Business News

Sitharaman provides update on new income tax bill, rejects rebate withdrawal concerns

.png)

2 min read | Updated on March 25, 2025, 09:58 IST

SUMMARY

Union Finance Minister Nirmala Sitharaman announced that the new Income Tax Bill will be discussed in the monsoon session of Parliament.

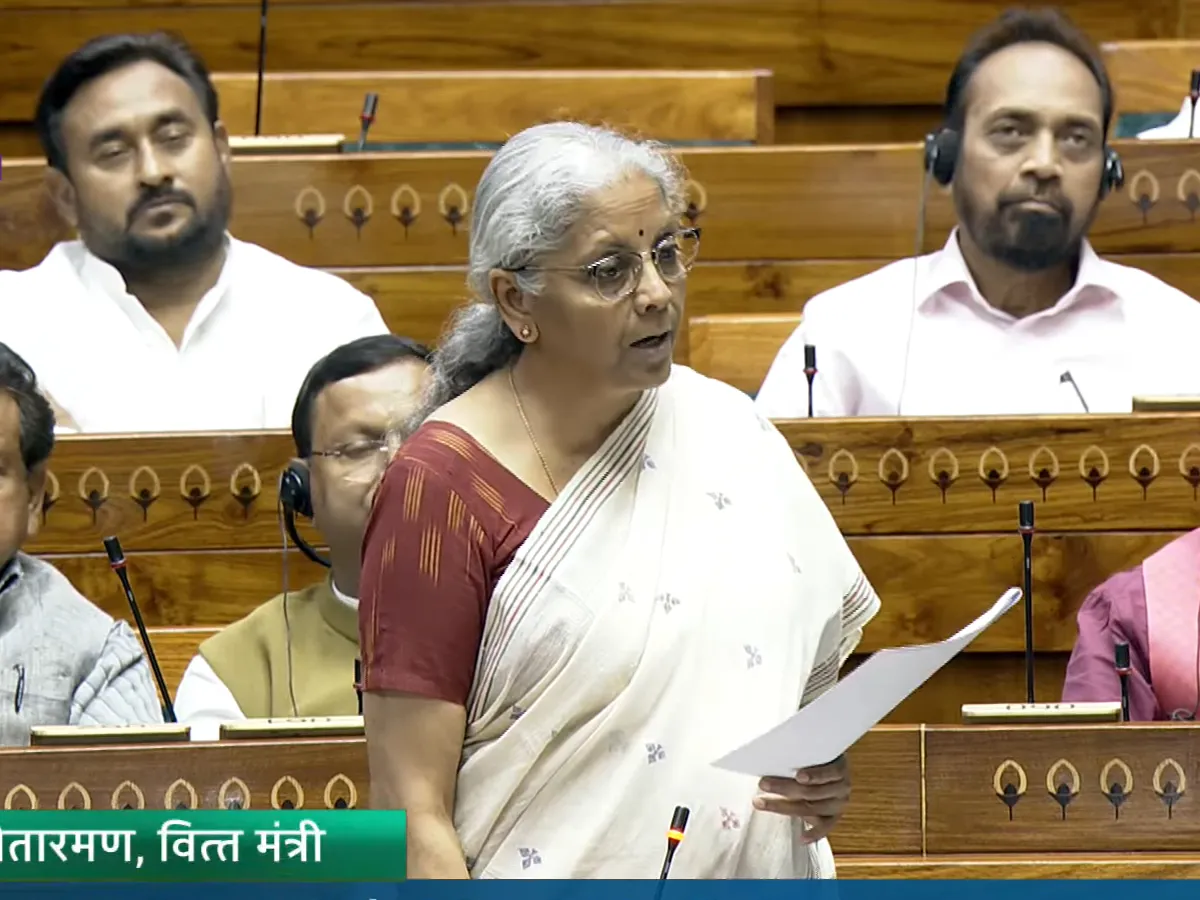

Union Minister Nirmala Sitharaman speaks in the Lok Sabha during the Budget session of Parliament, in New Delhi, Tuesday, March 25, 2025. (Sansad TV)

The new income tax bill will be taken up for discussion during the monsoon session of Parliament, Union finance minister Nirmala Sitharaman said on Tuesday.

Replying to the discussions on the Finance Bill 2025 in the Lok Sabha, Sitharaman said the new income tax bill is currently being reviewed by the Select Committee.

"...we will take it (new income tax bill) up in the monsoon session," Sitharaman said.

According to the ministry, the bill adheres to three core principles: ensuring clarity through textual and structural simplifications, maintaining continuity by avoiding major tax policy changes, and preserving predictability by keeping tax rates unchanged.

The new bill has a word count of 2.6 lakh, lower than 5.12 lakh in the I-T Act. The number of sections is 536 against 819 effective sections in the existing law.

The number of chapters has also been halved to 23 from 47.

Sitharaman highlighted key provisions of the Finance Bill, 2025, which she described as offering "unprecedented tax relief" to honour taxpayers while rationalising customs tariffs to boost manufacturing, promote exports, and provide relief to the common man.

She also confirmed that the equalisation levy on online advertisements will be abolished amid trade tensions with the US.

Addressing the concerns over tax on income more than ₹12 lakh, the minister explained the marginal relief mechanism under Section 87A of the Income Tax Act.

“Under the provision of section 87a, it has been ensured that the tax payable by a person having income marginally above ₹12 lakh is required to pay only the marginal amount of tax equal to the amount of income above 12 lakh, so that his carry home is also ₹12 lakh,” she said.

“For instance, with an income of ₹12.10 lakh, ₹10,000 is what he earns over the ₹12 lakh. So, for the ₹10 000, it will be paid as income tax only. Tax without marginal relief on that person earning ₹12.10 lakh would have been ₹61,500. So we have given the marginal relief,” the minister added.

Sitharaman also addressed apprehensions about the potential withdrawal of the income tax rebate in future years if collections slow down.

"Even during Covid, we did not raise taxes. Where we’ve come up with a rebate in order to benefit the middle class, an element of suspicion is being brought in saying ‘what if’,” the minister said.

About The Author

Next Story