Market recap (as of 6:40 pm)

- Gold 5 Dec Futures: ₹78,633/ 10 gram (▼ 0.4%)

- Silver 5 March Futures: ₹95,270/ 1 kg (▼ 0.5%)

- Crude Oil 18 Dec Futures: ₹5,972/ 1 BBL (▲ 0.6%)

Gold: The yellow metal is trading in the red on Thursday, with spot gold down 0.42% at $2,743 an ounce amid profit-taking. Gold's sharp decline over the past two weeks was driven by a strong rally in the U.S. Dollar Index. A rise in the U.S. dollar reduces demand for dollar-denominated assets such as gold as it affects purchasing power.

Silver: Silver prices are also trading lower, down 0.23% at $32.90 per ounce in the spot market. Precious metal investors are trading cautiously ahead of key economic data, including the European Central Bank (ECB) interest rate decision, initial jobless claims data, and producer price index data, which will be announced later today.

Crude Oil: Crude oil prices are trading marginally lower today. Brent Futures traded around $73.38, while WTI Crude traded around $70.17; both are down 0.2%. Oil prices are in the range despite the International Energy Agency (IEA) revising its oil demand projections upward for 2025. The global oil demand is expected to expand by 1.1 million barrels per day in 2025, up from the previous estimate of 990,000 barrels per day, mainly due to an increase in the economic stimulus measures in China.

Technical structure

Gold: After three days of a rally of over 3%, gold prices are currently trading lower near the immediate resistance of ₹79,100 zone. It is currently forming an inside candle on the daily chart, reflecting a pause after a sharp upmove. For the upcoming sessions, traders can monitor the immediate support of ₹78,400. If the price slips below the crucial support, it may turn range-bound with crucial support around the 21 and 50 day exponential moving averages (EMAs). On the other hand, a close above the ₹79,100 will further strengthen the ongoing trend.

Silver: After formation of doji candlestick pattern on 11 December, Silver faced resistance around the high of the indecision pattern and witnessed profit-booking. However, the broader trend of the silver remains sideways to bullish with immediate support around the ₹94,000 zone. For further clues, traders can monitor the high of the doji candlestick pattern. A close above the high of the doji will signal continuation of the bullish trend, while a close below the low of doji will invite further profit-booking.

Crude oil: The oil prices extended the positive momentum for the fourth consecutive day and reclaimed the 21 and 50 EMA on the daily chart. However, the broader structure of the crude remains range-bound and unless it breaks the crucial levels of ₹6,100 and ₹5,600, the trend may remain sideways. A break of this range on a closing basis will provide traders further directional clues.

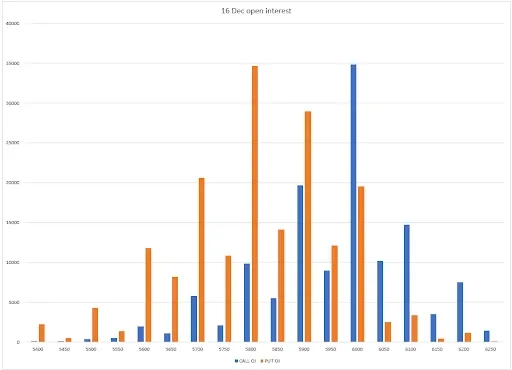

The open interest data for the 16 December expiry has a significant call base at 6,000 strike, suggesting resistance for the crude oil around this zone. Conversely, the put base was seen at 5,800 and 5,900 strikes, suggesting support for the index around this zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)