Business News

RBI MPC Meet 2024: Repo rate, policy stance maintained with 4:2 majority; check key highlights

.png)

4 min read | Updated on August 08, 2024, 12:34 IST

SUMMARY

As regards global growth, Das said the long-term outlook remains strong, but it is facing significant challenges in the medium term. The governor also noted that global financial markets have been exhibiting volatility.

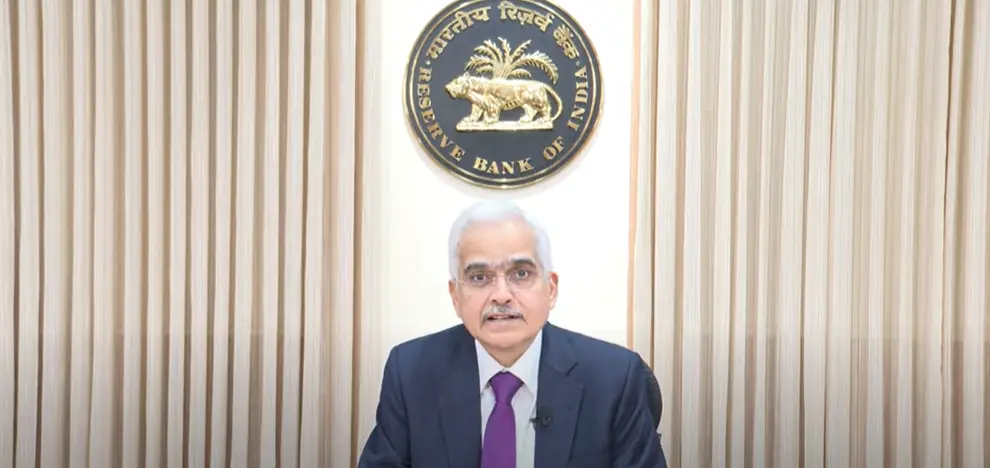

RBI Governor Shaktikanta Das addressing the press to announce the outcome of Monetary Policy Committee (MPC) meeting.

The Reserve Bank of India (RBI) on Thursday, August 8, kept the repo rate unchanged at 6.5% for the ninth time in a row, on expected lines. Moreover, the monetary policy committee (MPC) of the RBI maintained the "withdrawal of accommodation" stance in the policy meet, which ran between August 6 and August 8.

RBI Governor Shaktikanta Das, while announcing the policy, said that both the status quo on interest rates and the policy stance were decided by a 4:2 vote.

Further, the RBI kept the FY25 real GDP growth rate projection unchanged at 7.2%, with Q1 at 7.1%, Q2 at 7.2%, Q3 at 7.3%, and Q4 at 7.2%.

As regards global growth, Das said the long-term outlook remains strong, but it is facing significant challenges in the medium term. The governor also noted that global financial markets have been exhibiting volatility.

The statement read, "The global economic outlook remains resilient although with some moderation in pace. Inflation is retreating in major economies but services price inflation persists. International prices of food, energy and base metals have eased since the last policy meeting. With varying growth-inflation prospects, central banks are diverging in their policy paths. This is creating volatility in financial markets. Amidst recent global sell offs in equities, the dollar index has weakened, sovereign bond yields have eased sharply and gold prices have soared to record highs."

Domestic growth, the governor said, is holding up well on steady urban consumption. Das added that the MPC decided to focus on inflation mainly to support growth. The governor added that fixed investment activity remained buyont.

Das added, "Domestic economic activity continues to be resilient. On the supply side, steady progress in the southwest monsoon, higher cumulative Kharif sowing, and improving reservoir levels auger very well for Kharif output. Manufacturing activity continues to gain ground on the back of improving domestic demand."

Meanwhile, the central bank also maintained its earlier estimate of CPI inflation for FY25 at 4.5%.

Headline inflation has moderated from its peak but unevenly. Looking ahead, food price momentum has remained elevated in July. In Q2:2024-25, though favourable base effects are large, the sharper uptick in price momentum relative to earlier expectations is likely to result in a shallower softening of CPI headline inflation.

Inflation is expected to edge up in Q3 as favourable base effects taper off. The steady progress in monsoon, pick-up in kharif sowing, adequate buffer stocks of foodgrains and easing global food prices are positives for containing food price pressures. Adverse climate events remain an upside risk to food inflation. Crude oil prices continue to be volatile on demand concerns and geopolitical tensions. The revision in mobile tariff rates is likely to lead to an increase in core inflation.

Households’ inflation expectations have also gone up and consumer confidence has weakened. Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q2 at 4.4 per cent; Q3 at 4.7 per cent; and Q4 at 4.3 per cent. CPI inflation for Q1:2025-26 is projected at 4.4 per cent. The risks are evenly balanced.

Dr Shashanka Bhide, Dr Rajiv Ranjan, Dr Michael Debabrata Patra, and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50%, while Dr. Ashima Goyal and Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points.

Similarly, Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra, and Shri Shaktikanta Das voted to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth. Dr. Ashima Goyal and Prof. Jayanth R. Varma, however, voted for a change in stance to neutral.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story