Business News

New Income Tax Bill 2025 tabled in Lok Sabha: What are the proposed changes in draft law and what's next?

.png)

4 min read | Updated on February 13, 2025, 18:20 IST

SUMMARY

The Income Tax Bill, 2025, reduces the size and complexity of the Income Tax Act, 1961, cutting the word count, sections, and chapters while increasing clarity through tables and formulae.

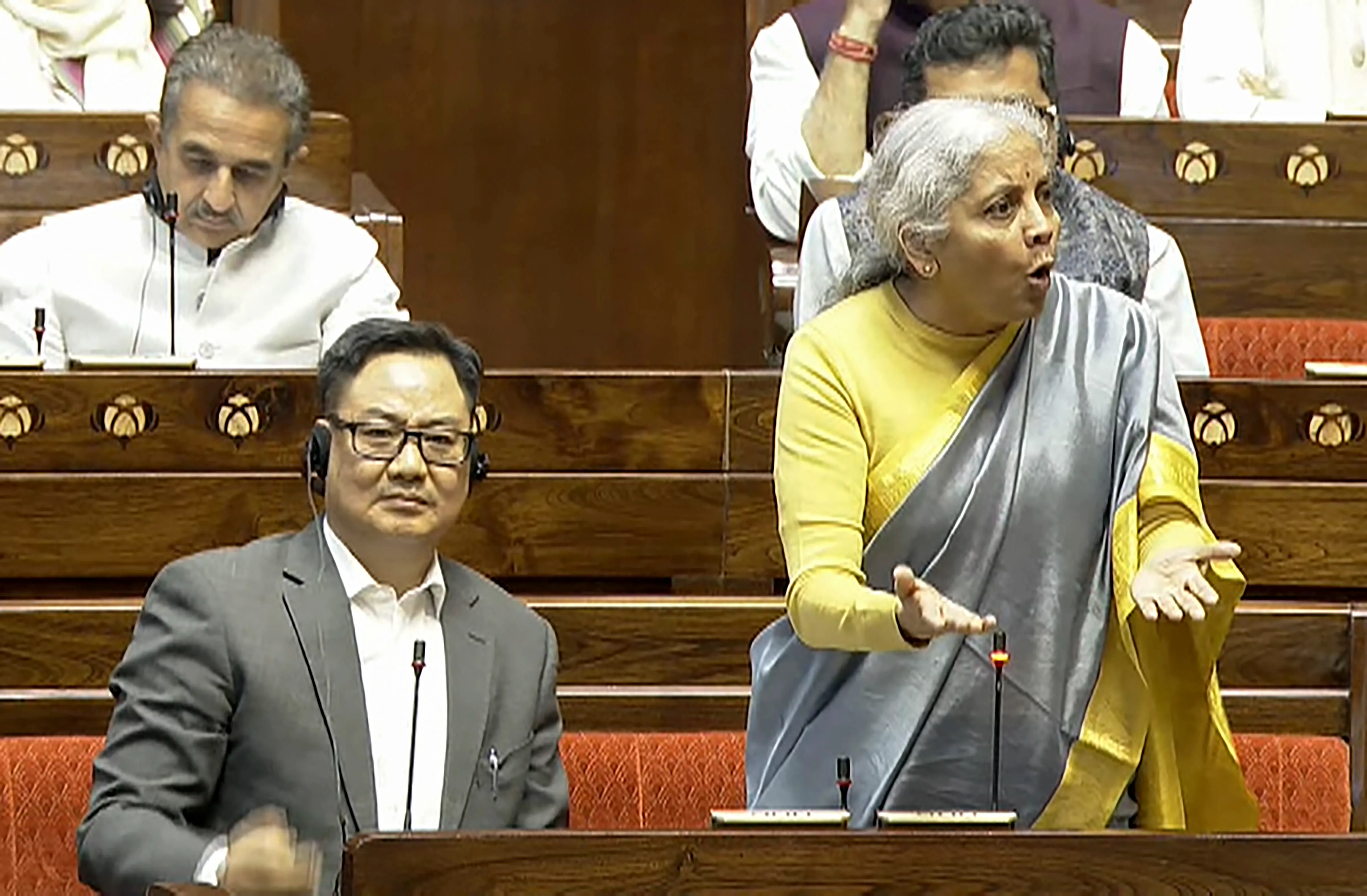

Union Finance Minister Nirmala Sitharaman speaks in the Rajya Sabha during the Budget session of Parliament, in New Delhi, Thursday, Feb. 13, 2025.

Union Finance Minister Nirmala Sitharaman on Thursday introduced the Income Tax Bill, 2025, in the Lok Sabha, in a major step towards overhauling India’s tax laws. She urged Speaker Om Birla to refer the draft legislation to a select committee of the House for further scrutiny and recommendations.

The finance ministry stated that the proposed legislation is designed to simplify the existing tax framework, minimise ambiguities, and reduce litigation. According to the ministry, the draft law adheres to three core principles: ensuring clarity through textual and structural simplifications, maintaining continuity by avoiding major tax policy changes, and preserving predictability by keeping tax rates unchanged.

Key features of the Income Tax Bill, 2025

- Simplification and structural overhaul

The finance ministry said that the new bill reduces the complexity of tax laws by eliminating intricate language, removing redundant provisions, and reorganising sections for ease of reference. It is structured to enhance readability and navigation for taxpayers and professionals alike.

-

Reduced size and streamlined provisions

The bill significantly cuts down the length and complexity of the Income Tax Act, 1961:

- Word count reduced from 5.12 lakh to 2.6 lakh.

- Number of sections reduced from 819 to 536.

- Chapters halved from 47 to 23.

- 1,200 provisos and 900 explanations have been removed for better clarity.

-

Use of tables and logical grouping

- The new draft includes 57 tables, up from 18 in the existing law, to facilitate easy comprehension of tax provisions.

- Provisions on exemptions, Tax Deducted at Source (TDS), and Tax Collected at Source (TCS) are now presented in tabular format.

- Salary-related provisions, including deductions like gratuity, leave encashment, and pension commutation, are consolidated within the salary chapter itself, eliminating the need to cross-reference multiple sections.

-

Increased tax certainty

- The bill seeks to minimise litigation by retaining key legal phrases, particularly where courts have given rulings, with minimal modifications.

- It consolidates provisions with similar subject matter, reducing scope for multiple interpretations.

- Sections related to international taxation have been clarified to ensure better compliance and predictability.

-

Elimination of 'previous year' and 'assessment year' concepts

- The bill does away with the concepts of “previous year” and “assessment year,” which often created confusion for taxpayers. This change simplifies compliance, particularly for new taxpayers who previously had to track multiple timeframes.

-

Revised framework for non-profit organisations

- The provisions for NPOs are consolidated into seven sub-parts, making compliance and regulatory requirements clearer and more structured.

-

Enhanced use of formulae

- The bill introduces 46 formulae, a significant increase from 6 in the previous law, to offer more precise calculations and interpretations.

Comparison of Income Tax Act, 1961 and Income Tax Bill, 2025

| Item | Existing Income-tax Act, 1961 | Proposed Income-tax Bill, 2025 | Change (Reduction/Addition) |

|---|---|---|---|

| Words | 512,535 | 259,676 | Reduction: 252,859 words |

| Chapters | 47 | 23 | Reduction: 24 chapters |

| Sections | 819 | 536 | Reduction: 283 sections |

| Tables | 18 | 57 | Addition: 39 tables |

| Formulae | 6 | 46 | Addition: 40 formulae |

What’s next?

After introducing the bill, Sitharaman requested that the Speaker refer the draft law to a select committee of the House. The committee is expected to review the bill and submit its report by March 10.

Once the select committee presents its findings, the bill will return to the Cabinet for approval before being reintroduced in Parliament for debate and passage. The Speaker will determine the composition and operational rules of the select committee in the coming days.

Related News

About The Author

Next Story