Market News

Premier Energies IPO opens; check key risk factors

.png)

4 min read | Updated on August 28, 2024, 07:20 IST

SUMMARY

The company on Monday raised ₹846 crore from anchor investors. Nomura Funds, Abu Dhabi Investment Authority, HDFC Mutual Fund (MF), ICICI Prudential MF, Axis MF, Kotak MF, Nippon India MF, Sundaram MF, and UTI MF are among the anchor investors, according to a circular uploaded on the BSE website.

The company was established in 1995.

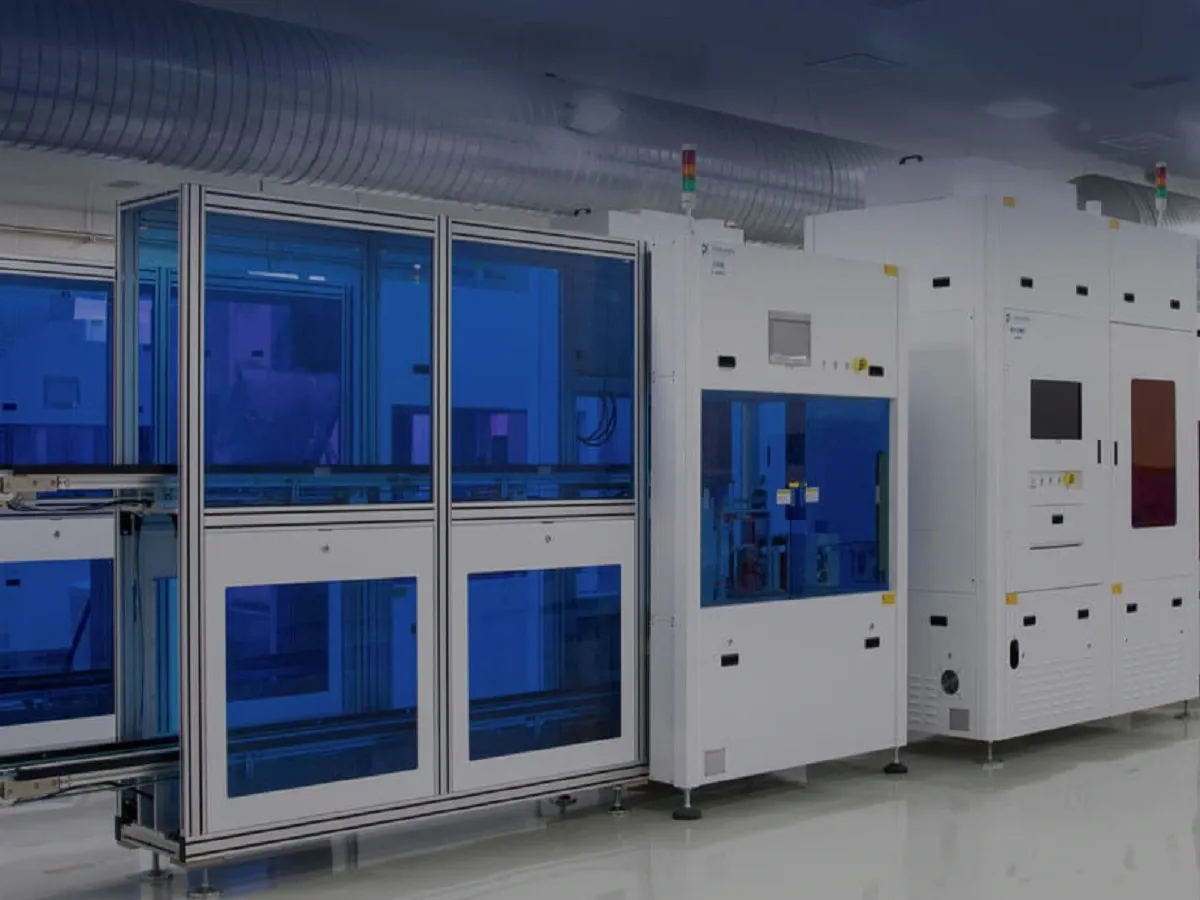

Premier Energies, an integrated solar cell and solar module manufacturing company that was established in 1995, will launch its initial public offering (IPO) on Tuesday, August 27, to raise ₹2,830 crore.

The company is backed by GEF Capital, a Washington, DC-based private equity investor.

The three-day share sale will conclude on August 29, and the bidding for anchor investors took place on Monday (August 26).

The company raised ₹846 crore from anchor investors. Nomura Funds, Abu Dhabi Investment Authority, HDFC Mutual Fund (MF), ICICI Prudential MF, Axis MF, Kotak MF, Nippon India MF, Sundaram MF, and UTI MF are among the anchor investors, according to a circular uploaded on the BSE website.

The company allocated 1.88 crore equity shares to 60 funds at ₹450 apiece, aggregating the transaction size to ₹846.11 crore, it showed.

The price band for the public issue has been set at ₹427-₹450 apiece.

The IPO is a combination of a fresh issue of equity shares aggregating up to ₹1,291.4 crore and an offer-for-sale (OFS) of up to 3.42 crore shares by the selling shareholders, valued at ₹1,539 crore at the upper end of the price band. This takes the total issue size to ₹2,830 crore.

Kotak Mahindra Capital Company Ltd, J.P. Morgan India, and ICICI Securities are the book-running lead managers for the issue.

Fund utilisation

The company said that the proceeds from the fresh issue to the tune of ₹968.6 crore will be allocated for investment in the company's subsidiary, Premier Energies Global Environment Pvt Ltd, for part-financing the establishment of a 4 GW Solar PV TOPCon Cell and 4 GW Solar PV TOPCon Module manufacturing facility in Hyderabad and towards general corporate purposes.

- Revenue dependent upon limited number of customers

The company, in its Red Herring Prospectus (RHP), said its reveue from operations is dependent upon a limited number of customers, and the loss of any of these customers or loss of revenue from any of these customers could have a material adverse effect on its business, financial condition, results of operations, and cash flows.

The company also added that these key customers may also replace the company with its competitors, replace their existing products with alternative products that they do not supply, or refuse to renew existing arrangements on terms acceptable to us or at all.

- Company's prospects depends on success of two products namely, solar cells and modules

The primary products Premier Energies manufactures are solar cells and solar modules.

"We are therefore exposed to the changes in demand for solar cells and modules manufactured using monocrystalline technology, which would affect our business, profitability, and prospects.

Demand for and widespread adoption of solar power technology is generally affected by the cost-effectiveness, performance, and reliability of solar power compared to traditional energy sources, the price volatility of solar power equipment, and seasonality and weather conditions impacting the installation and generation of solar power, among others," it said.

- Manufacturing facilities in Telangana

The company's manufacturing facilities are located in Telangana, which exposes its operations to potential geographical concentration risks arising from local and regional factors that may adversely affect its operations and, in turn, its business, results of operations, and cash flows, the RHP mentions.

- Financial performance of subsidiaries

As regards this, the company's RHP said, "Most of our subsidiaries have incurred losses at some point in the last three fiscals and the three months ended June 30, 2024, and any similar losses in the future may adversely affect our business, financial condition, and cash flows. This includes Premier Energies Global Environment Private Limited, the subsidiary to which the net proceeds will be applied."

It further mentions that it had negative cash flows of ₹(155.29) million in fiscal 2023 and ₹(410.48) million in the three months ended June 30, 2024, and may continue to have negative cash flows in the future.

- Significant decline in actual production

The company experienced a significant decline in actual production and annual installed capacity of solar modules in the past three fiscal years and the three months ended June 30, 2024. Should similar decreases occur in the future, its business, financial condition, and results of operations may be adversely affected.

- Non-compliance with the FEMA Act in the past

"In the past, we failed to comply with certain provisions of the Foreign Exchange Management Act, 1999, and also with the Companies (Prospectus and Allotment of Securities) Rule, 2014, and had to compound such non-compliances. We cannot assure you that there will be no such non-compliances in the future and that our company, subsidiaries, directors, or the directors of our subsidiaries will not be subject to any penalty or any additional payments," it added.

About The Author

Next Story