Market News

MCX gold hits fresh record high, silver rebound to trade above ₹97,000; check today's trade setup

.png)

3 min read | Updated on February 19, 2025, 18:23 IST

SUMMARY

MCX Gold prices hit a fresh record high on February 19th and moved past the bearish engulfing candle formed on February 14th. For directional clues, traders can monitor the high (86,358) of the bearish reversal pattern. A close above this zone will invalidate the reversal pattern and will signal the continuation of the bullish momentum.

International crude oil futures advanced on Wednesday, with Brent futures rising 0.53% to $76.24 per barrel | Image: Shutterstock

Market recap (as of 6:00 pm)

- Gold 4 April Futures: ₹86,330/ 10 gram (▲ 0.25%)

- Silver 5 March Futures: ₹97,150/ 1 kg (▲ 0.31%)

- Crude Oil 19 March Futures: ₹6,305/ 1 BBL (▲ 0.91%)

Market experts note that traders and investors are closely watching developments on oil export sanctions as the U.S. works to broker a deal to end the war in Ukraine.

Technical structure

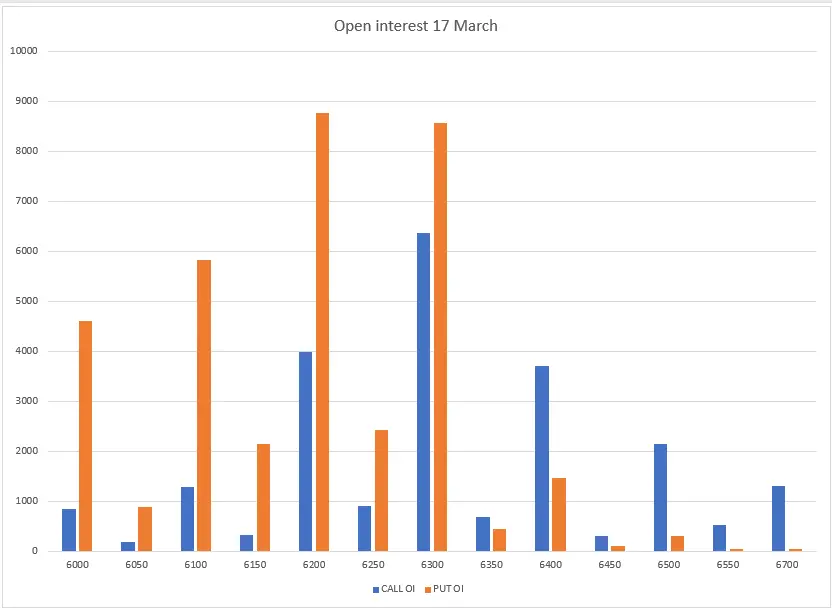

Meanwhile, the open interest build-up for the 17 March expiry saw significant put options build-up at 6,200 and 6,300 strikes, indicating support for the crude around these levels. Meanwhile, the call options base was seen at 6,300 and 6,400 strike with relatively low volume.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story