Business News

Tax department invites stakeholders' input for drafting income-tax rules, related forms

.png)

2 min read | Updated on March 18, 2025, 16:36 IST

SUMMARY

The Income Tax Bill, 2025 was introduced in Parliament last month and is currently under examination by the Select Committee for detailed consideration.

A utility has been launched on the e-filing portal for submission through an OTP-based validation process. Image: Shutterstock

The Central Board of Direct Taxes (CBDT) on Tuesday invited suggestions from stakeholders on the income-tax rules and related forms under the provisions of the Income Tax Bill, 2025, which was tabled in Parliament and is currently being examined by a Select Committee.

CBDT has urged stakeholders to specify the relevant provisions of the Income-tax Rules, 1962, while submitting their suggestions. The collected inputs will be compiled and forwarded to the Select Committee for consideration.

"In alignment with the comprehensive review of the Income-tax Act, 1961, an effort is underway to collect inputs and work on simplification of the associated Income Tax Rules and Forms," CBDT said in a statement.

"The objective of this initiative is to enhance clarity, reduce the compliance burden, and eliminate obsolete rules, making tax processes more accessible for taxpayers and other stakeholders," it added.

It also aims to streamline rules and forms to improve comprehension, ease filing, minimise administrative hassles and errors, and boost transparency and efficiency in tax administration, it said.

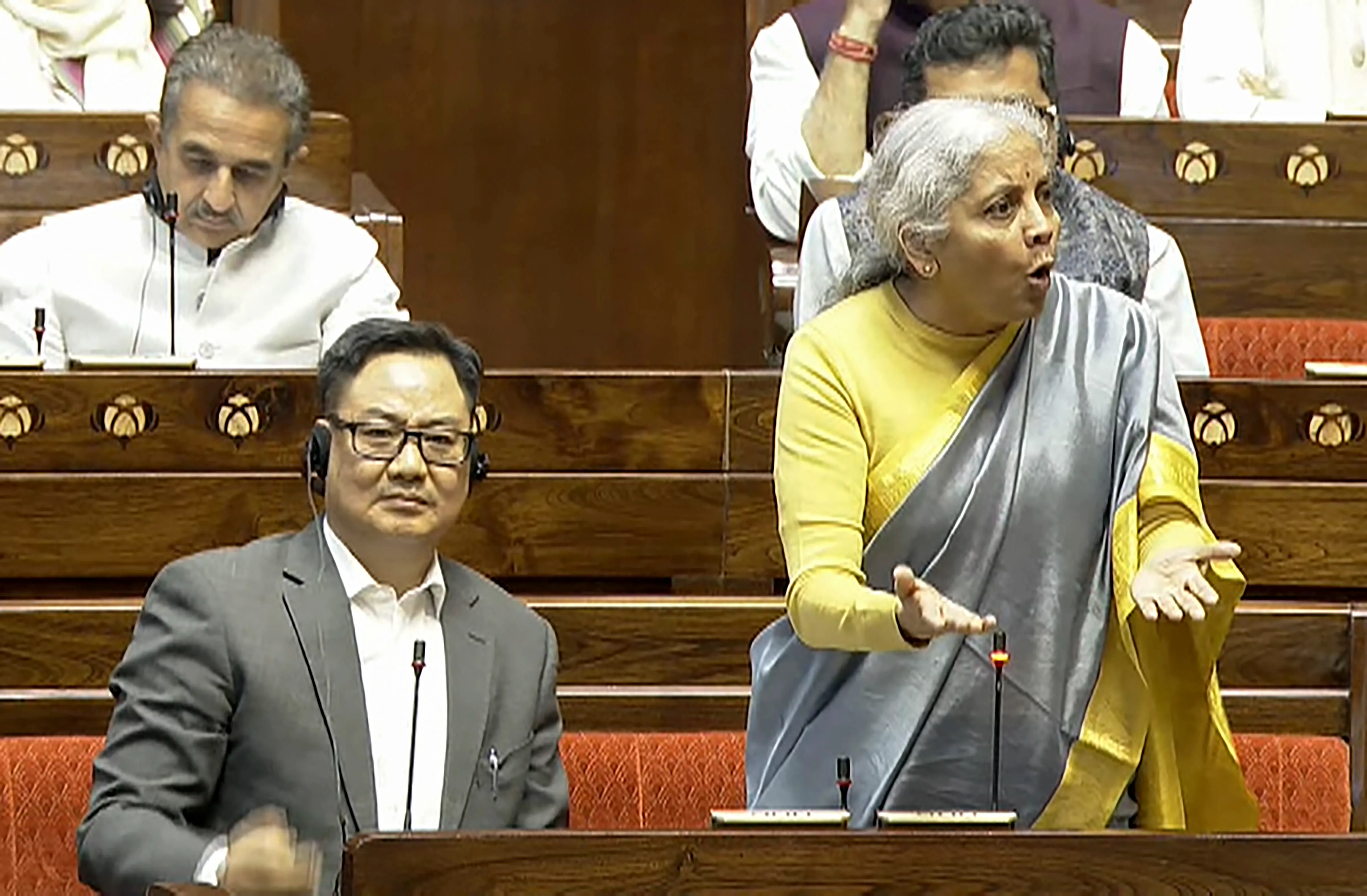

Last month, Union Finance Minister Nirmala Sitharaman introduced the Income Tax Bill, 2025, in the Lok Sabha, in a major step towards overhauling India’s tax laws. The draft legislation was referred to a select committee of the House for further scrutiny and recommendations.

According to the finance ministry, the proposed legislation is designed to simplify the existing tax framework, minimise ambiguities, and reduce litigation.

Related News

About The Author

Next Story