Market News

Commodity trade setup for Dec 4: Gold consolidates around ₹76,000, Crude sustains positive momentum in a range

.png)

4 min read | Updated on December 04, 2024, 17:55 IST

SUMMARY

Crude oil 18 December futures on MCX showcased a bullish engulfing pattern on the daily chart on 3 December. Short-term traders should monitor the high of this bullish reversal pattern closely. A decisive close above the high would confirm the pattern, signalling further upside, while a rejection at higher levels could invalidate the setup.

Crude oil prices are trading firmly as market participants expects OPEC and its allies to extend oil output cuts to Q12025.

Market recap (as of 5:45 pm)

- Gold 5 Dec Futures: ₹76,857/ 10 gram (▼ 0.06%)

- Silver 5 Dec Futures: ₹91,862/ 1 kg (▼ 0.36%)

- Crude Oil 18 Dec Futures: ₹5,930/ 100 BBL (▲ 0.02%)

However, despite positive triggers, crude oil prices haven't been able to surpass $75 per barrel levels amid geopolitical tension across different parts of the world. Weekly crude oil inventories numbers will be announced later in the day.

Technical structure

However, the pattern gets confirmed if the close of the subsequent candle is above the high of the reversal candle. Meanwhile, it is important to note that the broader structure of the crude oil remains range-bound between 6,100 and 5,600 since 15 October. A break of this range on a closing basis will provide further directional clues to the traders.

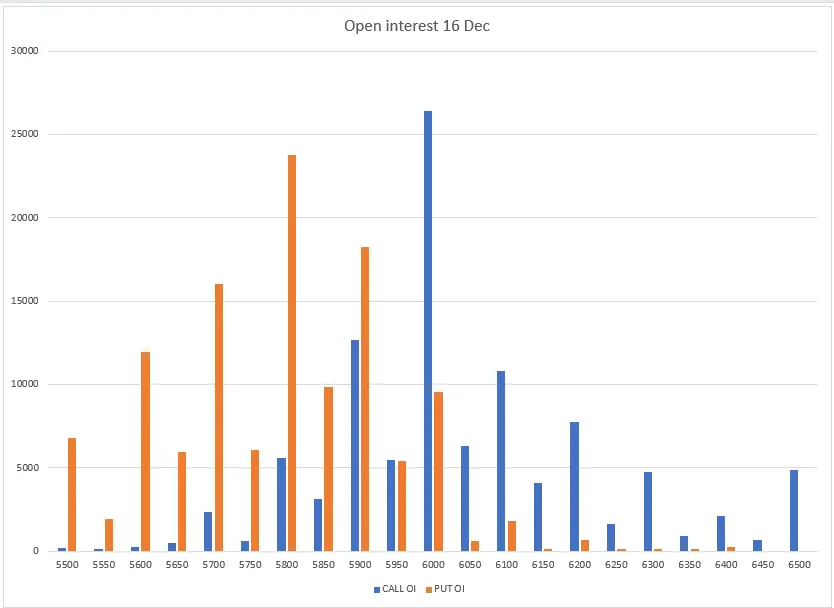

The open interest data for the 16 December expiry of crude oil saw significant additions of put options at 5,800 and 5,900 strikes. Conversely, the call options base remained at 6,000 strike, suggesting that crude may face resistance around this zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story