Market News

Commodity trade setup for November 13: Gold trades near crucial support; crude oil remains range-bound; check details

.png)

3 min read | Updated on November 13, 2024, 19:07 IST

SUMMARY

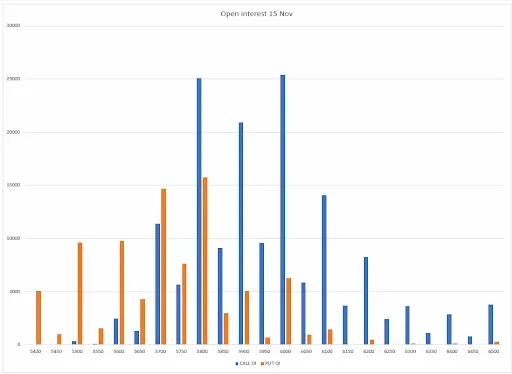

According to the options data for the 15 November expiry, crude oil saw significant call placement at 6,000 and 5,800 strikes. This indicates that crude prices will face resistance around these levels. On the other hand, the 5,800 and 5,700 put also witnessed additions, pointing at range-bound movement around these levels.

Commodities trade setup 13 Nov: Gold slips to crucial support, Oil prices remain range-bound

Market recap (as of 6:45 pm)

- Gold 5 Dec Futures: ₹75,188/ 10 gram (▲ 0.3%)

- Silver 5 Dec Futures: ₹90,205/ 1 kg (▲ 0.9%)

- Crude Oil 19 Nov Futures: ₹5,778/ 1 BBL (▲ 0.03%)

OPEC said global oil demand would grow by 1.82 million barrels per day (bpd) in 2024, down from last month's forecast of 1.93 million bpd. This is largely due to weakness in China, the world's largest oil importer.

Technical structure

Open interest

The open interest (OI) data for the 15 November expiry on MCX saw the highest call OI at 5,800 and 6,000 strikes, indicating resistance around these levels. Conversely, the put base was visible at 5,800 and 5,700 strikes, suggesting range-bound movement around these levels.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

Next Story