Market News

MCX Gold inching closer to all-time high, Crude oil consolidates around ₹6,600; check today's trade setup

.png)

3 min read | Updated on January 22, 2025, 19:34 IST

SUMMARY

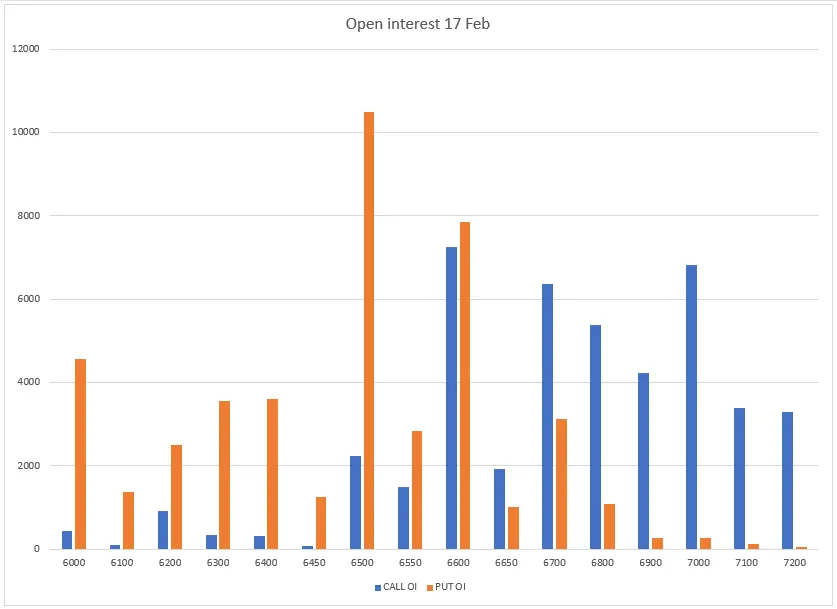

The open interest data for the 17 February expiry of crude oil saw significant call and put build-up at 6,600 strike, suggesting range-bound activity around this level.

Crude oil prices stabilised and ended the four-day losing streak after a sharp fall of nearly 4%.

Market recap (as of 7:15 pm)

- Gold 5 Feb Futures: ₹78,555/ 10 gram (▲ 0.42%)

- Silver 5 March Futures: ₹91,920/ 1 kg (▼ 0.19%)

- Crude Oil 19 Feb Futures: ₹6,578/ 1 BBL (▲ 0.21%)

President Trump laid out a sweeping plan to maximise oil and gas production, including speeding up approvals for new energy projects, rolling back environmental protections and withdrawing the US from the Paris climate pact.

Technical structure

The open interest data for the 17 February expiry of crude oil saw significant call and put build-up at 6,600 strike, suggesting range-bound activity around this level. Meanwhile, the put base remains established at 6,500 strike, indicating support for the index around this zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story