Business News

Economic Survey 2024: FY25 GDP forecast to corporate sector profit growing 4X; here are the key highlights

.png)

3 min read | Updated on July 22, 2024, 13:54 IST

SUMMARY

India’s economy carried forward the momentum it built in FY23 into FY24 despite a gamut of external challenges. India's real GDP grew by 8.2% in FY24, exceeding 8% mark in three out of four quarters of FY24. The focus on maintaining macroeconomic stability ensured that external challenges had minimal impact on India’s economy.

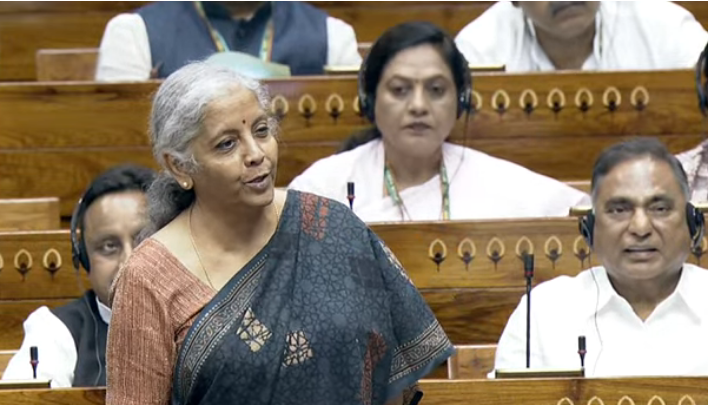

Finance Minister Nirmala Sitharaman in Parliament

Union Finance Minister Nirmala Sitharaman, on Monday, July 22, tabled Economic Survey 2023-34 in Lok Sabha.

Economic Survey 2023-34 highlights

- India’s economy carried forward the momentum it built in FY23 into FY24 despite a gamut of external challenges. India's real GDP grew by 8.2% in FY24, exceeding 8% mark in three out of four quarters of FY24. The focus on maintaining macroeconomic stability ensured that external challenges had minimal impact on India’s economy.

- The government’s thrust on capex and sustained momentum in private investment has boosted capital formation growth. Gross Fixed Capital Formation increased by 9% in real terms in 2023-24.

- The real GDP growth forecast of 6.5-7% for FY25 is higher as compared to the last Economic Survey, which had predicted the real GDP to grow in the range of 6% to 6.8% in FY24.

- "In terms of financial performance, the corporate sector has never had it so good. Results of a sample of over 33,000 companies show that, in the three years between FY20 and FY23, the profit before taxes of the Indian corporate sector nearly quadrupled," the survey said.

- Capital expenditure on Railways jumped 77% in the last 5 years. Read more.

- Indian economy has recovered and expanded in an orderly fashion post pandemic. The real GDP in FY24 was 20% higher than its level in FY20, a feat that only a very few major economies achieved. Prospects for continued strong growth in FY25 beyond look good, subject to geopolitical, financial market and climatic risks.

- "The advent of Artificial Intelligence casts a huge pall of uncertainty as to its impact on workers across all skill levels – low, semi and high. These will create barriers and hurdles to sustained high growth rates for India in the coming years and decades. Overcoming these requires a grand alliance of union and state governments and the private sector," Economic Survey said.

- The market capitalisation of the Indian stock market has seen a remarkable surge, with the market capitalisation to GDP ratio being the fifth largest in the world.

- "The Indian economy is on a strong wicket and stable footing, demonstrating resilience in the face of geopolitical challenges. The Indian economy has consolidated its post-Covid recovery with policymakers – fiscal and monetary – ensuring economic and financial stability. Nonetheless, change is the only constant for a country with high growth aspirations. For the recovery to be sustained, there has to be heavy lifting on the domestic front because the environment has become extraordinarily difficult to reach agreements on key global issues such as trade, investment and climate," the survey stated.

- India’s services exports grew by 4.9% to USD 341.1 billion in FY24, with growth largely driven by IT/software services and ‘other’ business services.

- Remittances to India to grow at 3.7% to USD 124 billion in 2024 and 4% in 2025 to reach USD 129 billion.

- As much as 56.4% of the disease burden in India is due to unhealthy diets. "If India needs to reap the gains of its demographic dividend, it is critical that its population’s health parameters transition towards a balanced and diverse diet," the survey noted.

- Increased FDI inflows from China can help India enhance participation in the global supply chain and boost exports.

- The short-term inflation outlook for India is benign, the survey said.

Open FREE Demat Account within minutes!

Join nowVolatile markets?

Ride the trend with smart tools.

+91

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story