Market News

Stock market today: All you need to know before opening bell on December 3

3 min read | Updated on December 03, 2024, 08:15 IST

SUMMARY

The global markets closed in the green, giving cues for a positive opening of Indian markets on Tuesday. The NASDAQ and S&P500 in the US closed at record high levels on Monday on upbeat earnings seasons for Q3 2024. The Asian markets, too, followed suit and traded largely in green, with the Japanese Nikkei index leading with over 600 point gains this morning.

The GIFT NIFTY indicates a positive start for Indian markets with 10 points gain on Tuesday morning.

Domestic benchmark indices are expected to open positively, taking cues from upbeat global markets. The NIFTY50 and the SENSEX closed in green on the first trading day of December with 0.6% gains led by large-cap stocks. The GIFT NIFTY trades at 24,430 levels, 10 points higher at 7:10 am on Tuesday.

Global markets

Major global indices, including the US, Europe, and Asia, closed positively on Monday. Germany’s DAX index closed at record-high levels on Tuesday. The Nasdaq and S&P500 in the US, too, closed at record high levels on upbeat earnings for Q3 2024. The tech-heavy NASDAQ index closed 185 points higher at 19,403 levels, and the S&P500 closed 0.25% higher at 6,035. However, the broader market index of Dow Jones closed 100 points lower amid a cautious stance.

Asian markets

In Asia, the Japanese index Nikkei traded 1.5% or 600 points higher on Tuesday morning, largely due to a rally in Japanese tech stocks following the positive momentum of tech stocks in the US. On the contrary, the Chinese and Hong Kong indices traded marginally lower, with 0.1% losses.

Crude oil

The crude oil prices remained steady on Tuesday morning after falling from intraday high levels on Monday as the Chinese economy posted strong growth numbers, indicating a higher demand for oil in the world’s largest consumer markets. The Brent crude oil prices traded flat at $71.7 per barrel, while WTI crude oil traded at $67.6 per barrel, largely unchanged.

FII and DII data

Foreign institutional investors started the December month on a muted note with ₹238 crores worth of net selling in Indian markets. While DII opened the December month on a strong note by buying Indian equities worth ₹3,588 crore.

Domestic triggers

Indian markets are also likely to react to media reports of a hike in GST on certain products. According to the report by CNBC TV18, the Government is planning to propose a special rate of 35% GST on Tobacco and Tobacco products and aerated Beverages. In addition, readymade garments above ₹1500 to ₹10,000 may attract 18% GST. While the readymade garments above ₹10,000 may attract 28% GST. High-end luxury products like watches, shoes, and handbags may also witness higher GST. Following the news, stocks like ITC and Godfrey Phillips will remain focused on Tuesday’s trade.

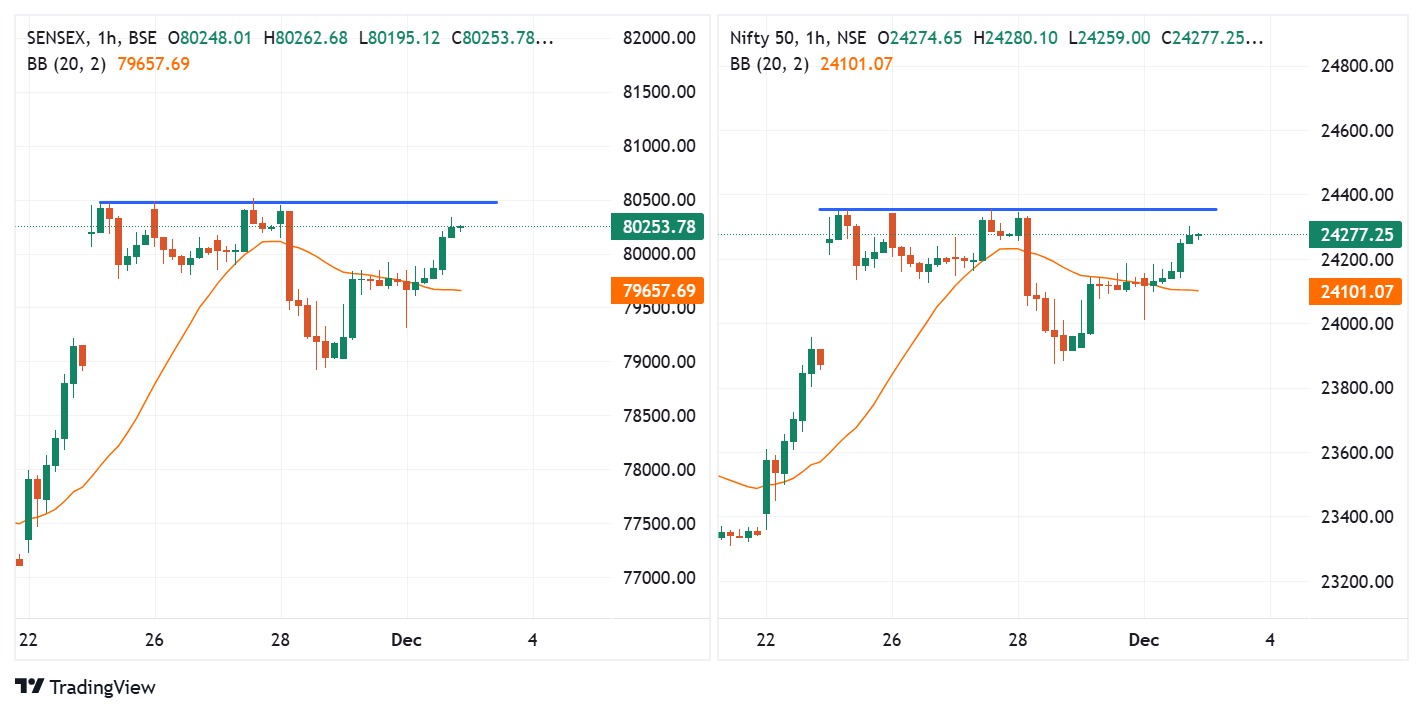

Chart check

(Source: Tradingview,Upstox)

(Source: Tradingview,Upstox)About The Author

Next Story