Bull call spread strategy in options trading

A bull call spread is an options strategy that traders implement when they have a moderately bullish view on a stock or an index. In this strategy, a trader buys an ATM (at-the-money) call option and sells an OTM (out-of-the-money) call option which works as a hedge.

Let’s see how this strategy works.

Derivatives build-up

In the recent market fall, the Nifty50 corrected more than 9% from its early-June high of 16,793.

The July 7 options data of the Nifty50 shows a significant base of more than 12.4 lakh contracts at 16,000 call option strike, suggesting that the index may face resistance at this point.

Strategy

Let's understand how this strategy works.

In this strategy, a trader initiates a long position in ATM (at-the-money) call option of 15,800 strike price (7th July expiry) at ₹179 and simultaneously shorts an OTM (out-of-the-money) call option of 16,000 strike price (7th July expiry) at ₹96, as a hedge.

The lot size of Nifty50's F&O contract is 50 shares per lot.

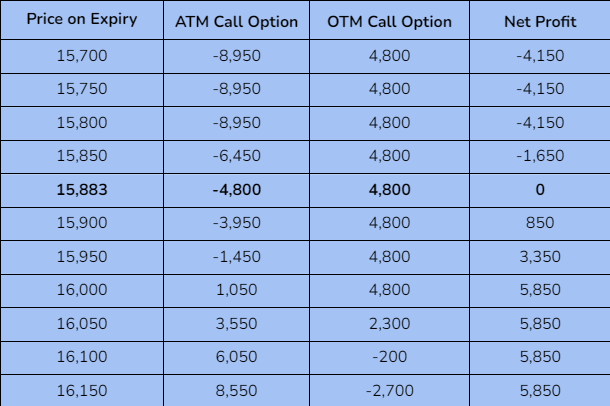

Pay-off table

###### Note: The table illustrated here is for better understanding and educational purposes only.

###### Note: The table illustrated here is for better understanding and educational purposes only.

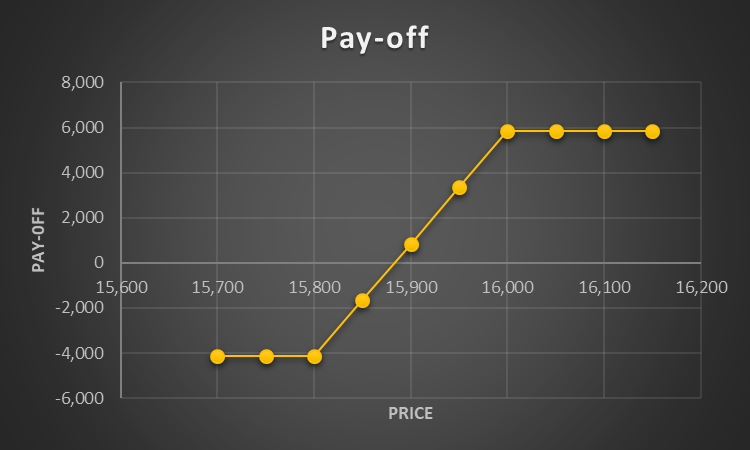

Pay-off graph

###### Note: The graph illustrated here is for better understanding and educational purposes only.

###### Note: The graph illustrated here is for better understanding and educational purposes only.

Break-even point

It is a point or a price where a trader incurs no-profit-no-loss. In this strategy, the breakeven point is 15,883. It is calculated by adding the net premium paid (₹179

- ₹96 = ₹83) to the ATM (at-the-money) call option strike price (15,800).

Scenario 1: Nifty50 moves from15,883to16,000

Now, closer to the expiry, if the index moves higher and closes at 16,000, the trader will make a total profit of ₹5,850.[Profit on long call option: (₹21 * 50 = ₹1,050) + profit on short call option: (₹96 * 50 = ₹4,800)].

As you can see in the pay-off table, above 16,000, the profit for the trader is capped at ₹5,850.

Scenario 2: Nifty50 falls below15,883

In case the index falls below the breakeven point of this strategy, i.e. 15,883, then the strategy will start incurring a loss. The total loss of the trader is limited to the net premium paid of ₹4,150 (₹83 * 50).

Scenario 3: Nifty50 remains at15,883

At this point, the trader will neither have incurred a profit nor a loss, as the net premium (₹83) paid will be recovered by the 15,800 strike price call option, which will have a premium of ₹83.

We hope this strategy was simple and easy to understand. We’ll be coming up with many strategies that will help you identify trade setups easily.

Until then, happy trading!

About the author: Kush Bohra is a SEBI-registered investment advisor (INA000008525) and an F&O expert.

Disclaimer

*Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. *

We do not recommend any particular stock. The index mentioned in this article is purely for showing how to do analysis. Take your own decision before investing.