Market News

Stock market today: All you need to know before opening bell on December 6

3 min read | Updated on December 06, 2024, 08:22 IST

SUMMARY

The Indian markets saw a strong close on benchmark indices on Thursday, with NIFTY50 and SENSEX closing 1% higher, respectively. The market rally was largely driven by FII's ₹8,500 crore worth of buying of Indian equities. However, all eyes remain on the key policy outcome by RBI on Friday morning.

FII's continued their buying spree for the third consecutive day on Thursday giving boost to pullback rally from the lower levels.

Indian markets are expected to open cautiously, largely driven by global and domestic cues. Global markets retreated on Thursday across the board amid profit booking. Caution also prevailed ahead of key November Jobs data expected to be released late in the day.

Key triggers for the day

RBI policy outcome

The Reserve Bank of India’s monetary policy committee is scheduled to announce the outcome of a bi-monthly policy meeting. Experts predict a CRR cut amid a slowdown-like scenario in the economy. The RBI governor's guidance commentary on rate cut trajectory, GDP growth expectations, and inflation will remain in focus.

OPEC+ delays output hike

The OPEC+ pack, in its key meeting, decided to delay the production hike by three months and extended the unwinding of cuts by 2026 due to weak demand and high production by non-OPEC+ countries. Following the announcement, oil prices retreated from the higher levels to trade lower on Friday morning. The WTI crude and Brent crude oil prices traded 0.5% lower at the time of writing

US Jobs report

The highly anticipated US non-farm payroll data will be released later today. The consensus estimates suggest the US economy added 200,000 jobs in November. Any number below the estimates will boost hopes for more rate cuts in the Federal Reserve's December policy meeting.

US markets

The S&P500 NASDAQ retreated from record highs to close 0.2% lower on Thursday amid profit booking at higher levels. Market participants await key non-farm payroll data, which will be released on Friday, setting the tone for rate cuts in the upcoming policy meeting.

Asian markets

Shares in Asia traded mixed this morning amid weak global cues. The Japanese indices traded over 350 points lower, while Chinese markets opened higher Friday morning. In Japan, data showed that inflation-adjusted real wages remained unchanged in October compared to the previous year.

FII DII data

The foreign institutional investors changed their stance in early December to become net buyers from net sellers. The FIIs maintained their buying spree on Thursday with ₹8,500 crore worth of buying in the Indian markets. While DIIs sold nearly ₹2,300 crore worth of Indian equities in front of them.

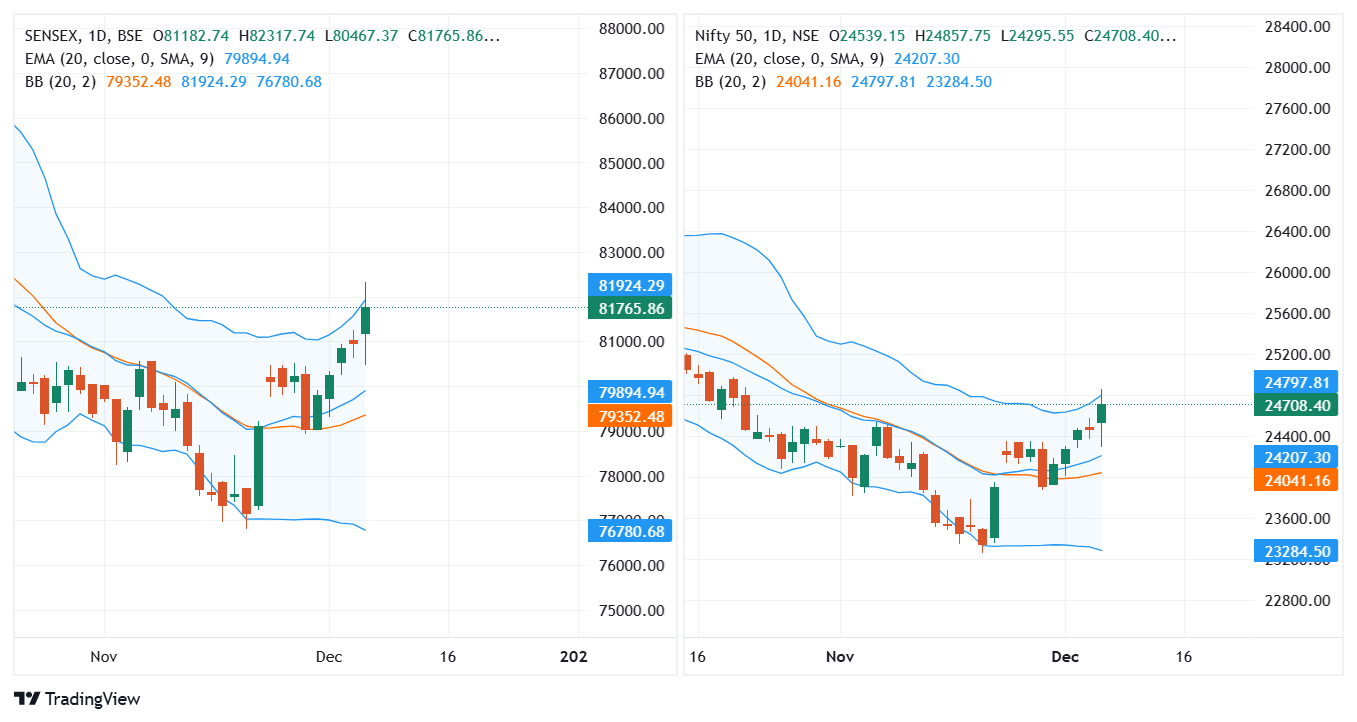

Chart check

The NIFTY50 and SENSEX touched the upper levels of Bollinger bands on Thursday and retreated from there, indicating some pullback from higher levels. However, the broadening of Bollinger bands and prices trading near the upper levels indicates market bullishness.

About The Author

Next Story