Market News

How will Donald Trump’s second term impact the markets? Here’s what his first tenure tells us

4 min read | Updated on January 21, 2025, 12:30 IST

SUMMARY

As Donald Trump returned for his second term as US President, experts and investors are keenly watching his ‘protectionist’ approach to the economy. His first executive orders addressed the issues of illegal immigration, energy supply and the federal workforce. Despite much hype about the impact of his protectionist actions, taking a look at his first tenure may give us some cues about how markets, commodities and economies will perform in the next four years.

During his first tenure markets performed phenomenally despite trade war and other conflicts.

Donald Trump, who was sworn in as the 47th President of the US, signed array of executive orders targeting areas of immigration, energy policy, national policy and government workforce. These first orders didnt include any sanctions or tariffs on the world and China which he claimed to execute on first day of his second term. Markets across the globe rejoiced his decisions to delay on the tariffs and closed higher on Monday.

Experts and investors are keenly watching his ‘protectionist’ approach to the economy. His decisions at home could impact the global economy at large. However, beyond the hype, taking a look at his previous tenure may give some clues as to what one can expect from his second term.

Key decisions that Trump took during his first term

- Sanctions were imposed on Chinese goods worth $395 billion, primarily electronic manufacturing, machinery and consumer goods. This was in addition to trade war tactics initiated against China for unfair trade practices, intellectual property theft and trade imbalance.

- Trump also imposed 25% and 10% tariffs on global steel and aluminium imports, respectively. The tariffs proved to be beneficial to the steel and aluminium industry in the US, as they revived some of the key steel and aluminium mills. However, Chinese oversupply in the global markets kept the prices in check. Later, Canada and Mexico were exempted from tariffs.

- Tariffs were imposed on solar panel manufacturers outside the US, as cheaper imports from Southeast Asian nations impacted domestic manufacturers.

- Sanctions were imposed on Iran after it withdrew from the nuclear deal. It put severe economic sanctions on oil exports, financial institutions, and industrial sectors.

- Sanctions were also imposed on Russia for the annexation of Cremia, interfering in the US elections and involvement in cyber attacks. In addition, certain sanctions were imposed on North Korea to put pressure on its complete denuclearisation.

- In response to the above tariffs and sanctions, nations worldwide also announced retaliatory tariffs on US agriculture industrial goods, disrupting the supply chain for US consumers and increasing their costs.

Markets displayed resilience despite all odds

| Global indices and gold prices | Performance from Jan 2017 to Jan 2021 |

|---|---|

| Dow Jones | 55% |

| NASDAQ | 162% |

| NIFTY50 | 74% |

| Nikkei225 | 50% |

| FTSE | (6.7%) |

| DAX | 20% |

| Shanghai Composite | 14.5% |

| Gold | 53.1% |

Despite various sanctions, tariffs, and a separate tweet war, markets showed strong resilience during Trump’s first term.

Crude oil prices were steady amid trade disruptions

Apart from equity markets, commodities like crude oil, which are directly impacted by tariffs and sanctions across the globe, remained largely unchanged from his tenure in January 2017 to January 2021, except for a few wild swings due to a demand-supply mismatch. According to the latest media reports, Trump is planning to remove restrictions on oil extractions in the US, which could boost supply in the markets and put downward pressure on prices.

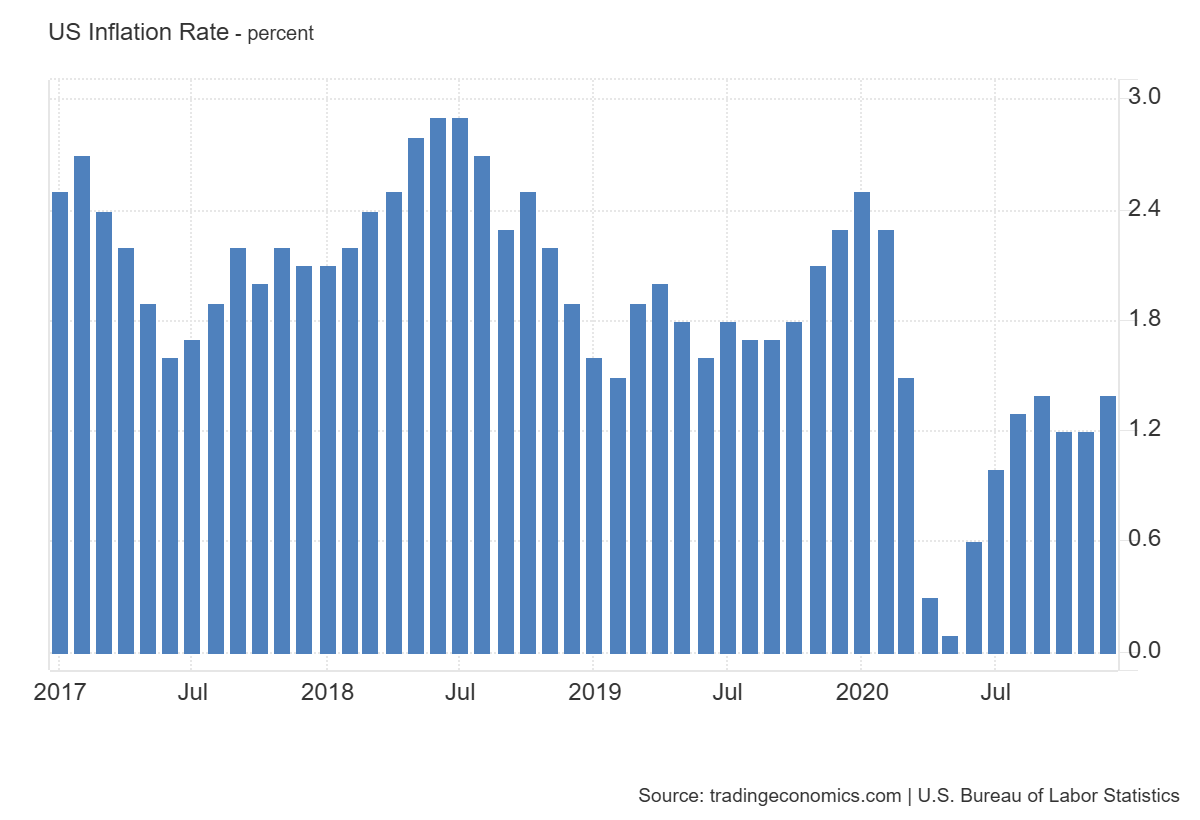

US inflation remained under control

US inflation, which has become a key overhang for global markets as it determines global liquidity, also remained in the range of 2.4% to 2.5%.

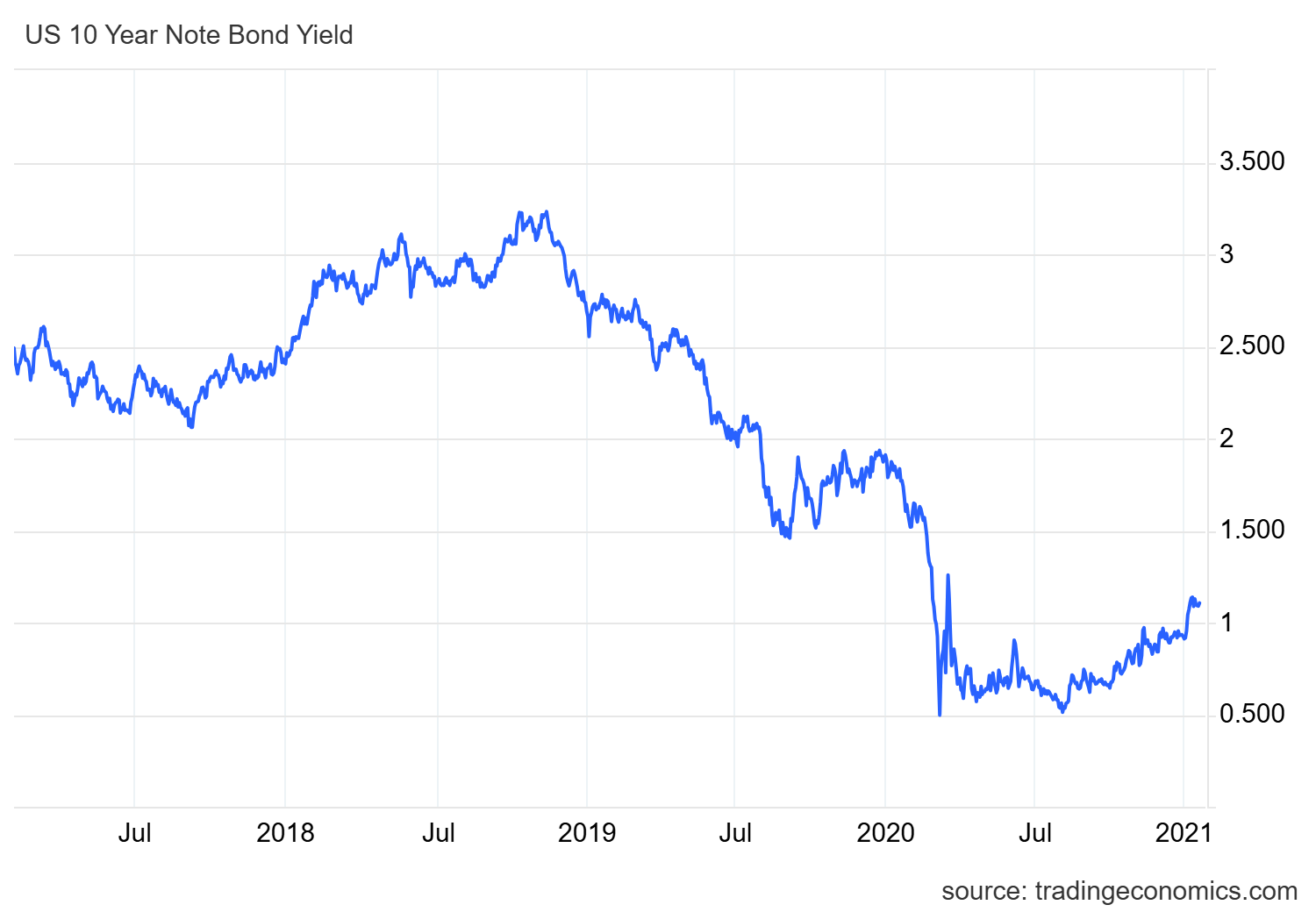

Yield stability spurred investor confidence

A steady inflation rate also kept the policy rates in check, and so did the yields. From January 2017 to March 2020, the US 10-year bond yields traded in a stable range of 1.5% to 3%. The stable yields in the US provided risk capital across all global markets, including India. If the yields stabilise further and the dollar index cools down, global markets could see a higher inflow of money from foreign investors.

Volatility stayed in control, and corporate profits grew steadily

The volatility indicator S&P 500 VIX also traded in the range of 11 to 15 for most of the period until March 2020, after which, due to the COVID-19 crash, the VIX skyrocketed to 80. In addition, overall corporate profits in the US grew consistently at an annual rate of 2.5% in each quarter from 2017 to 2020, after which the temporary blip due to COVID-19 impacted corporate earnings.

Bottomline

The data suggests that Trump’s policies make more noise before the impact. In his second term, he has claimed to take more drastic decisions like a 10% blanket tariff on all imports from the world and 60% on China, the impact of which is unknown at this stage. However, markets have efficiently dealt with situations like the COVID-19 pandemic, the Russia-Ukraine war and other conflicts. This gives confidence that any unexpected change will impact the markets, but markets will keep looking for opportunities in these changes.

About The Author

Next Story