Business News

RBI MPC Meeting 2024: RBI reduces CRR to 4% from 4.5%; check key highlights of the latest policy meeting

.png)

4 min read | Updated on December 06, 2024, 12:46 IST

SUMMARY

The RBI Governor Shaktikanta Das, while announcing the policy on Friday, December 6, said that the cut in the CRR rate will make available ₹1.16 lakh crore in liquidity for banks. CRR is a certain portion/percentage of a bank's deposits that must be kept as reserves with the central bank (RBI, in the case of India).

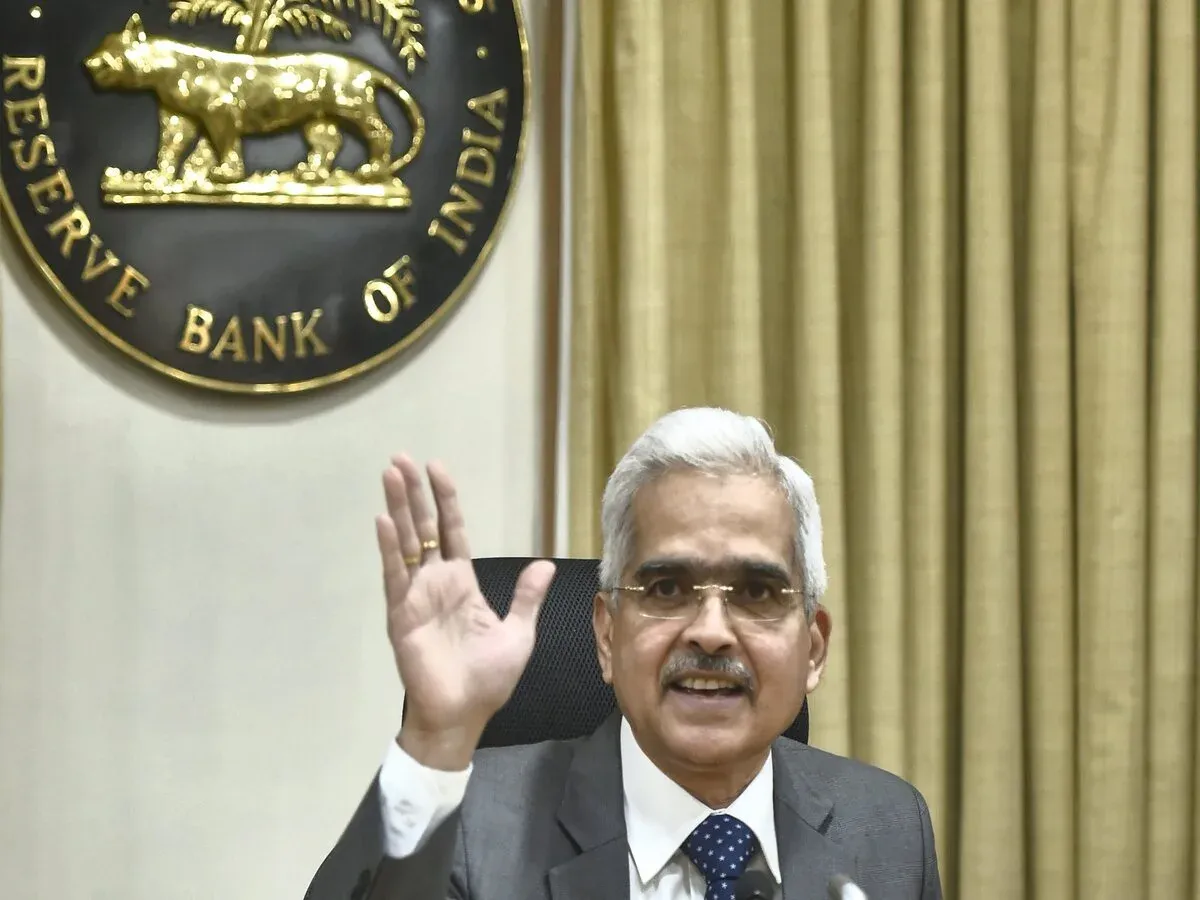

RBI Governor Shaktikanta Das

The RBI Governor Shaktikanta Das, while announcing the policy on Friday, December 6, said that the cut in the CRR rate would lead to the release of ₹1.16 lakh crore to banks and improve their lending capacity.

CRR is a certain portion/percentage of a bank's deposits that must be kept as reserves with the central bank (RBI, in the case of India).

Reacting to the announcement, the banking stocks were trading with healthy gains.

The NIFTY Bank index was trading 196.40 points higher with 9 out of 12 constituents trading in the green. The biggest gainers were Bank of Baroda, Axis Bank, Canara Bank, and PNB.

Status quo on repo rate for 11th time

The Reserve Bank of India on Friday decided to keep the policy rate unchanged for the 11th time in a row. The rate increase cycle was paused in April last year after six consecutive rate hikes, aggregating to 250 basis points since May 2022.

The RBI maintained the status quo on interest rate despite July-September quarter GDP growth falling to a seven-quarter low of 5.4%, as against its own projection of 7%.

The decision to leave the repo rate unhanged was decided by a 4 to 2 majority.

Neutral stance maintained too

Announcing the fifth bi-monthly monetary policy for the current financial year, RBI Governor Shaktikanta Das said the MPC has decided to keep the repo rate unchanged at 6.5% while keeping the policy stance unchanged at neutral.

The decision to retain the stance was unanimous.

The governor said MPC will remain watchful of incoming macroeconomic data for future action.

GDP forecast lowered sharply at 6.6%

The RBI sharply cut the GDP growth projection to 6.6% from the earlier level of 7.2%, while raising the inflation target to 4.8% from the previous projection of 4.5% for the current fiscal year.

The government in October reconstituted the Reserve Bank's rate-setting panel—the Monetary Policy Committee (MPC). This was the second MPC meeting of the reconstituted panel with three newly appointed external members—Ram Singh, Saugata Bhattacharya, and Nagesh Kumar.

What did RBI Guv say on Inflation?

Inflation increased sharply in September and October 2024 led by an unanticipated increase in food prices. Core inflation, though at subdued levels, also registered a pick-up in October. Fuel group remained in deflation for the 14th consecutive month in October. In the near term, despite some softening, lingering food price pressures are likely to keep headline inflation elevated in Q3, the statement said.

Going ahead, a good rabi season would be critical to the softening of the food inflation pressures. Manufacturing and services firms surveyed by the Reserve Bank point to firming up of input costs and selling prices in Q4:2024-25.27

"Taking all these factors into consideration, CPI inflation for 2024-25 is projected at 4.8%, with Q3 at 5.7%; and Q4 at 4.5%. CPI inflation for Q1:2025-26 is projected at 4.6%; and Q2 at 4%. The risks are evenly balanced," the statement said.

What do these inflation and growth conditions mean for monetary policy?

The MPC said that the near-term inflation and growth outcomes in India have turned somewhat adverse since the October policy. The medium-term prognosis on inflation suggests further alignment with the target, while growth is expected to pick up its momentum. Persistent high inflation reduces the purchasing power of consumers and adversely affects both consumption and investment demand.

The overall implication of these factors for growth is negative. Therefore, price stability is essential for sustained growth. On the other hand, a growth slowdown – if it lingers beyond a point – may need policy support.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story