Market News

MCX silver reclaims ₹93,800, will it sustain the bullish momentum?; check today's trade setup

.png)

3 min read | Updated on February 03, 2025, 18:13 IST

SUMMARY

Silver futures on MCX are currently trading above the crucial resistance zone of ₹93,600 after breaking out from the downward slopping trendline. For short-term clues, traders can monitor the price action around this zone. A close above this level or rejection will provide further clues.

Commodity trade setup 3 Feb: MCX Silver reclaims ₹93,600, will is sustain the bullish momentum? | Image: Shutterstock

Market recap (as of 6:00 pm)

- Gold 4 April Futures: ₹82,950/ 10 gram (▲ 0.78%)

- Silver 5 March Futures: ₹93,880/ 1 kg (▲ 0.71%)

- Crude Oil 19 Feb Futures: ₹6,491/ 1 BBL (▲ 2.2%)

Analysts warn that announced tariffs could escalate into a trade war, potentially slowing global growth and fueling inflation.

Technical structure

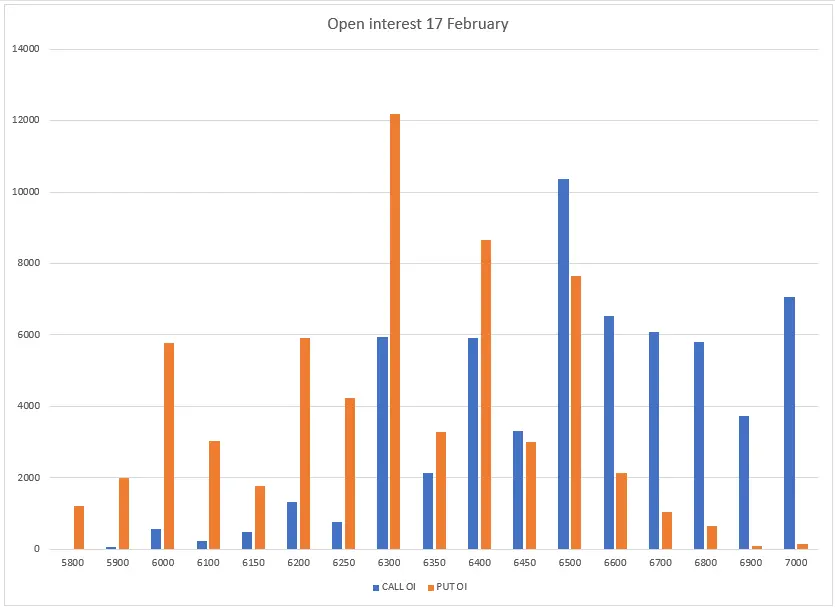

The open interest data for the 17 February expiry saw significant put addition at 6,300 strike, suggesting support for the index around this zone. On the flip side, the call base was seen at 6,500 and 7,000 strikes, marking them as immediate resistance zones.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story