Market recap (as of 6:30 pm)

- Gold 5 Dec Futures: ₹78,356/ 10 gram (▲ 0.02%)

- Silver 5 March Futures: ₹95,053/ 1 kg (▼ 0.47%)

- Crude Oil 18 Dec Futures: ₹5,901/ 1 BBL (▲ 0.96%)

Gold: The yellow metal trades marginally higher today, with spot gold trading 0.36% higher at $2,728 per ounce. Gold prices are trading in a narrow range near the $2,700 level as market participants are cautious ahead of the US inflation data for November, which will be announced later in the day.

Silver: Silver prices are trading lower, down 0.43% at $32.62 per ounce in the spot market. Precious metals investors are looking forward to key economic data to be announced later this week and more clues about political instability in South Korea and Syria, which could boost demand for safe-haven assets.

Crude Oil: Crude prices are trading higher on Wednesday, with Brent Futures trading around $72.83, up 0.93%, while WTI Crude traded 0.99% higher around $69.27. Oil prices are higher for the third consecutive day as traders/investors expect demand to rise in China, the world's largest crude importer. Beijing announced on Monday that it would relax monetary policy to try to stimulate economic growth. Crude oil prices will likely react to US crude oil inventories numbers, which will be announced later today.

Technical structure

Gold: After a sharp up move of over 2% in the last two trading sessions, the yellow metal has taken resistance around the immediate resistance zone of ₹79,000. The gold broke out of the ten-day consolidation with a strong consolidation and is currently trading above its 21 and 50 day exponential moving averages (EMAs). The current structure looks bullish with immediate support around the ₹77,700 zone. Unless it slips below this level, the trend may remain bullish.

Silver: The silver also broke its three week long consolidation and captured the psychologically crucial ₹94,000 mark on closing basis. However, after the sharp up move the silver witnessed profit-booking and is currently consolidating around the ₹95,000 zone and is trading above all its short -term EMAs ( 21 and 50). Unless Silver surrenders ₹94,000 on closing basis, it may extend the bullish momentum towards ₹99,000. However, a close below ₹94,000 on the daily chart will indicate weakness.

Crude oil: Crude prices remained upbeat for the third day in a row and are attempting to capture the 21 EMA as of 5 pm. After rebounding from the crucial support zone of ₹5,600 crude oil is maintaining the range-bound structure since last two months between ₹6,100 and ₹5,600. Unless crude oil breaks this range on a closing basis, the trend may remain range-bound.

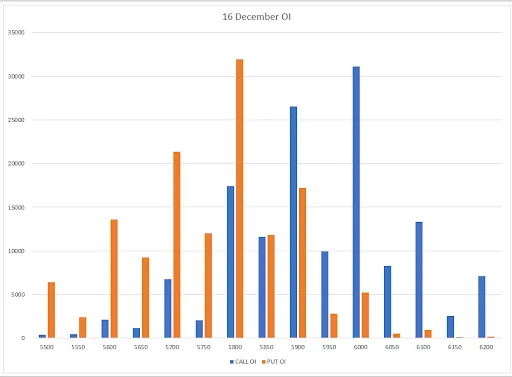

The open interest data for the 16 December expiry saw significant additions of put options at 5,800 and 5,700 strikes, indicating support for the crude oil around these levels. Conversely, the call base remained at 6,000 and 5,900 strikes, suggesting the oil prices may face resistance around these levels.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)