Market News

How does the Union Budget impact the markets?

9 min read | Updated on January 27, 2025, 12:37 IST

SUMMARY

Unfortunately, you can’t predict the markets day-to-day, and this also applies to major news events like the Union Budget. Some will say that “history may not repeat itself, but it may rhyme”. To understand the potential, looking at past market return data is a good place to start. While you may not uncover a definitive strategy, you will at least have a better idea of how to assess the potential reward and risk.

Of the last 24 budgets, 10 budget days had a positive return on the budget day | Image: Shutterstock

Major news events can drive significant price movements in the financial markets. Whether this news is a company’s earnings announcement, the launch of a ground-breaking new product, a change in the interest rates, or other releases of other economic information, market prices will move accordingly. The Union Budget is one of these major news events. Traders will speculate in the days leading up to the budget on the information that could potentially be released. Once the information is released, traders will continue to speculate, and investors will begin to adjust their portfolios based on their perceived opportunity.

Whether this is your first budget day as a trader or your tenth, understanding how the indices and stocks react to this market-moving event is critical. When you have an event like this, you may want to apply a different approach than you would with your normal daily trading. Let’s take a look at how the NIFTY50 and Bank Nifty performed around the Union Budget.

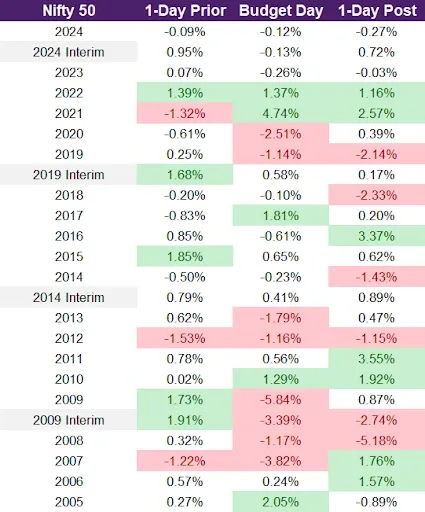

NIFTY50: Historical price movements during Union Budget

If you are an investor or trader, the great thing about the markets is that there is never a shortage of data to help guide you. Of course, the challenge is that the insights provided from historical data aren’t a guarantee that similar things will occur in the future. With that in mind, let’s start by looking at the last 20 years of Nifty 50 returns surrounding the Union Budget. This data in illustration 1 also includes four interim budgets. We have highlighted days where the index moved up or down by more than 1%. Two things should be visually evident: 1) there isn’t a consistent up or down movement and 2) the returns on days surrounding the budget announcement are volatile.

Here are some quick insights from this table.

-

Of the last 24 budgets, 10 budget days had a positive return on the budget day.

-

Five budget days saw returns greater than +1% while eight budget days returned less than -1%.

-

If you bought the NIFTY at the market close 2 days prior to the budget and exited at the market close the day after the budget, you would have seen a positive return on 12 (50%) of the budget days.

-

In the 12 periods when the cumulative return was positive, the average cumulative return was 3.0% over the three days.

-

In the 12 periods when the cumulative return was negative, the average cumulative return was 2.7% over the three days.

Let’s explore some more recent data. In illustration 2 below, we provide returns for the last 10 years including interim budget days. We are providing data across multiple columns. Here is how to read them. In the column labelled “-5 Days” are the total returns for the five days prior to the budget day. In the column labelled “+3 Days” are the total returns for the three days after the budget day. The “Budget Day” column lists the returns associated with the budget day. These returns are close-to-close returns which means that we are looking at the price at the market close of budget day and the price at the market close on the day before the budget day.

On budget day, the median, or 50th percentile of returns for the Nifty are essentially flat. The best year had a return of +4.74% and the worst year had a return of -2.51%.

| NIFTY50 | -5 Days | -3 Days | -1 Day | Budget Day | +1 Day | +3 Days | +5 Days |

|---|---|---|---|---|---|---|---|

| Best Year | 2.29% | 1.75% | 1.85% | 4.74% | 3.37% | 6.99% | 7.13% |

| 3rd Quartile | 0.32% | 0.75% | 1.06% | 0.83% | 0.83% | 2.08% | 2.09% |

| Median | -0.34% | -0.40% | 0.16% | -0.11% | 0.30% | 1.02% | 0.53% |

| 1st Quartile | -2.38% | -0.86% | -0.30% | -0.35% | -0.09% | 0.09% | -1.66% |

| Worst Year | -6.55% | -4.24% | -1.32% | -2.51% | -2.33% | -4.71% | -3.99% |

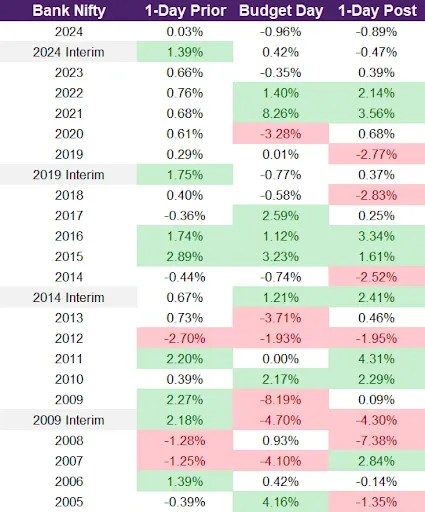

Bank Nifty: Historical Union Budget price movements

Since many companies that are impacted by the Union Budget are constituents of the Bank Nifty, we looked at the data for the returns for this index as well. Illustration 3 shows the returns for the Bank Nifty on the day prior, the day of, and the day after the Union Budget for the last 24 budget days including the interim ones. Similar to illustration 1, we have highlighted returns that are either greater than +1% or less than -1%. One thing to note is that the returns for the Bank Nifty tend to be more volatile than for the NIFTY50.

Across the last 20 years:

- 12 of the 24 budget days saw a positive return for the Bank Nifty on the day of the Union Budget

- 8 budget days saw a positive return of more than 1%

- 6 budget days had a negative return of less than -1%

Further, we have Bank Nifty returns for the last 10 years with cumulative returns for the +/-5 days surrounding the budget day. The median budget day return was +0.21% with the best and worst years having returns of +8.26% and -3.28% respectively. Two other quick call-outs are that:

- The median cumulative return in the five days leading up to the budget day was 0.0%

- Median cumulative return in the 3 days after the budget day was +0.95%

To generalise, the Bank Nifty is flat leading up to the Union Budget and has historically drifted upwards in the days following. Of course, you must remember that past returns aren’t guarantees of future returns.

| Bank Nifty | -5 Days | -3 Days | -1 Day | Budget Day | +1 Day | +3 Days | +5 Days |

|---|---|---|---|---|---|---|---|

| Best Year | 3.57% | 2.52% | 2.89% | 8.26% | 3.56% | 8.83% | 8.75% |

| 3rd Quartile | 0.75% | 0.79% | 1.48% | 1.69% | 1.74% | 2.59% | 3.05% |

| Median | 0.00% | 0.23% | 0.67% | 0.21% | 0.38% | 0.95% | 0.12% |

| 1st Quartile | -1.94% | -0.57% | 0.37% | -0.63% | -0.58% | -0.97% | -2.60% |

| Worst Year | -5.06% | -2.38% | -0.36% | -3.28% | -2.83% | -5.18% | -4.78% |

Bullish or bearish option strategies

Now that you have this information, perhaps you are interested in making a directional trade on the Nifty 50 or Bank Nifty. How would you do this with options? If you were bullish on the Nifty or Bank Nifty and believed that the price of these indices would rise in the future, you could enter into a long call. This strategy gives you the right to buy the underlying asset at a specific price. For example, if you are bullish on the Nifty and the current price is 23155, you could select the strike price of 23150. Of course, when you trade options, you need to select an expiration date. With the Union Budget happening on 1 Feb, you will want to select an expiry that is after this date. In this case, the nearest expiry is 6 Feb. If the NIFTY50 or Bank Nifty rises above the strike price by more than what you paid for the call option prior to expiry, you will be profitable.

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story