Business News

India should not import cynicism from abroad; private investment could offset risks: Finance Ministry

3 min read | Updated on March 26, 2025, 12:10 IST

SUMMARY

The finance ministry report highlighted greater trust in institutions in developing nations, including India, compared to developed countries.

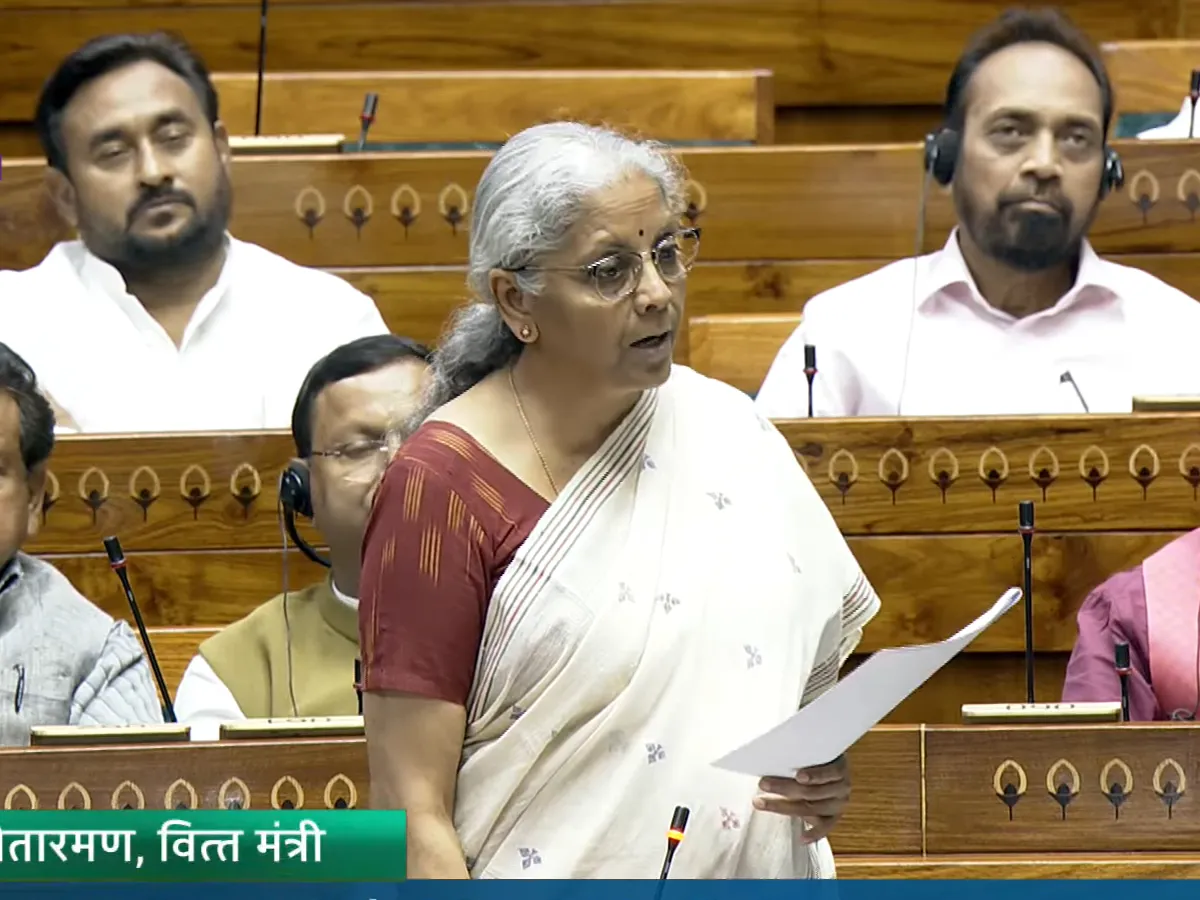

Union Minister Nirmala Sitharaman speaks in the Lok Sabha during the Budget session of Parliament, in New Delhi, Tuesday, March 25, 2025. (Sansad TV)

India should be careful not to import the pervasive cynicism and pessimism from abroad amid elevated uncertainty stemming from geopolitical tensions and trade policy developments, the finance minister said on Wednesday.

In its monthly economic review for February 2025, the ministry pointed to a survey that suggested greater trust in institutions in developing countries, including India, than in developed parts of the world.

“The survey respondents in developing countries, including India, had greater trust in institutions and were more optimistic about a better future,” the ministry said, citing 2025 Edelman Trust Barometer.

“We should be careful not to import the pervasive cynicism and pessimism from abroad.”

The Indian economy has demonstrated resilience amid global uncertainties, with growth gaining momentum in the third quarter of FY25 due to a revival in private consumption and an uptick in core merchandise exports, according to the report.

The ministry noted that high-frequency indicators, such as double-digit growth in e-way bills and sustained expansion in PMI indices, point to improved economic activity in the January- March quarter.

“The growth in Q4 of FY25 is likely driven by improved export growth, pick-up in government capital expenditure post-elections and impetus to economic activity associated with Kumbh Mela,” the report said.

Highlighting that inflation was at a seven-month low in February 2025, the ministry said the inflationary pressures are likely to remain subdued in the coming months as record food grain production is expected in 2024-25.

Meanwhile, core merchandise exports (excluding oil and bullion) grew by 8.2% between April 2024 and February 2025, while gross FDI inflows rose by 12.4% from April 2024 to January 2025.

"The foreign exchange reserves are adequate to cover more than 11 months of imports."

The current labour market conditions are stable, with the urban unemployment rate remaining unchanged during the third quarter of FY25, the report noted.

“Many employment outlook surveys indicate a sense of optimism and an increased willingness to engage in hiring practices in the upcoming quarter.”

However, the ministry cautioned that geopolitical tensions, trade policy uncertainties, volatile commodity prices, and financial market fluctuations pose risks to growth in the next fiscal year.

It emphasised that private sector investment could counter these challenges, given India’s steady growth trajectory.

"...if the private sector were to invest in the economy, banking on the resilience of the Indian economy and its steady growth outlook, it would overpower the risks to the growth outlook considerably. It is essential that the industry recognises the mutual endogeneity of its investment spending and consumption demand."

About The Author

Next Story