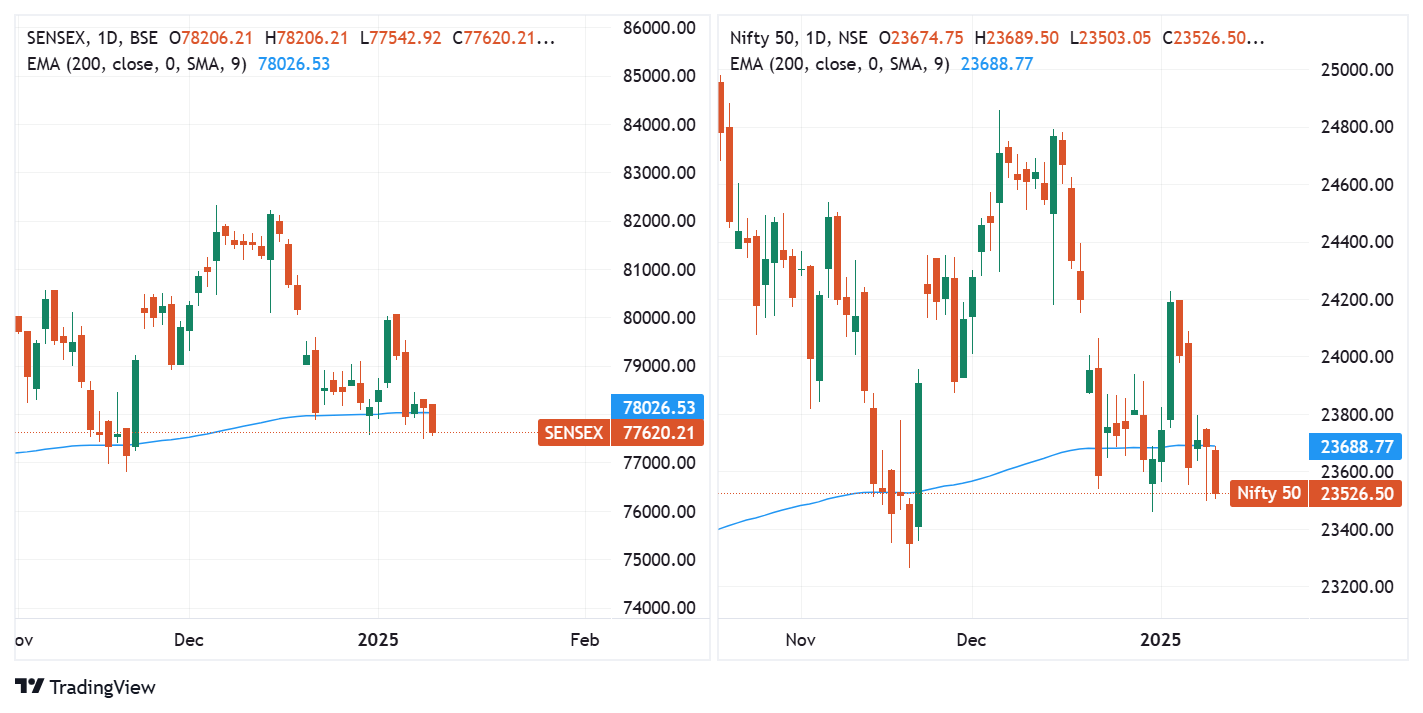

Markets have given a decisive breakdown below 200 DEMA levels on the benchmark indices, and FIIs have added their short positions in the index futures with 2.67 lakh contracts. Asian markets traded in negative territory as economic indicators from China show an aggravated slowdown in the world's second-largest economy.

NIFTY50 and SENSEX close below 200 DEMA levels.

Indian stock markets are expected to open cautiously on Friday amid mixed cues from global markets. The GIFT NIFTY traded largely unchanged at 8:00 am. The US markets were closed on Thursday because of a national holiday for the mourning of ex-US president Jimmy Carter.

US markets

The US markets were closed on Thursday on national mourning of Ex-US President Jimmy Carter. The US index futures traded in the red with NASDAQ futures down 30 points, Dow Jones futures down by over 100 points on Friday morning.

Asian markets

Asian markets opened lower Friday morning as the Federal Reserve’s hawkish statements continued to rattle investor sentiments across Asia. The Japanese Nikkei index traded in the red, with 260-point losses. The Chinese markets, too, traded in red as Central Bank officials indicated halting the bond-buying program to support bond prices.

Crude oil prices

Brent crude and WTI crude oil prices gained on Thursday after over 1% as colder weather in the northern hemisphere could boost oil demand. The Brent crude oil prices and WTI crude oil prices opened 0.3% lower on Friday morning.

FII and DII Data

Foreign investors aggravated their selling in the Indian markets on Wednesday by selling Indian equities worth ₹7,100 crore, as a stronger dollar and rising bond yields provided a safer option in a volatile global market environment. On the other hand, domestic investors continued to add Indian equities worth ₹7,610 crore. In the derivatives market, the FIIs added their short positions to 2.67 lakh contracts, higher than the previous day’s 2.38 lakh contracts.

Chart check

The NIFTY50 and SENSEX have closed below 200 DEMA levels, indicating a bearish signal for broader Indian markets in the medium term

About The Author

Next Story