Market News

Naturewings Holidays shares hit 5% lower circuit after listing at 28% premium on BSE SME

.png)

3 min read | Updated on September 10, 2024, 15:55 IST

SUMMARY

Naturewings Holidays IPO was booked nearly 384 times during the subscription period from September 3 to September 5.

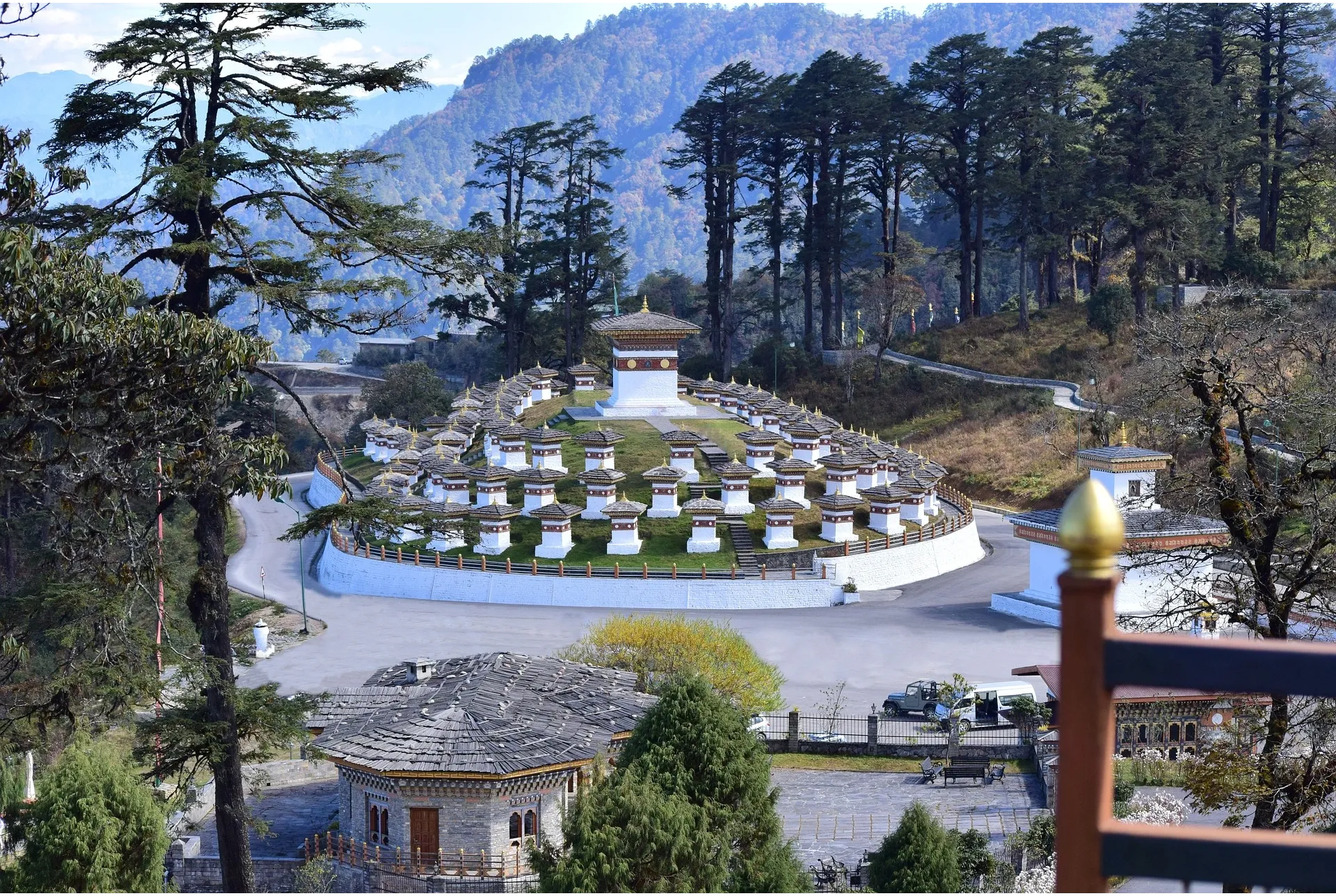

Naturewings Holidays offers holiday packages for travellers visiting the Himalayan range in India, Bhutan and Nepal.

Shares of travel services provider Naturewings Holidays Ltd settled at 5% lower circuit after listing at an over 28% premium on the BSE SME platform.

Since the minimum bidding quantity in the Naturewings Holidays IPO was 1,600 shares, successful bidders who were allotted shares in the primary issue were sitting on listing gains of at least ₹33,600 (₹21 x 1,600), as soon as the stock started trading on the exchange.

Naturewings Holidays IPO details

The ₹7.03-crore SME IPO received tremendous investor response during its subscription period, from September 3 to September 5. After the three-day bidding period ended, the Naturewings Holidays IPO was booked nearly 384 times, with the company receiving bids for more than 34.6 crore shares as against 9.02 lakh shares on offer.

The retail portion was overbooked by a whopping 487 times. Retail individual investors had placed bids for over 21.98 crore shares against 4.51 lakh shares set aside for the category. The non-institutional investors (NIIs) category was booked over 270 times, with applications for over 12.21 crore shares against 4.51 lakh shares on offer.

The Naturewings Holidays IPO comprised a fresh issuance of 9.5 lakh shares, with no offer-for-sale (OFS) component. The IPO was a fixed-price issue, with shares being offered at ₹74 apiece in a lot size of 1,600 units.

The company had said that it proposed to utilise the IPO proceeds to meet working capital requirements and finance capital expenditure for marketing and business promotions.

Of the gross proceeds of ₹7.03 crore, the company said that it would utilise ₹3.95 crore for working capital needs, ₹1.02 crore for marketing and business promotions and ₹86.30 lakh for general corporate purposes.

Incorporated in December 2018, Naturewings Holidays is a Kolkata-based Himalayan destination management company that offers holiday packages for travellers visiting the Himalayan range in India, Bhutan and Nepal.

The company provides land and air bookings, in-transit arrangements, hotel reservations, and destination management services.

As of March 31, 2024, the company had served approximately 7,163 packages to over 33,065 travellers on a cumulative basis through a network of more than 100 travel agents registered with them in major cities in India.

Related News

About The Author

Next Story