Business News

Lok Sabha passes Banking Laws (Amendment) Bill, 2024: Key changes and why they matter

.png)

4 min read | Updated on December 03, 2024, 20:41 IST

SUMMARY

The Lok Sabha has passed the Banking Laws (Amendment) Bill, 2024, introducing reforms such as allowing up to four nominees for bank accounts, extending cooperative bank director tenures to 10 years, and raising the threshold for substantial interest from ₹5 lakh to ₹2 crore.

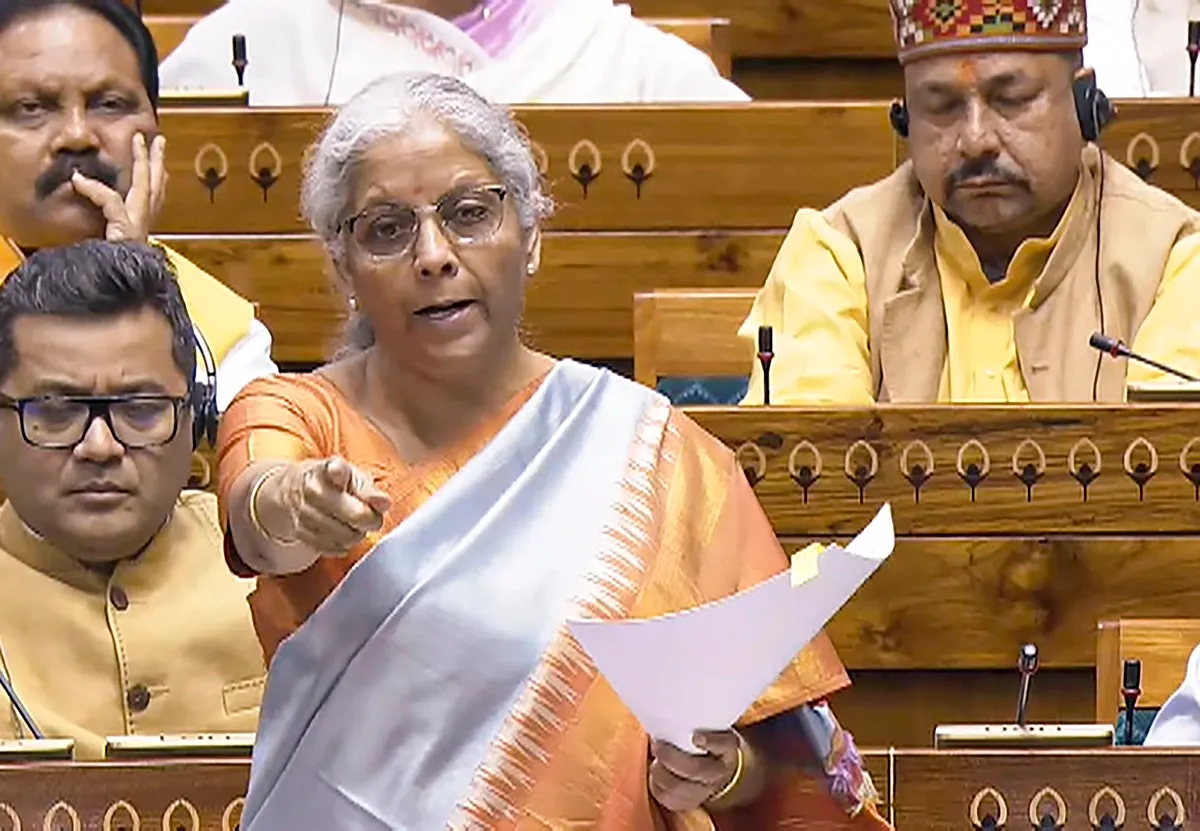

Union Finance Minister Nirmala Sitharaman speaks in the Lok Sabha during the Winter session of Parliament, in New Delhi, Tuesday, Dec. 3, 2024.

The Lok Sabha on Tuesday passed the Banking Laws (Amendment) Bill, 2024, moving a step closer to allowing bank account holders to have up to four nominees in their accounts.

The Bill, presented by finance minister Nirmala Sitharaman, was passed through a voice vote after a brief debate.

Replying to the debate on the Bill, Sitharaman said depositors will have the option of successive or simultaneous nomination facility, while locker holders will have only successive nomination.

"The intention is to keep our banks safe, stable, healthy, and after 10 years you are seeing the outcome," Sitharaman said.

Key takeaways from the Bill

-

Account holders can now appoint up to four nominees.

-

For deposit accounts, nominations can be successive (one after another) or simultaneous (all at once). Simultaneous nominations will divide benefits based on declared proportions.

-

For lockers, only successive nominations are allowed.

-

Directors (other than the chairperson or whole-time directors) in cooperative banks can now serve for up to 10 years instead of the current eight years.

-

A director of a Central Cooperative Bank can also serve on the board of a State Cooperative Bank, provided they are a member of both.

-

The definition of “substantial interest”-- holding shares of over ₹5 lakh or 10% of the paid-up capital of the company, whichever is less– has been revised.

-

The limit, previously set at ₹5 lakh, will now be ₹2 crore.

- Instead of the current system of reporting compliance on the second and fourth Fridays of each month, banks will now submit reports on the 15th and the last day of every month.

-

Unclaimed dividends or bond interest left idle for over seven years will now be transferred to the Investor Education and Protection Fund (IEPF). This includes shares linked to unpaid dividends.

-

Individuals can still claim these funds or shares from the IEPF.

Banks will now have the authority to decide how much to pay their auditors, a function earlier controlled by the RBI in consultation with the central government.

The Bill also tweaks how cash reserves are calculated. The definition of a “fortnight,” used to determine the average daily balance banks maintain with the RBI, has been revised. Instead of spanning from a Saturday to the second Friday after, a fortnight is now either the 1st to 15th or 16th to the last day of each month.

The government believes the changes will bring India’s banking laws in sync with global best practices.

"The proposed amendments will strengthen governance in the banking sector and enhance customer convenience with respect to nomination and protection of investors," Sitharaman said while moving the bill for consideration and passing.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story