Market News

Market highlights| NIFTY50 surges past 26,000 ahead of monthly expiry, volatility eases 5%

.png)

3 min read | Updated on September 25, 2024, 19:13 IST

SUMMARY

Monthly options data for the NIFTY50 shows a strong presence of put writers between the 25,900 and 25,700 strikes, suggesting support around these levels. Meanwhile, call sellers have established their base at 26,000 and 26,200, suggesting resistance around these levels.

Stock list

Technical structure of the NIFTY50 index remains bullish

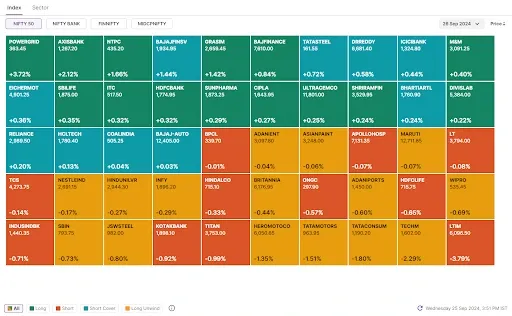

Markets hit a fresh all-time high, extending the winning streak for a fifth consecutive day. NIFTY50 index traded in a narow range ahead of the monthly futures and options expiry, but experienced strong buying momentum towards the end of the session. It successfully crossed and held the psychologically important 26,000 level and closed above it.

Sectorally, Real-Estate (+0.6%) and Metals (+0.4%) were the top gainers, while PSU Bank (-0.8%) and IT (-0.6%) lost the most.

The technical structure of the NIFTY50 index remains bullish as it continues to form higher highs and higher lows on the daily chart, while consistently holding above the previous day's low at the close. Immediate support is seen at the 25,850 level, with key support at 25,700.As long as the index remains above these levels, the bullish trend is likely to continue.

-

Top gainer and loser in NIFTY50: Power Grid (+4.0%) and LTIMindtree (-3.6%)

-

Top gainer and loser in NIFTY Midcap 100: Zee Entertainment (+5.7%) and PB Fintech (-5.8%)

-

Top gainer and loser in NIFTY Smallcap 100: Five-Star Business Finance (+5.1%) and Indian Energy Exchange (-4.3%)

Key highlights of the day

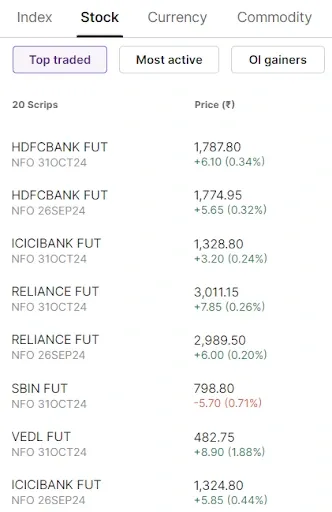

Top traded futures contracts

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): PB Fintech, Max Healthcare, LTIMindtree, Punjab National Bank and Marico

📈Open=Low (Bull power): Apollo Tyres, Tata Chemicals, HDFC Bank and Eicher Motors

🏗️Fresh 52 week-high: Tata Communications, Power Grid, NTPC, Bajaj Finserv and IPCA Laboratories

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story