Market News

NIFTY50 reclaims 25,000, eyes record high ahead of monthly expiry

.png)

3 min read | Updated on August 26, 2024, 18:32 IST

SUMMARY

The NIFTY50 index formed a bullish candle on the daily chart and filled the second bearish gap formed on 2 August. With index sustaining its gains at higher levels, the immediate support lies around 24,800. However, as NIFTY50 approaches its previous all-time high, traders should also remain cautious of profit-booking.

Stock list

NIFTY50 reclaims 25,000, eyes record high ahead of monthly expiry

Markets extended the positive momentum after positive handover from Wall Street after the US Federal Reserve Chair Jerome Powell siganlled a rate cut in September. The NIFTY50 index reclaimed the 25,000 mark after sixteen sessions and formed a bullish candle on the daily chart.

Except for PSU Banks (-0.5%) and Media (-0.2%), all the major sectoral indices ended the day in the green. Metal (+2.1%) and Real-Estate (+1.7%) sectors advanced the most.

Buoyed by positive global cues, the NIFTY50 index filled the second bearish gap from 2 August and sustained its opening gains through-out the day. Closing above the pshyhcologically crucial 25,000 mark, index signals positive momentum. However, as it nears its previous all-time high (25,078), traders should be cautious of potential profit-booking. Immediate support for the index lies around 24,800 zone. If index falls below this level, it may enter a range-bound phase with increased volatility.

-

Top gainer and loser in NIFTY50: HCL Technologies (+4.2%) and Apollo Hospitals (-1.1%)

-

Broader markets ended the day in green and consolidated its gains at higher levels. The NIFTY50 Mid cap 100 index gained 0.6%, while the Small cap 100 index advanced 0.2%

-

Top gainer and loser in NIFTY Midcap 100: PB Fintech (+7.2%) and One 97 Communications (-4.4%)

-

Top gainer and loser in NIFTY Smallcap 100: Honasa Consumer (+7.9%) and Great Eastern Shipping (-3.0%)

Key highlights of the day

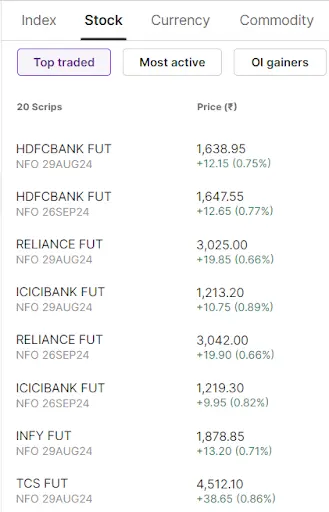

Top traded futures contracts

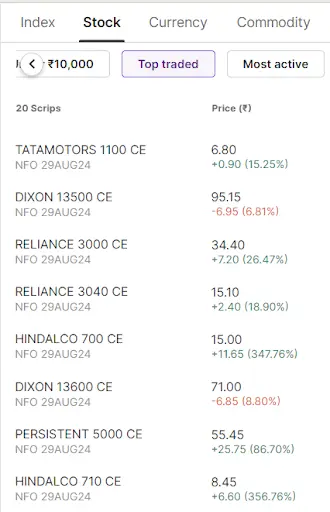

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Fsn E-Commerce (Nykaa), Supreme Industries, Icici Prudential, Adani Green and HDFC Life Insurance

📈Open=Low (Bull power): Colgate-Palmolive, Divi’s Laboratories, Info-Edge (Naukri), Max Financial Services, HDFC Bank and Biocon

🏗️Fresh 52 week-high: PB Fintech, HCL Technologies, Indian Hotels, Tech Mahindra, JSW Steel and Persistent Systems

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story