Market recap (As of 7:10 pm)

- Gold 5 Dec Futures: ₹78,457/ 10 gram (▼ 0.1%)

- Silver 5 Dec Futures: ₹96,423/ 1 kg (▼ 0.3%)

- Crude Oil 19 Nov Futures: ₹5,693/ 100BBL (▼ 5.7%)

Gold: The yellow metal started the week on a lower note, with spot gold trading 0.6% lower at $2,729 per ounce. The fall in gold prices can be attributed to a rise in the U.S. dollar index against the basket of currencies. Investors also await key U.S. macro data, including personal consumption expenditures price index (PCE) and third-quarter GDP estimates, later this week. The data remains crucial ahead of the U.S. Fed meeting on 8 November.

Silver: Silver prices are also trading lower, down 0.70% at $33.54 per ounce in the spot market. Precious metals prices have eased from record levels last week. However, experts believe increased uncertainty over the U.S. presidential election and ongoing geopolitical tensions between Israel and Iran will likely spur demand for safe havens like gold and silver.

Crude Oil: Crude prices fell significantly on Monday, with Brent Futures dropping to $71.14 and WTI Crude at $67.31, both falling nearly 6%. This comes after Israel’s targeted retaliation against Iran failed to inflict substantial damage. As per reports, Israel's military action avoided striking Iran’s critical oil and nuclear sites, and Iran's oil production remains unaffected.

Technical structure

Gold: The Gold prices of the MCX futures (5 December) contract extended the consolidation for the third consecutive day, with the broader trend remaining bullish. The yellow metal has immediate resistance around ₹78,850, while support is visible at ₹77,900. Unless it breaches this zone on a closing basis, the trend may remain sideways.

Silver: After forming a doji candlestick pattern last week, the silver prices is currently consolidating between the previous week’s range. Positional traders can closely monitor the low and the high of the doji as it is a neutral candlestick pattern. A close above or below the previous week’s doji will provide further directional clues. Meanwhile, short-term traders can monitor the support at one level. A close below this level can lead to a short-term momentum up to support two zones.

Crude oil: Crude oil futures on MCX declined 6% in the morning session and slipped below the crucial support one and two zones on the hourly chart. After a sharp move, the price action remains weak, with immediate resistance around ₹6,100. Additionally, if the price slips below the ₹5,670 zone, it may extend the weakness. Traders should avoid fresh shorts and can monitor the price action around the VWAP.

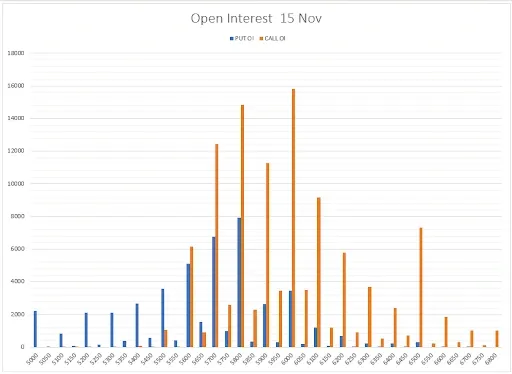

Crude oil options overview (Expiry: November 15)

The open interest data of the 15 November expiry saw significant call build-up at 6,000 and 5,800 strikes, suggesting resistance for the crude oil futures in this zone. On the flip side, the put base remained subdued and was shifting at 5,600 and 5,700 zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)