Market News

NIFTY50 slips amid profit booking forms bearish candle before expiry

.png)

3 min read | Updated on July 10, 2024, 18:10 IST

SUMMARY

For the 11 July expiry, the NIFTY50 index has immediate support around the 24,100 zone, while resistance is near the 24,450 mark. A breakout beyond this range will provide traders with further directional clues.

NIFTY50 slips amid profit-booking, forms bearish candle before expiry

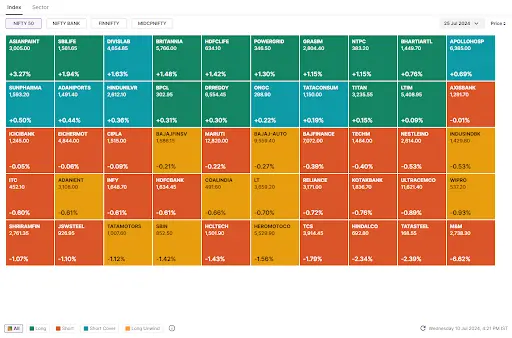

Markets started Wednesday's session on a flat note and faced profit-booking near record levels. A sharp fall in mid and small-cap stocks in the first half pressured the benchmark indices. In the second half, both the NIFTY50 and SENSEX recovered half of their losses to end the day at 24,324 and 79,924 respectively, down 0.5%.

Barring Pharma (+0.3%) and FMCG (+0.2%), all the major sectors came under selling pressure with Automobiles (-2.0%), Metals (-1.6%) and IT (-1.0%) declining the most.

The NIFTY50 index formed a bearish engulfing candle on the daily chart, indicating the emergence of resistance on the daily chart. The bearish engulfing is a bearish reversal pattern in which the red candle engulfs the previous candle and ends below the previous day’s low. However, the reversal pattern is confirmed only if the subsequent day’s close is lower than the bearish candle.

-

Top gainer and loser in NIFTY50: Asian Paints (+3.2%) and Mahindra and Mahindra (-6.6%)

-

The broader markets witnessed profit-booking in the first half. Both the NIFTY Midcap 100 and Smallcap 100 index fell nearly 3% from opening levels. However, they rebounded from the day’s low, closing with losses of 0.2% and 0.8%, respectively.

-

Top gainer and loser in NIFTY Midcap 100: Tube Investments of India (+5.1%) and Fertilisers And Chemicals Travancore (-5.0%)

-

Top gainer and loser in NIFTY Smallcap 100: NLC India (+4.6%) and Blue Star (-7.3%)

Key highlights of the day

🎨Asian Paints (+3.2%) and Berger Paints (+2.4%) came into the spotlight following their decisions to increase the prices of their paint products across portfolios. As per reports, Asian Paints increased prices by 1%, while Berger Paints hiked prices in the range of 0.7%-1%.

🚘Mahindra and Mahindra slipped over 6% after the company slashed the price of its best-selling XUV 700. This comes after the U.P government waived the registration tax on electric hybrid cars.

🚢Adani Ports (+0.6%) won a contract to operate a terminal at Deendayal Port in Kandla, Gujarat. The company has been awarded a Letter of Intent (LoI) to develop, operate and maintain a berth at the port for 30 years.

🎲Delta Corp initially slipped over 5% after the company reported a 68% YoY fall in its net profit to ₹21 crore for Q1FY25. The sharp fall in the profit was due to a decline in gaming revenues.

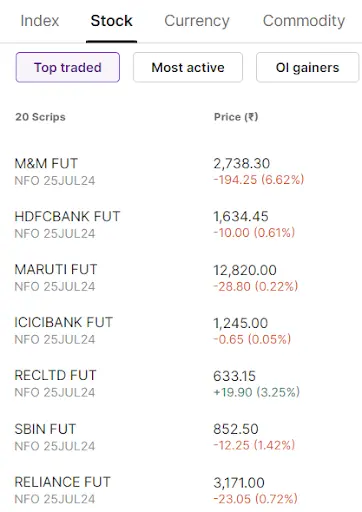

Top traded futures contracts

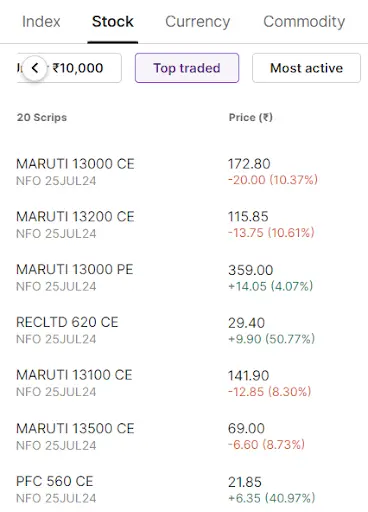

Top traded options contracts

4 trading insights from NIFTY 200🔍

📈Open=Low(Bull power): Fortis Healthcare, Britannia and Indian Bank

⚠️Fresh 52 week-low: N/A

See you tomorrow!

About The Author

Next Story