Market News

Understanding historical trends for options trading on Budget days

8 min read | Updated on January 30, 2025, 12:06 IST

SUMMARY

Market speculation ahead of the Union Budget 2025 can drive volatility, especially for the Bank Nifty. Traders often use options strategies like long straddles to benefit from market movements. However, risks such as implied volatility "crush" after the budget announcement could impact profitability. Understand historical trends and strategies to navigate.

Historical returns of various trading strategies aren’t necessarily indicative of future returns | Image: Shutterstock

Before an event like the Union Budget, there could be speculation in the markets. The activity of traders, whether they are bullish or bearish, could make prices drift directionally or make them more volatile. Once the event occurs, there will likely be additional price movement. This is because if the market thinks that if the information released during the event is bullish and if the pre-event market movements are flat or bearish, then the market could keep rising.

On the other hand, there could be a situation of “buy the rumour and sell the news”. In this case, the market may have risen in anticipation of the event’s news and the market could reverse downward after the event.

Predicting the returns of the markets with certainty is impossible. However, that doesn’t mean you can’t use past market behaviour to provide context and insights into patterns that could emerge. In this article, we will take a look at how Bank Nifty performed around the budget day as well as how options reacted leading up to the event.

So how do the markets react around Budget day?

Looking back over the prior 10 years, including 4 interim budget days, the Bank Nifty has seen a range of movements from -3.28% to +8.26% from the market close on the day before the market close on the budget day. The median return is +0.21%. You can see this in the table below. Before and after the budget day, the markets still tend to be volatile. For example, the “-3 Days” column shows the returns in the 3 days prior to the budget day. Alternatively, the “+3 Days” column shows the returns over the 3 days following the budget day. The median return for the 3 days before is +0.23% and +0.95% for the 3 days after.

| Bank Nifty | -5 Days | -3 Days | -1 Day | Budget Day | +1 Day | +3 Days | +5 Days |

|---|---|---|---|---|---|---|---|

| Best Year | 3.57% | 2.52% | 2.89% | 8.26% | 3.56% | 8.83% | 8.75% |

| 3rd Quartile | 0.75% | 0.79% | 1.48% | 1.69% | 1.74% | 2.59% | 3.05% |

| Median | 0.00% | 0.23% | 0.67% | 0.21% | 0.38% | 0.95% | 0.12% |

| 1st Quartile | -1.94% | -0.57% | 0.37% | -0.63% | -0.58% | -0.97% | -2.60% |

| Worst Year | -5.06% | -2.38% | -0.36% | -3.28% | -2.83% | -5.18% | -4.78% |

How have options traders used this information historically?

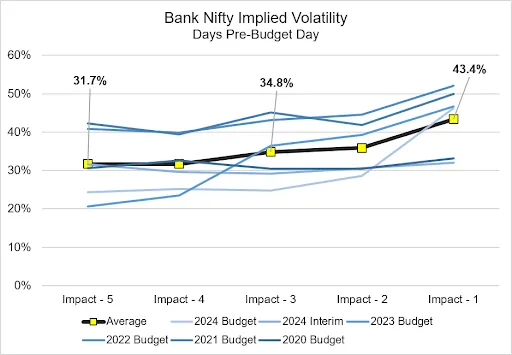

Some traders may buy calls if they believe the major indices will rise or some may buy puts if they think that they will fall in price. When this happens, it places significant buying pressure on options leading to a rise in implied volatility. You will see this phenomenon before binary events like earnings announcements and the Union Budget. In illustration 2 below, we show the implied volatility for the Bank Nifty leading into the Union Budget for the last 5 years. On average, the IV rises from 31.7% to 43.4% in the five days leading up to the event day. Increasing IV is indicative of increased demand for options.

As an options trader, how can you use this information?

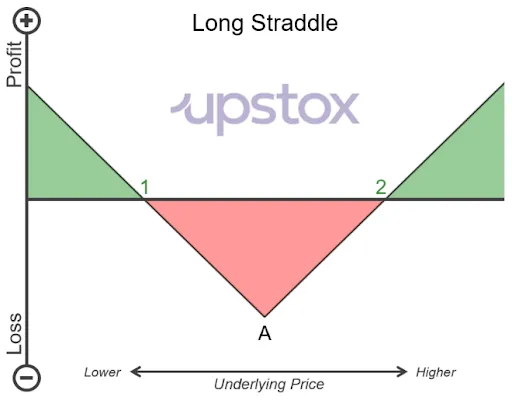

It is extremely difficult to determine the direction of the markets, particularly leading into an event like the Union Budget. Something great about options is that you don’t have to trade directionally – you can trade non-directionally. A long straddle is a non-directional strategy that lets a trader speculate on the future volatility of the underlying index or stock. Instead of just buying a call or just buying a put, you purchase both! Since you are buying two option contracts, you are paying two premiums. Therefore, the underlying will need to move enough – either up or down – to cover the cost of these premiums and turn a profit. The payoff diagram of a long straddle is in illustration 3 below.

How have long straddles performed historically?

In illustration 4, we show the backtest of a Bank Nifty long straddle being entered several days prior to the Union Budget over the last 5 years. We have this backtest with the assumption that you either exit on the market close prior to the budget day (top table) or exit on the market close the day of the Union Budget (bottom table).

While there isn’t historical consistency in terms of profitability of these strategies, the backtest where you exit prior to the budget day generally performs better than exiting on the close of the day of the Union Budget. In some instances, the performance can completely flip. For example, in the column labeled “2024-I” (2024 Interim Budget), the top backtest has positive performance across all days where you enter. Conversely, the bottom backtest has negative performance across the same days simply by holding through the Union Budget day.

Bank Nifty - Long Straddle: Exit on Close of Day Prior to Union Budget

| Enter on Close of | 2020 | 2021 | 2022 | 2023 | 2024 - I | 2024 |

|---|---|---|---|---|---|---|

| Budget Day - 2 | 1.9% | 5.0% | 2.7% | -2.6% | 6.6% | -4.4% |

| Budget Day - 3 | -9.0% | -6.3% | -4.1% | -6.0% | 0.7% | -0.2% |

| Budget Day - 5 | -18.3% | -14.8% | 1.6% | 116.0% | 2.8% | -12.2% |

Bank Nifty - Long Straddle: Exit on Close of Union Budget Day

| Enter on Close of | 2020 | 2021 | 2022 | 2023 | 2024 - I | 2024 |

|---|---|---|---|---|---|---|

| Budget Day - 2 | -0.3% | 134.4% | -24.8% | -37.1% | -13.7% | -38.6% |

| Budget Day - 3 | 15.8% | 110.9% | -40.4% | -40.8% | -18.5% | -18.6% |

| Budget Day - 5 | -3.4% | 34.4% | 3.9% | 142.9% | -11.6% | -33.0% |

What are some potential risks with long straddles around the Union Budget?

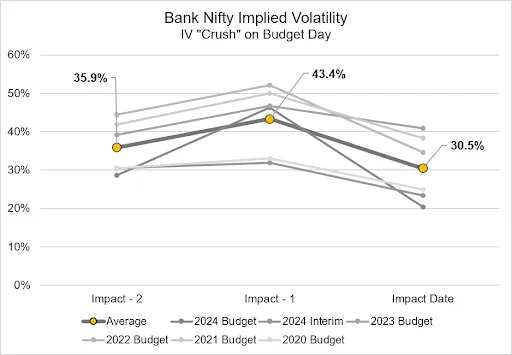

Something interesting happens following the release of new information: uncertainty falls. With this reduction in uncertainty, implied volatility falls as traders exit their option positions. This is known as the IV “Crush” and is observed after market moving events like earnings announcements. Illustration 6 shows that this also occurs after the Union Budget. Two days prior to the Union Budget, the average of the implied volatility of the Bank Nifty over the last 5 years is 35.9%. On the day prior to the budget, the implied volatility rises to 43.4% and then is “crushed” down to 30.5% on the market close of the Union Budget.

Historical returns of various trading strategies aren’t necessarily indicative of future returns on those same strategies. Despite this, the concepts we’ve discussed still form a foundation of option trading around market-moving events like the budget day. We do know that the following things will regularly occur:

- Option implied volatility will tend to rise leading up to the event.

- Prices of the underlying index or stock will likely be more volatile than any other random day of the year.

- Option implied volatility will tend to fall after the event.

With these insights, you can make the decision whether to go long a straddle is the right move for you.

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story