Business News

RBI action against Paytm Payments Bank explained

.png)

5 min read | Updated on February 02, 2024, 17:37 IST

SUMMARY

The RBI recently issued a directive instructing Paytm Payments Bank to halt all banking services by the end of this month. In this blog, we will delve into the impact of RBI directives on bank’s operations and financial position including stock price, and overall market perception, past regulatory actions and future course of actions.

Stock list

RBI has imposed restrictions on Paytm Payments Bank

The RBI recently issued a directive instructing Paytm Payments Bank to halt all banking services by the end of this month. In this article, we will delve into the impact of RBI directives on bank’s operations and financial position including stock price, and overall market perception, past regulatory actions and future course of actions.

RBI directive: A closer look

A Comprehensive System Audit report, along with a subsequent compliance validation report conducted by external auditors, revealed persistent non-compliance issues and significant supervisory concerns within the bank. These findings, deemed significant, led regulatory authorities to initiate additional supervisory measures:

No further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc. after February 29, 2024, other than any interest, cashbacks, or refunds which may be credited anytime.

Withdrawal or utilisation of balances by its customers from their accounts including savings bank accounts, current accounts, prepaid instruments, FASTags, National Common Mobility Cards, etc. are to be permitted without any restrictions, upto their available balance.

The Nodal Accounts of One97 Communications Ltd and Paytm Payments Services Ltd. are to be terminated at the earliest, in any case not later than February 29, 2024.

No other banking services, other than those referred in (ii) above, like fund transfers (irrespective of name and nature of services like AEPS, IMPS, etc.), BBPOU and UPI facility should be provided by the bank after February 29, 2024.

Settlement of all pipeline transactions and nodal accounts (in respect of all transactions initiated on or before February 29, 2024) shall be completed by March 15, 2024 and no further transactions shall be permitted thereafter.

Paytm’s response to RBI directive

Paytm Payments Bank, in its exchange filing, said that it is taking swift action to adhere to the directives issued by the RBI. It said it is collaborating closely with the regulatory authority to promptly address its concerns. To reduce the impact of restrictions, Paytm said they partnered with multiple banks, not limited to Paytm Payments Bank, for various payment products

It has already initiated partnerships with other banks since the inception of the embargo in March 2022 (see section below) and intend to expedite these plans further, transitioning entirely to other bank partners. Henceforth, Paytm will operate in partnership with other banks, excluding Paytm Payments Bank Limited. The subsequent phase of Paytm’s journey involves expanding its payments and financial services business through partnerships with other banks.

How big is Paytm Payments Bank?

The payment bank serves as the custodian for over 330 million wallet accounts. Notably, considering that the current monthly transacting users stand at 100 million, Paytm leveraged the extensive customer base within Paytm Payment Bank for the sale of payment and financial products. This strategic move allowed Paytm to capitalise on the existing user ecosystem, potentially mitigating the impact of restrictions on new customer acquisition.

Furthermore, Paytm has established itself as the third-largest player in the market, with 17% market share in FASTag toll payments serving a user base of around 60 million. This significant market presence positions Paytm as a key player in the FASTag domain, underlining its potential resilience and adaptability within the broader financial services landscape.

Business impact

Existing Balances: Paytm said this won't affect user deposits in their savings accounts, wallets, FASTags, and NCMC accounts. Users can still use their existing balances in these accounts.

Merchant & Payment Gateway: The Paytm Payment Gateway business for online merchants will keep offering payment solutions to its current merchants. Services like Paytm QR, Paytm Soundbox, and Paytm Card Machine for offline merchants will also keep running as usual, and they can still sign up new offline merchants. Paytm is yet to receive approval for payment aggregator licence while peers have received.

Other financial services like giving out loans, selling insurance, and broking stocks are not connected to Paytm Payments Bank Limited and won't be affected by this change.

Financial impact

In response to the RBI's directive preventing Paytm Payments Bank from accepting fresh deposits, Paytm anticipates a potential "worst-case impact" ranging between ₹300 crore to ₹500 crore on its annual EBITDA, for a context Paytm’s adjusted EBITDA losses were around 1756 crores in FY23.

Impact on stock price

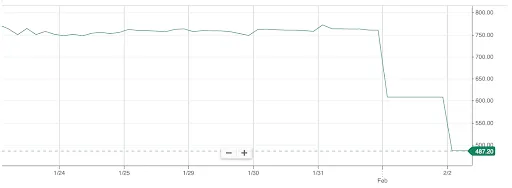

Following the regulatory action, Paytm shares have fallen by 40% in two days.

What other actions has RBI taken against Paytm earlier?

August 2018 - RBI raised observations about Paytm's user acquisition processes, particularly focusing on Know Your Customer (KYC) norms. March 2022 - RBI issued a directive to Paytm Payments Bank, halting the onboarding of new customers. October 2023 - RBI imposed a fine of Rs 5.39 crore on Paytm Payments Bank, citing deficiencies in regulatory compliance. These concerns collectively paint a picture of regulatory challenges and compliance lapses that have drawn the scrutiny of the RBI.

Way ahead

Although, the ban could significantly impact Paytm’s earnings as mentioned by the company in the response to RBI directive. While the exact impact of these restrictions cannot be ascertained at the current stage as the event is still unfolding.

The the key things to watch out for:

- Paytm’s new bank partnerships for offering its financial products

- Future corrective actions as instructed by RBI

- Collateral impact on other businesses of Paytm

- Monthly operational updates for upcoming months

- Actual financial impact which can only be ascertained from the results of March 2023

- Actions by institutional investors like mutual funds and FPIs that hold Paytm’s shares

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story