Market News

Gold vs silver: Which precious metal outperformed in 2024?

.png)

4 min read | Updated on December 22, 2024, 23:42 IST

SUMMARY

In 2024, gold rose 19.57% YTD, silver hit a 12-year high, and both outperformed key indices due to geopolitical tensions, US monetary easing, and rising renewable energy demand.

Gold and Silver in 2024: Performance, Influencing Factors, and 2025 Outlook

This year has been one of the best years for precious metals. Bullion, as an asset class, has performed exceptionally well in 2024. In fact, until November 2024, gold's return outperformed the US benchmark by delivering a 28% YTD return in dollar terms. However, as of December 20, NASDAQ (27.6% YTD) is slightly outperforming gold (26.3% YTD).

Returns on gold are not uniform across the globe, as currency fluctuations play a significant role. If you had purchased gold in India, your returns would not match the 26% gain in 2024, as currency depreciation impacts the returns. In India, your returns would be approximately 19.7%. The rise in gold prices can be attributed to its safe-haven appeal, which benefitted the asset class amid heightened geopolitical tensions throughout the year.

Silver’s performance this year has also been impressive, reaching its highest levels in recent months during October 2024. This was supported by US monetary easing and growing demand for silver in sectors like renewable energy technologies such as solar panels.

Gold vs Silver: 2024 performance

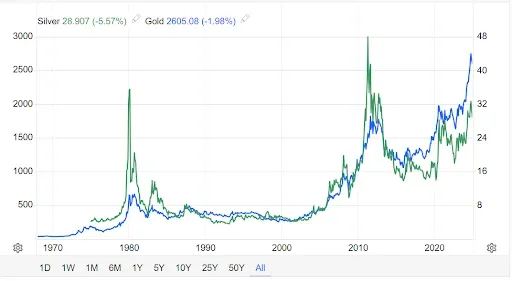

Here is a chart from TradingView showcasing YTD returns: gold delivered a 19.57% YTD return, and silver a 16.62% YTD return. Both metals outperformed the NIFTY 50 index on a YTD basis.

Gold spot prices at ₹76,800 per 10g (as of Dec 20)

The surge in gold prices was driven by central bank purchases, geopolitical risks, and a volatile global economy. Western investors increased their investments in gold due to declining interest rates. Asian investment also contributed to the price rise despite weak consumer demand.

Silver spot prices at ₹90,500 per 1kg (as of Dec 20)

Silver prices reached its highest levels in recent months during October 2024, driven by its dual role in industrial applications (accounting for half of silver demand) and investment (about 24%). US monetary easing and growing demand for renewable energy technologies like solar panels were key factors behind the silver price rise.

Price volatility is a key factor when comparing gold and silver. Silver is generally more volatile due to its smaller market size and industrial demand, which leads to sharper price swings. Above chart from Trading Economics can help visualise this difference. Interestingly, despite the silver price rise, its current value remains below its 1980 peak.

What influences gold prices?

Gold prices are affected by four major factors: economic expansion, risk and uncertainty, opportunity cost, and market momentum. These factors collectively shape the demand and supply dynamics of gold, thus impacting its pricing.

-

Economic Expansion: Consumer demand, influenced by surplus income, plays a significant role in gold pricing. Higher surplus income typically leads to increased investment in gold.

-

Risk and Uncertainty: Geopolitical instability and financial market volatility drive investment into gold as a safe haven.

-

Opportunity cost: Opportunity cost means the potential benefits you miss out on when choosing one investment over another. Gold's attractiveness often depends on bond yields. When bond yields are high, they offer better returns, making gold less appealing since it doesn’t earn interest. But when bond yields are low, gold becomes more attractive as a safer investment option.

-

Market momentum: Momentum can amplify or counteract trends in gold prices.

In the Union Budget, a 9% cut in import duties on gold and a revision in taxation, reducing LTCG from 36 months to 24 months (with the tax rate lowered from 20% to 12.5% without indexation), supported Indian gold demand.

Gold and silver 2025 outlook

The prices of gold and silver will depend on various scenarios. Let’s discuss three probable scenarios: base, bullish, and bearish.

-

Base case: Prices could remain range-bound with a slight upside potential, supported by stable interest rates, subdued inflation, and a weakening US dollar. This scenario assumes moderate geopolitical risks and steady central bank purchases.

-

Bullish scenario: Gold prices could reach new highs, driven by a dovish Fed (lower interest rates, potentially leading to higher inflation in coming years), escalating geopolitical tensions, severe financial market instability, and robust central bank and investor demand.

-

Bearish scenario: Gold prices could face downside pressure in a high-interest-rate environment that exceeds market expectations. Stronger competition from other asset classes like equities and real estate could also weigh on gold. Prolonged high interest rates in Asian countries might further weaken consumer demand for gold.

Gold is expected to remain elevated compared to past averages, while silver is also likely to show modest gains, as supply may lag behind the growing global demand for the metal.

About The Author

Next Story