Market News

Commodity trade setup for November 18: Gold and crude oil rebound from crucial support, silver protects 200 EMA

.png)

3 min read | Updated on November 18, 2024, 19:05 IST

SUMMARY

Crude oil prices fell below the 5,700 level on Friday, signalling potential weakness in the market. Crude oil is currently trading around the critical 5,600 level, a support zone from where crude has rallied twice before. A break below this level could intensify the bearish momentum. On the upside, resistance remains firmly in place at 5,800.

Silver prices of 5 December contract respected the 200 EMA and rebounded from lower levels.

Market recap (as of 7:00 pm)

- Gold 5 Dec Futures: ₹74,824/ 10 gram (▲ 1.1%)

- Silver 5 Dec Futures: ₹89,950/ 1 kg (▲ 1.7%)

- Crude Oil 19 Nov Futures: ₹5,717/ 100 BBL (▲ 0.6%)

Technical structure

Open interest

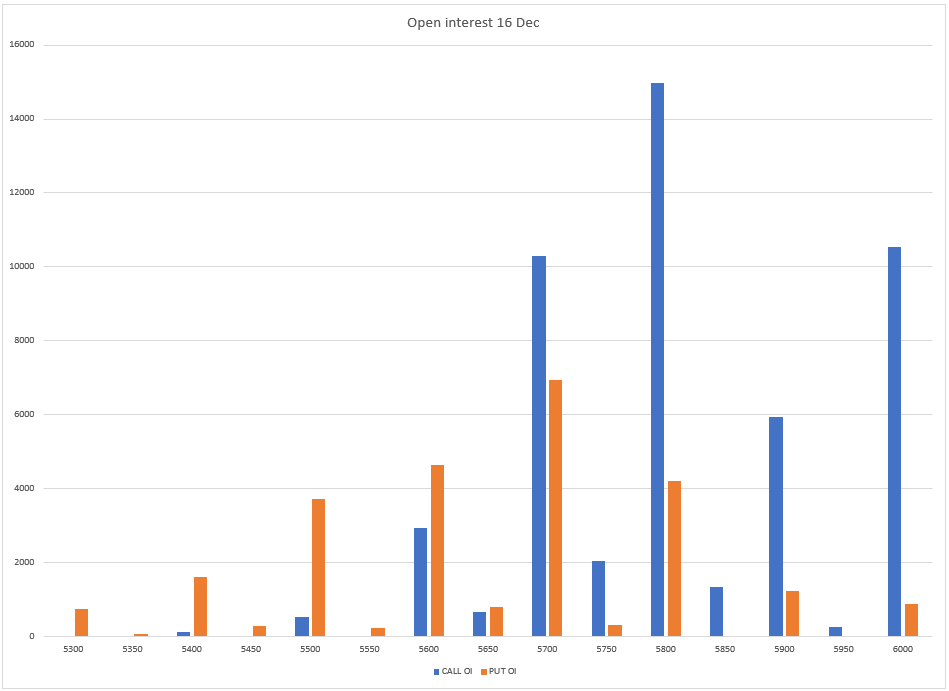

The open interest (OI) data for the 16 December expiry has call base at 5,800 and 5,700 strikes, indicating resistance for the crude prices around these levels. On the other hand, the put base was seen at 5,700 and 5,600 with relatively lower volume.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story