Market News

CLN Energy IPO Day 1: BSE SME issue booked 1.6x; check offer size, price band and other key details

.png)

4 min read | Updated on January 23, 2025, 19:18 IST

SUMMARY

The components manufacturer for electric vehicles (EVs) aims to raise ₹72.3 crore from investors through the IPO. CLN Energy IPO is open for bidding till Monday, January 27. The company has fixed the price band at ₹235 to ₹250 per share for the IPO.

The EV components manufacturer’s revenue from operations stood at ₹74.83 crore in the quarter ended September 30, 2024

The initial public offering (IPO) of small and medium enterprise (SME) CLN Energy Ltd was fully subscribed within a few hours of launch on the first day of subscription on January 23.

The components manufacturer for electric vehicles (EVs) aims to raise ₹72.3 crore from investors through the IPO. The public offer is open for bidding till Monday, January 27.

The BSE SME issue was booked 1.65 times at the end of bidding, led by the Non-Institutional Investors (NIIs).

As per the BSE data, the issue received bids for more than 34.25 lakh shares against 20.71 lakh shares on offer, leading to an overall subscription of 1.65 times.

Retail investors subscribed their quota 1.96 times with bids for more than 18.8 lakh shares compared to 9.57 lakh shares set aside for the category. The NIIs subscribed their segment 1.76 times with bids for more than 9.97 lakh shares against the allocation of 5.66 lakh shares. The Qualified Institutional Buyers (QIBs) category was also fully subscribed on the first day. The QIBs applied for 5.47 lakh shares against the allocation of an equal number of shares.

Ahead of the launch of its IPO, CLN Energy raised a total of ₹20.52 crore from anchor investors on January 22. The company allotted 8,20,800 shares to three anchor investors at a price of ₹250 per equity share.

Here’s a look at all the key details about the IPO for the investors looking forward to applying for the shares of the company.

CLN Energy IPO price band and other details

The initial public offering of the EV components manufacturer consists of an exclusively fresh issue of 28.92 lakh equity shares.

The company has fixed the price band at ₹235 to ₹250 per share for the IPO.

The minimum lot size is 600 shares for the retail investors, aggregating to an investment of ₹1,50,000. The High Networth Individuals (HNIs) can bid for at least two lots of 1,200 shares, amounting to ₹3,00,000.

Aryaman Financial Services Ltd is the book-running lead manager of the CLN Energy IPO, while Bigshare Services Private Ltd is the registrar for the issue.

CLN Energy IPO dates

The IPO allotment status is expected to be finalised on Tuesday, January 28, following the subscription.

The company is scheduled to process refunds on January 29 and the allottees will also receive the shares in their Demat accounts the same day.

CLN Energy Ltd has proposed to list its shares on the BSE SME platform on Thursday, January 30.

About CLN Energy and use of IPO proceeds

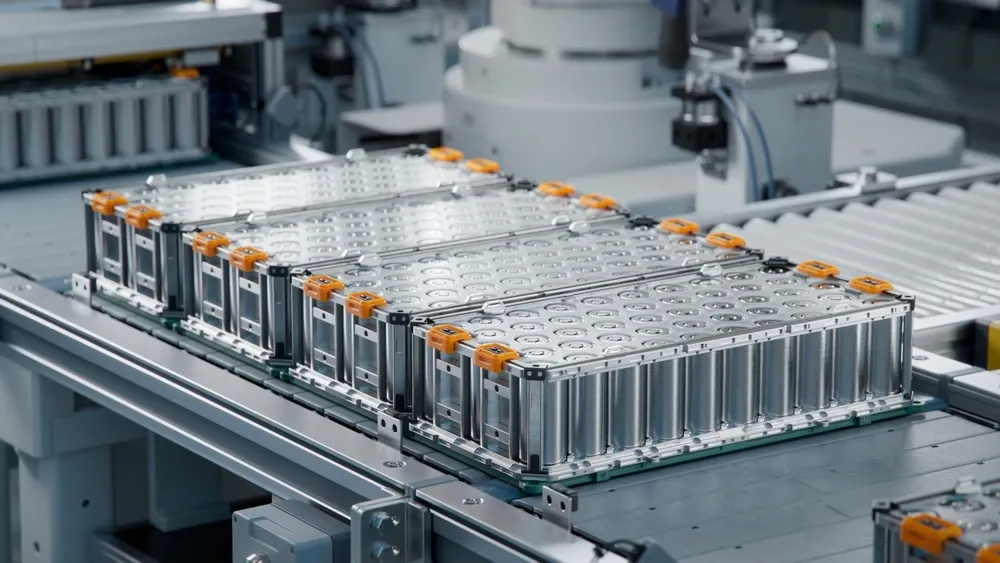

The company has two state-of-the-art manufacturing facilities in Noida (Uttar Pradesh) and Pune (Maharashtra), spanning across a combined area of 63,000 square feet. The Noida facility is equipped with the capacity to produce 60,000 motors per year. The company’s facilities are capable of handling high volumes of lithium-ion battery production.

As per CLN Energy’s RHP, the company will be using the proceeds from the fresh issue to purchase machinery and equipment, capital requirements and general corporate purposes.

The EV components manufacturer’s revenue from operations stood at ₹74.83 crore in the quarter ended September 30, 2024. The net profit was recorded at ₹4.63 crore in the same period.

For the financial year ended March 31, 2024, CLN Energy’s revenue from operations stood at ₹132.7 crore compared to ₹128.81 crore in the preceding fiscal year (FY23). Its profit after tax (PAT) for FY24 jumped to ₹9.79 crore compared to ₹72.87 lakh in FY23.

About The Author

Next Story