Market News

Commodity trade setup Dec 9: Gold and Silver sustain bullish momentum, Silver eyes ₹94,000 mark

.png)

4 min read | Updated on December 10, 2024, 08:15 IST

SUMMARY

Silver prices have risen over 1% on the February futures contract on the MCX, trading near the critical resistance level of ₹94,000 as of 4 PM. Over the past two sessions, silver has formed an inside candle on the daily chart, signaling consolidation at higher levels. Short-term traders should closely watch the high and low of the December 4 candle, as a decisive close above or below these levels could offer key short-term trading signals.

Commodities trade setup 9 Dec: Gold and Silver sustains bullish momentum, Silver eyes ₹94,000 mark

Market recap (as of 6:45 pm)

- Gold 5 Dec Futures: ₹77,262/ 10 gram (▲ 0.8%)

- Silver 5 March Futures: ₹94,483/ 1 kg (▲ 2.2%)

- Crude Oil 18 Dec Futures: ₹5,793/ 100 BBL (▲ 1.1%)

Technical structure

Meanwhile, the short-term traders can closely monitor the high and low of the 25 November candle of the February futures contract on the MCX. A close above or below these levels may provide short-term directional clues to the traders.

The short-term traders can keep an eye on the ₹5,600 zone for directional clues. A break below this level may increase the selling pressure.

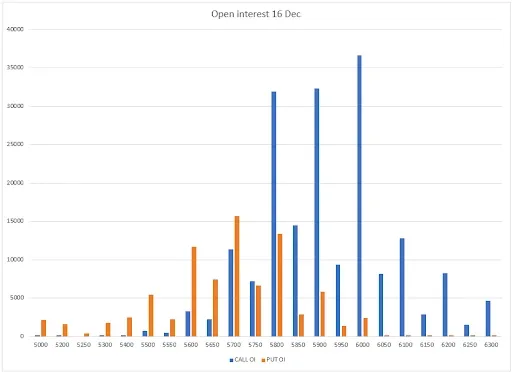

The open interest data for the 16 December expiry remains in favour of bears as the crude oil sustained the call base at 6,000 and 5,900 strikes. Conversely, the put base was seen at 5,700 strike with relatively low volume, suggesting a support for the crude around this zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story