Business News

Charging up: Number of EVs in India zooms 868% in five years

4 min read | Updated on August 03, 2024, 17:44 IST

SUMMARY

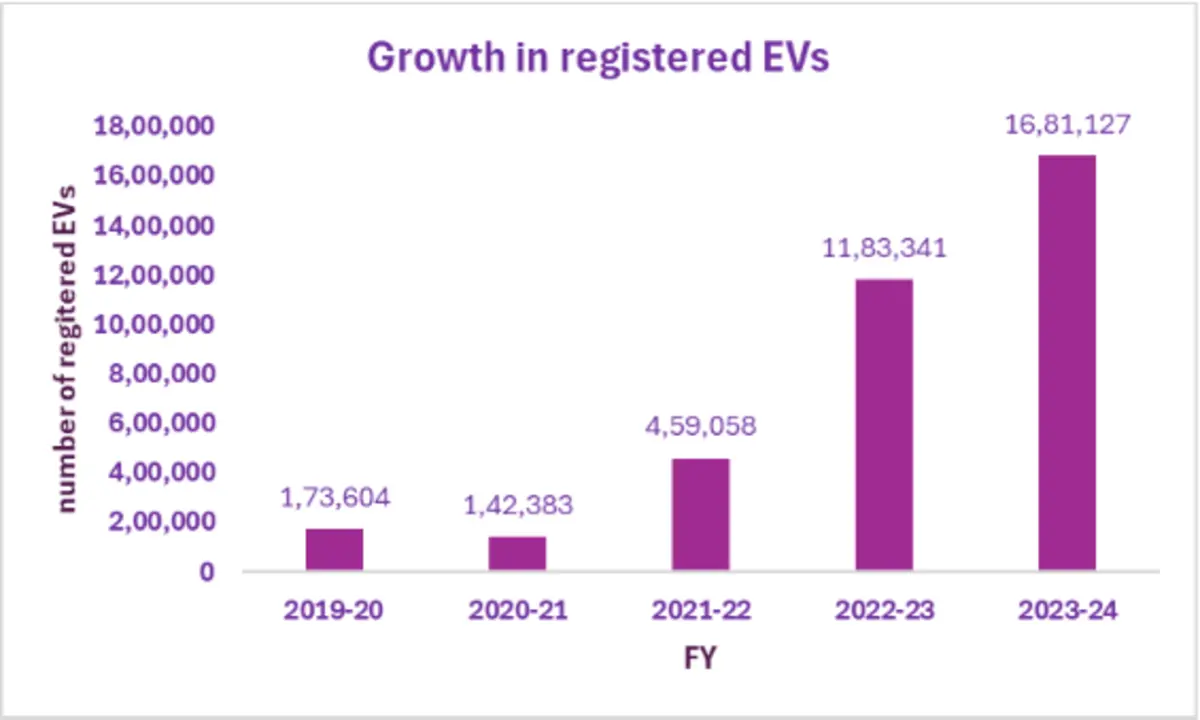

In the financial year 2019-20, the number of registered EVs in India amounted to 1.74 lakh and by FY 2023-24, the number had increased to 16.81 lakh. Niti Aayog had set a target of EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

There was about 158% increase in the number of registered EVs from FY 2021-22 at about 4.59 lakh to 11.83 lakh in FY 2022-23.

India has witnessed tremendous growth of approximately 868% in the number of registered electrical vehicles (EVs) from 2019-20 to 2023-24.

In 2019-20 the number of registered EVs in India amounted to 1.74 lakh and by FY 2023-24 the number had increased to 16.81 lakh, a press release by the Ministry of Heavy Industries stated.

The number of EVs registered in India in FY 2023-24 increased by 42.06% in contrast to that in FY 2022-23, as per the release issued on Friday, August 2.

Further, there was about 158% increase in the number of registered EVs from FY 2021-22 at about 4.59 lakh to 11.83 lakh in FY 2022-23.

Number of EVs registered in India increased 868% from 1.73 lakh in FY 2019-20 to 16.81 lakh in FY 2023-24. Source: PIB

Number of EVs registered in India increased 868% from 1.73 lakh in FY 2019-20 to 16.81 lakh in FY 2023-24. Source: PIBNiti Aayog had set a target of EV sales penetration of 30% of private cars, 70% of commercial cars, 40% of buses and 80% of two and three-wheelers by 2030.

However, as per a report by Bain & Company, EVs could reach 40% penetration by 2030, “driven by strong adoption (45%+) in both two-wheeler (2W) and three-wheeler (3W) categories.”

EVs accounted for about 5% of total vehicle sales between October 2022 and September 2023, the Bain & Company report said.

According to Bain & Company, EVs could generate over $100 billion in revenue and could account for more than 40% of India’s automotive market by 2030.

To realise the potential of the EV industry, the government had launched schemes such as FAME and the ongoing Electric Mobility Promotion Scheme (EMPS)

Government Schemes

The government of India had launched the Faster Adoption and Manufacturing of Electric Vehicles in India (FAME) scheme in April 2015 with the aim of promoting the adoption of EVs in India. The scheme was divided into two phases phase 1 of FAME had a budget of ₹895 crore and operated until March 2019.

The second phase of the scheme called FAME-II started in April 2019 and concluded on 31 March 2024.

The FAME scheme aimed to incentivize the purchase of EVs by offering financial subsidies to the buyers. Subsidies were available for electric two wheelers, 3 wheelers, 4 wheelers, buses and charging stations.

The scheme aims to incentivise the purchase of electric vehicles by offering financial subsidies to buyers. Subsidies are available for Electric 2 Wheelers, Electric 3 Wheelers, Electric 4 Wheelers, Electric Buses, and charging stations. The scheme focuses on four main areas: technological development, generating demand, piloting projects, and building charging infrastructure.

Along with giving incentives, the scheme established “7,432 EV Charging Stations to 3 Oil Marketing Companies (OMCs) and 148 EV Charging Stations to other entities spread in all states and 6 Union Territories,” the Ministry of Heavy Industries said in December 2023.

With the conclusion of the FAME-II scheme in March 2024, the new Electric Mobility Promotion Scheme (EMPS) which came to effect on April 1, 2024 will keep up the momentum in the EV industry.

With a total outlay of ₹500 crore, the main aim of the EMPS scheme is to subsidise the purchase of electric 2 wheelers and three wheelers. The scheme was supposed to conclude after four months in July 2024 but has been extended till September 30.

According to the report by Bain & Company, there exist roadblocks that need to be addressed for India’s EV industry to realise its $100 billion revenue potential.

“EVs are currently priced higher than internal combustion engine (ICE) vehicles. There’s also anxiety over range, limitations in charging infrastructure, and friction in customer financing,” the report stated.

About The Author

Next Story