Market News

Impact of US elections on Indian markets: All you need to know

.png)

4 min read | Updated on November 05, 2024, 19:26 IST

SUMMARY

US presidential elections significantly influence global markets, particularly India. Historical data reveals that election outcomes affect market volatility, sector performance, and investor sentiment, with Democratic victories often leading to positive Indian market responses.

Swing states are known for their volatile voting trends, frequently swinging between the Democratic and the Republican parties

In the next 48 hours, a country representing 4% of the global population but contributing 24% to the world’s GDP is set to elect its president for the next four years. Will it be Kamala Harris or Donald Trump? Here’s a look at how this US election could impact global markets and a review of how past U.S. election outcomes have influenced the Indian stock market over the previous three cycles.

US elections significantly impact the stock market by influencing expectations around future policies, increasing market volatility, and often aligning with historical performance trends. Markets typically react swiftly post-election, with lasting effects on stock performance as the new administration’s economic policies unfold.

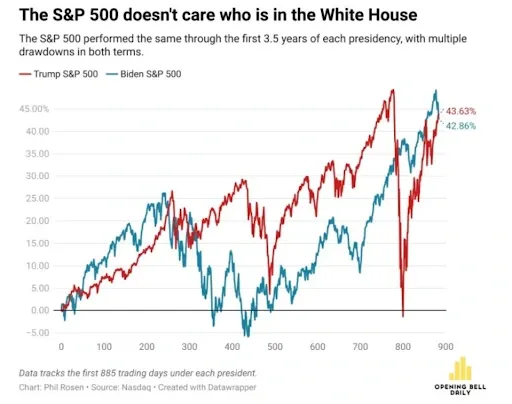

Bloomberg data shows that under Donald Trump’s administration, the S&P 500 rose by 70.2% and the NASDAQ by 142.9%. Under Joe Biden, the S&P 500 increased by 50.8% and the NASDAQ by 36.8%.

Source: Nasdaq

It has been observed that during the Trump administration, tech stocks and small caps consistently outperformed compared to their performance under Joe Biden’s administration.

How do US election results impact global markets?

US election results can have a strong impact on global markets, largely because their economic policies play a major role in shaping international trade, investment flows, and geopolitical stability.

From 1990 to 2021, the US stock market showed varying levels of correlation with other regions: 0.03 with Japan, 0.45 with Europe, and 0.27 with other Asian markets. This indicates a stronger influence on European markets, while Japanese and other Asian markets are less affected, as per data from CAIA.

Previous 3 election results and their impact on Indian markets

Because of the strong economic ties between the US and India, the results of US presidential elections often affect the Indian stock markets. In the past, Indian markets have seen fluctuations depending on who wins the election.

3 November 2020: Joe Biden Elected

The US election results were announced on November 3, 2020. The following day, both the NIFTY 50 and SENSEX opened positively, closing with gains of +0.80% and +0.88%, respectively. In November, NIFTY 50 surged by 11.39%, and SENSEX rose by 11.45%, both reaching new all-time highs that month. Since then, NIFTY 50 has gained 128%, and SENSEX has risen 117% from the election date to their respective all-time highs.

8 November 2016: Donald Trump Elected

The US election results were announced on November 8, 2016. The following day, NIFTY 50 opened down by 476 points, while SENSEX dropped by 1,340 points. It was a double whammy for the Indian benchmark indices as demonetisation was also observed. However, NIFTY 50 rebounded during the day, gaining 409 points from the intraday lows but still closing down by -1.31%, and SENSEX recovered by 1,146 points, ending the day down by -1.23%.

For the month, NIFTY 50 underperformed with a decline of -4.79%, while SENSEX fell by -4.61%. Despite this, during the Trump administration, NIFTY 50 gained 57%, and SENSEX increased by 65% until reaching their all-time highs.

6 November 2012: Barack Obama Re-elected

The US election results were announced on November 6, 2012. The next day, NIFTY 50 and SENSEX opened positively, with NIFTY 50 gaining 35 points to close up by +0.62% and SENSEX rising by 85 points to close up by +0.45%. Throughout the month, NIFTY 50 increased by +4.63%, while SENSEX rose by +4.51%. During Obama's administration, both NIFTY 50 and SENSEX saw a total gain of 65% until reaching their all-time highs.

It has been noted that whenever a candidate from the Democratic Party is elected, both SENSEX and NIFTY 50 tend to open positively and close the month with gains. During Biden's current presidential cycle, NIFTY 50 and SENSEX performed the better compared to the other two cycles, although other factors also contributed to their performance from 2020 to 2024.

About The Author

Next Story