Market News

How much is the NIFTY50 (or NIFTY Bank) likely to move during the Union Budget?

7 min read | Updated on January 30, 2025, 12:14 IST

SUMMARY

Tracking straddle prices and implied volatility over the next few days won’t tell you if the markets will go up or down on the budget day. The straddle prices will only give you the market’s estimate of the range of potential prices. However, knowing this information could provide you with insights about whether or not this year’s budget day will be more or less volatile than years past.

In addition to tracking the price of straddles, you should also consider watching the implied volatility. | Image: Shutterstock

On the day of the Union Budget, you could possibly see significant price movements – at least if history is any guide. Whenever major news is about to be announced, traders may speculate ahead of time on whether the news will be favourable or unfavourable. Depending on the information, traders may continue to push the prices in a trending direction or close out positions leading to a mean-reversion. In addition to this, investors will be assessing this information and determining whether the current prices are now a good value. All of this activity can lead to price volatility.

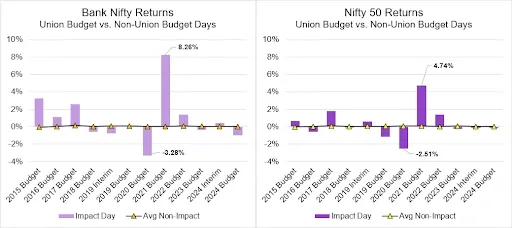

Let’s look at some historical returns for the Bank Nifty and NIFTY50. In below image, we show the returns on the budget day as well as the average returns for that index over the prior three-month period. For example, in 2021, the Bank Nifty had a return of 8.26% on the Union Budget day. The returns on the budget day are represented by a purple bar. However, in the three months preceding this, the average daily return was 0.03%. These non-budget day returns are represented by a line graph.

As you can see, in some years, there is a large movement on the budget day while in others, it is substantially smaller. Is there a way to estimate ahead of time how much the markets could move around the budget day? There is! But first, you need to understand a bit about an option strategy – the long straddle.

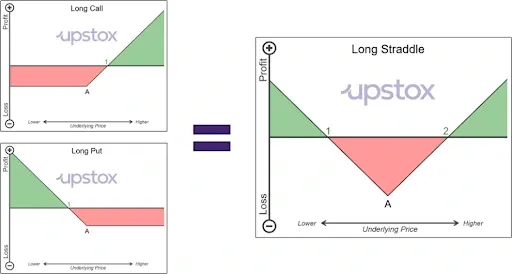

There are two types of options: a call and a put. When you buy a call option, you have the right but not the obligation to purchase the underlying stock or index. Buying a call option should be used when you believe the underlying stock or index will rise in value. With a put option, you have the right but not the obligation to sell the underlying stock or index. This is the opposite of a call option. Buying a put option is best if you believe the underlying stock or index will fall in price. Of course, you don’t just have to buy one or the other. You can buy both. Doing this is known as a straddle.

Below are the payoff diagrams of a long call (top left), a long put (bottom left), and a long straddle (right). A straddle is a non-directional option strategy. It doesn’t matter if the underlying stock or index rises or falls, as long as it moves enough to cover the cost of purchasing the straddle. The caveat of a long straddle compared to buying just a call or just a put is that you will be paying two premiums.

Let’s walk through how straddles can help us with the Union Budget.

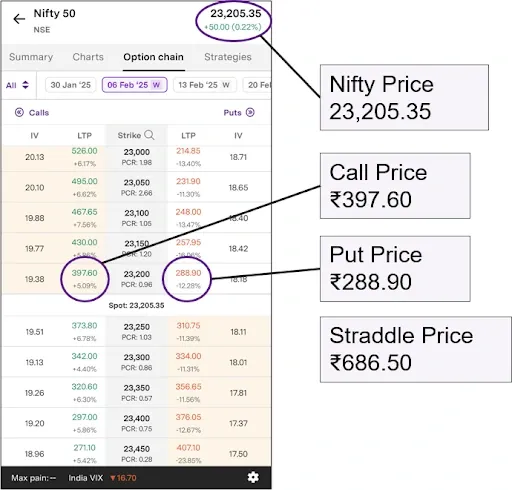

In image below we have a screenshot of the Upstox option chain. We have highlighted three points. On the top right is the current price of the NIFTY50. In the middle, you will see the spot price. Directly above that is the strike price of 23200. This is the at-the-money strike. The price of the at-the-money call is ₹397.60 and the at-the-money put is ₹288.90. A long straddle involves the purchase of the at-the-money call and put so the price of this straddle is 686.50.

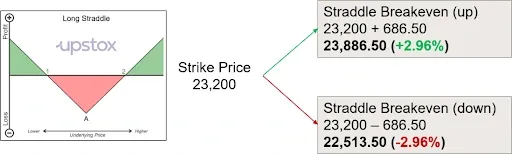

If you bought this straddle, the NIFTY would need to move up or down by more than what you paid in order to break even and start turning a profit. Specifically, the NIFTY needs to either move above the strike price of 23200 by more than 686.50 or below the strike price by more than 686.50. This is a move of +/-2.96%. This is not just the breakeven but it is also considered to be the “market implied move”.

So, what is the market-implied move?

Let’s walk through an example to better understand this. Assume you believe that Stock ABC will move from 100 to 110 tomorrow. You decide to buy it in hopes of a profit. Now, what if all market participants believed this? Traders would start buying at 100 which will increase the price to 101, then 102, and so on. Of course, traders will keep buying as long as there is profit potential. At 110, traders will stop buying because they won’t pay more than what they believe it is worth. This price point of 110 is known as the “market clearing” or “market equilibrium price”.

This is the same situation with straddles. If option traders believed that the underlying would move more than the current price of a straddle, then they would buy calls and puts. In doing so, this would raise the price and increase the breakeven more. For instance, the long straddle price is 686.50 and if traders believed that the Nifty would move by more than +/-2.96% before expiry, then more traders would enter into a long straddle. This would increase the price of the straddle. On the other hand, if traders believed the opposite and thought that the underlying would move less, then option traders would sell calls and puts. This would lower the price of the straddle as well as lower the market-implied move.

What should you be watching leading into the budget day?

Of course, you should be keeping an eye on the prices of straddles – this could be for the NIFTY50, Bank Nifty, or any optionable stock that you might be interested in trading. The expiry date to use would be the closest one after the Union Budget. For the NIFTY50 and Bank Nifty, it is 6 Feb and 27 Feb respectively. Right now, the NIFTY is expecting a price move of nearly +/-3% from now until expiration on 6 Feb. This, of course, would include the budget day. One caveat is that when you use straddles to estimate the market-implied move over a significant event like the Union Budget, it is common to multiply the market-implied move by 0.85. This is because option prices may not be able to accurately reflect the premium decay and other variables associated with implied volatility. So, the market is pricing a price move of +/-2.5% to 3.0% between now and expiry.

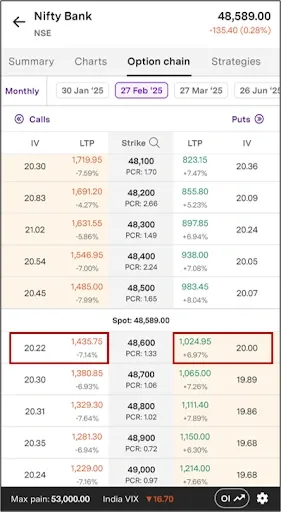

For the Bank Nifty, the market-implied price move is larger. We have a screenshot of this in illustration 6 below. In addition to tracking the price of straddles, you should also consider watching the implied volatility. Option prices can go up or down as the price of the underlying moves up or down. This can impact straddle prices. However, if the underlying is relatively flat and there is purchasing demand for the options, implied volatility will rise. In illustration 6, we are highlighting both the price and the “IV”. You should expect to see an increase in implied volatility in the days leading up to the budget day.

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story