Business News

10 years of PM Jan Dhan Yojana: 53 cr accounts opened, ₹2.31 lakh cr deposits accrued | Key achievements

4 min read | Updated on August 28, 2024, 16:28 IST

SUMMARY

August 28, 2024, marks a decade since the inception of the Pradhan Mantri Jan Dhan Yojana (PMJDY). With multifold achievements such as opening 53.14 crore accounts and accruing a total deposit balance of ₹2.31 lakh crore as of August 2024 under the scheme, the largest financial inclusion initiative in the world, has seen successful implementation.

Under the scheme, approximately 56% PMJDY account holders are women and about 67% beneficiaries are situated in rural and semi-urban areas

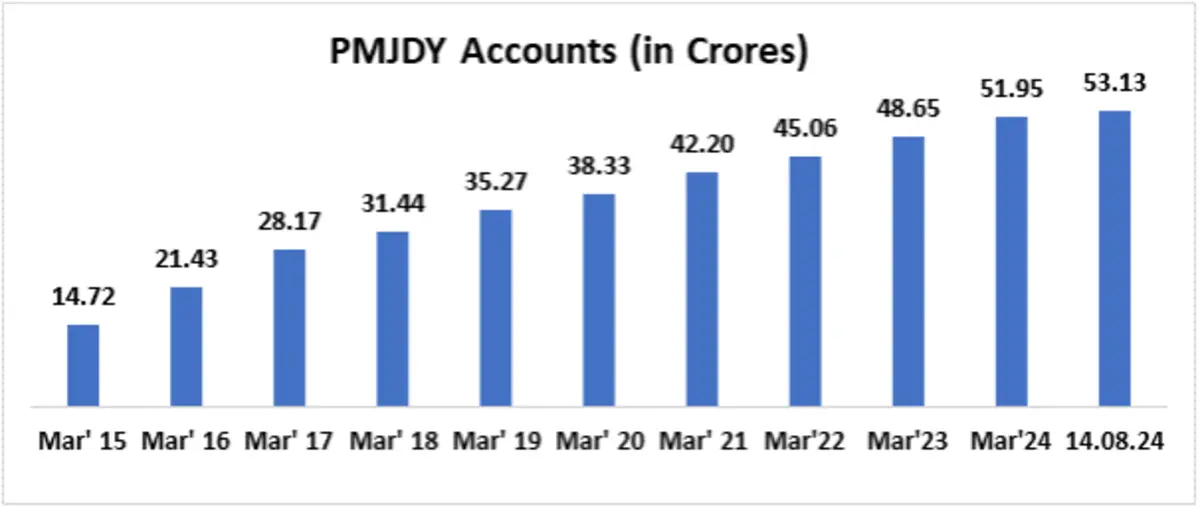

With an approximate 3.6-fold increase in accounts created from March 2015 to August 2024, the Pradhan Mantri Jan Dhan Yojana (PMJDY), the national mission for financial inclusion, completes a decade of successful implementation.

Jan Dhan Yojana, the largest financial inclusion initiative in the world, was launched by Prime Minister Narendra Modi on August 28, 2014, exactly a decade ago.

For every unbanked adult, the Jan Dhan Yojana provides one basic bank account, which has no need for any balance maintenance and no charges levied on it. To promote digital transactions, the beneficiary is also endowed with a free RuPay debit card with an in-built insurance cover of ₹2 lakh.

Account holders under the scheme are eligible to get an overdraft of up to ₹10,000 to cover emergencies.

The PMJDY accounts are imperative not only for receiving Direct Benefit Transfers (DBT) but they also act as a platform for subsidies or government payments to the beneficiary, in the process removing the need for a middleman.

“Universal and affordable access to formal banking services is essential for achieving financial inclusion and empowerment. It integrates the poor into the economic mainstream and plays a crucial role in the development of marginalised communities,” Finance Minister Nirmala Sitharaman was quoted saying in a press release issued by the government.

As of August 14, 2024, an aggregate of 53.14 crore beneficiaries have been banked under the scheme since its initiation, the release stated.

Under the scheme, approximately 56% PMJDY account holders are women and about 67% beneficiaries are situated in rural and semi-urban areas.

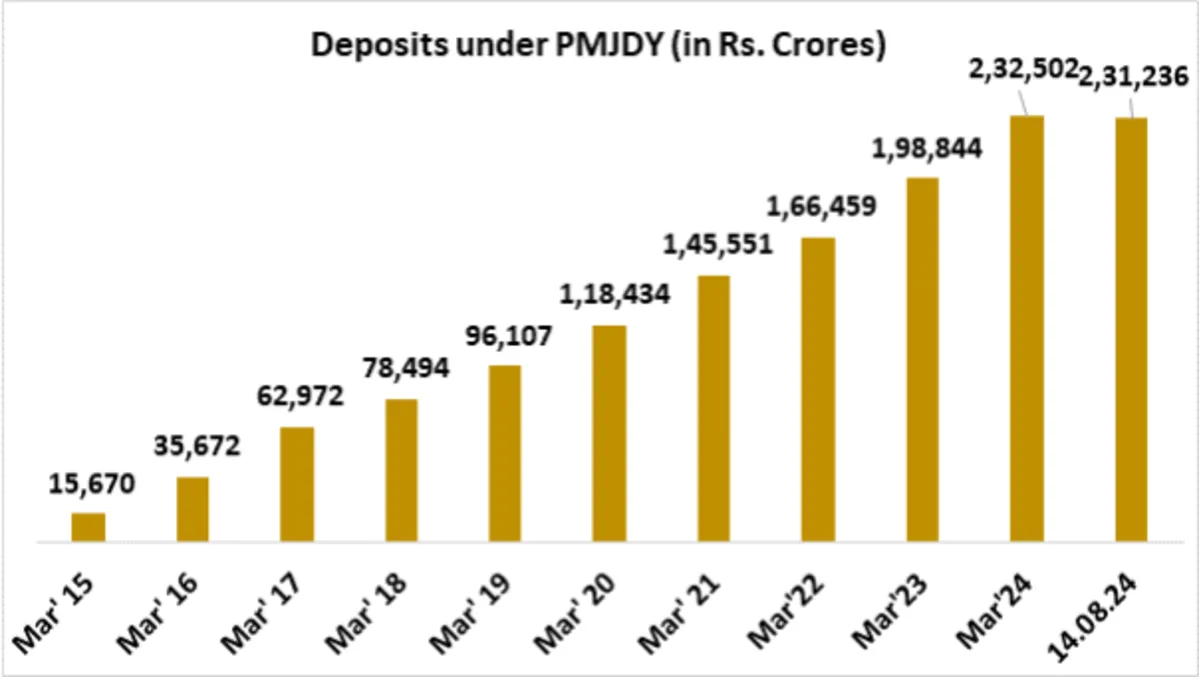

The total deposit balance under the initiative, increased from ₹15.67 thousand crore in March 2015 to ₹₹2.31 lakh crore as of August 14, 2024, accounting for an almost 14-fold spike. This correlates with the 3.6-fold increase in account creation from March 2015 to August 2024.

“Average deposit per account is ₹4,352 as on August 14, 2024. Average deposit per account has increased 4 times over August 2015. Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habits among account holders,” the press release said.

Demonstrating an upward trend, the issuance of RuPay cards to beneficiaries of the PMJDY scheme has increased 1.7-fold since March 2015, with more than 36 crore RuPay cards issued as of August 2024.

“...These bank accounts have garnered a deposit balance of ₹2.3 lakh crore, and resulted in the issuance of over 36 crore free-of-cost RuPay cards, which also provide for a ₹2 lakh accident insurance cover. Notably, there are no account opening fees or maintenance charges and no requirement to maintain a minimum balance,” the Finance Minister said.

With the installation of 89.67 lakh Point of Sale (PoS) or mobile Point of Sale (mPoS) machines and the introduction of mobile based payment systems like UPI, the total number of digital transactions have gone up from 2.3 thousand crore in the financial year 2018-19 to 16.4 thousand crore in FY 2023-24 the report highlighted.

“The total number of UPI financial transactions have increased from 535 crore in FY 2018-19 to 13,113 crore in FY 2023-24. Similarly, total number of RuPay card transactions at PoS and e-commerce have increased from 67 crore in FY 2017-18 to 96.78 crore in FY 2023-24,” the press release said.

While enabling savings, PMJDY provides access to credit to those without a formal financial history.

“Account holders can now show saving patterns, which makes them eligible for loans from banks and financial institutions. The closest proxy is sanctions under Mudra loans, which rose at a compounded annual rate of 9.8%in five years from FY 2019 to FY 2024. This access to credit is transformative as it empowers individuals to grow their incomes,” the Ministry of Finance said in the press release.

“The consent-based pipeline created through the linking of Jan Dhan-Mobile-Aadhaar has been one of the most important pillars of the financial inclusion ecosystem. It has enabled swift, seamless and transparent transfer of Government welfare schemes to eligible beneficiaries and promoted digital payments,” the FM said.

Prime Minister Narendra Modi commemorated the 10th anniversary of Jan Dhan Yojana.

“Today, we mark a momentous occasion— #10YearsOfJanDhan. Congratulations to all the beneficiaries and compliments to all those who worked to make this scheme a success. Jan Dhan Yojana has been paramount in boosting financial inclusion and giving dignity to crores of people, especially women, youth, and the marginalised communities,” the Prime Minister said on X.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story