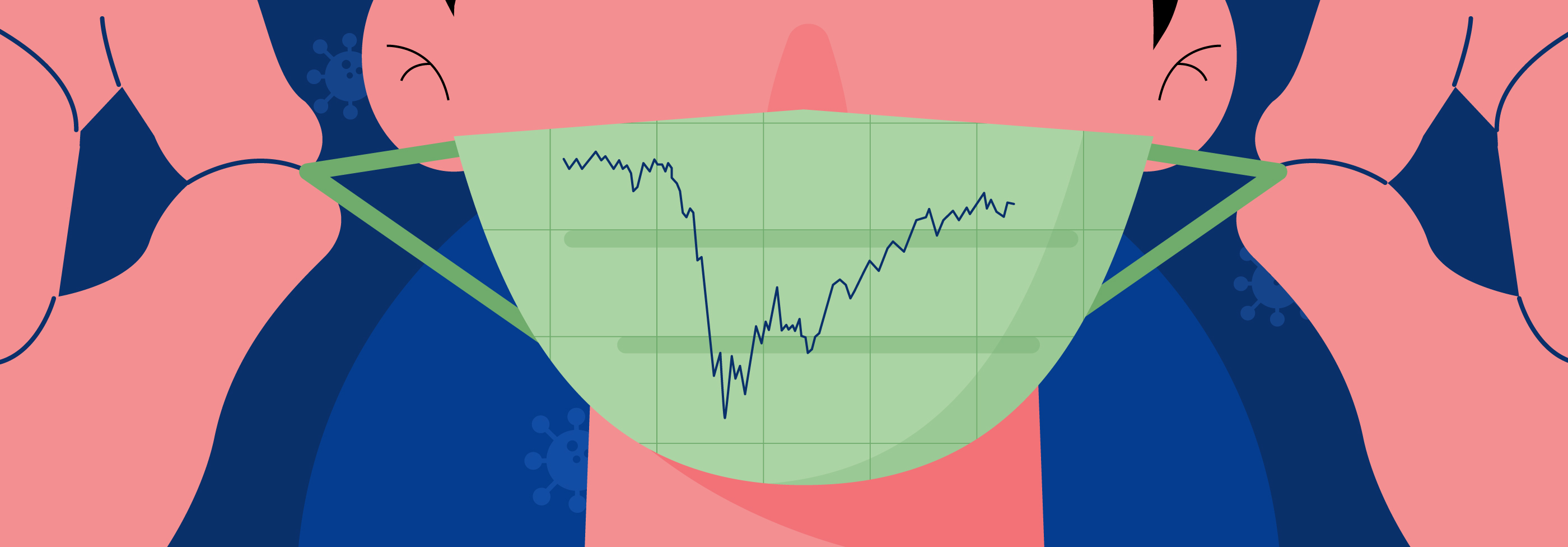

The Sensex fell from around 42,000 in mid-February to a little below 26,000 in late March, while the Nifty plunged to mid-7,000s from a high of about 12,300.

In a nutshell

|

Remember 24 March 2020? It was when our 1.3 billion-strong country went under lockdown for the first time. Both the Sensex and Nifty had begun their free-fall in February in the wake of the Covid-19 pandemic. The Sensex dove from around 42,000 in mid-February to a little below 26,000 in late March, while the Nifty plunged to mid 7,000s from a high of about 12,300. And then, the two indices did a complete U-turn.

Notably, during this period, the nation came to a grinding halt. Offices closed down, public transport services were suspended, and people largely confined themselves to their houses. The country’s unemployment figures skyrocketed. As per the Centre for Monitoring Indian Economy, unemployment rose from 8.7% in March to 23.5% in April and May. The GDP growth slowed down to 3.1% in the January-March quarter.

If you remember, the markets bottomed out on March 24 and remained turbulent till the first week of April. Since then, however, the markets have rallied steadily. Even the GDP contraction by a staggering 23.9% during the April-June quarter hasn’t dented the markets much. But why? Let’s find out.

- The numbers don’t tell the whole story

The stock market indices don’t always truly represent the economy’s current condition. Instead, they reflect a forward-looking expectation from the economy. Think of it this way: You invest money in the market expecting to make a profit in the future. That’s because most investors are betting on the economy to eventually emerge out of the pandemic. When investors think that the stock market is undervalued, they start picking up quality stocks at low valuations. The rise in demand pushes up the market indices, even though there is no real change in economic factors.

- Liquidity creates demand for stocks

Governments the world over have done their bit to save their economies in the wake of the pandemic. Take, for instance, the interest rate cuts by the US Federal Reserve, the US govt’s Paycheck Protection Program for small businesses, India’s repo-rate cuts, and other pro-lending measures seen across the globe. These measures are aimed to create ‘liquidity’; in other words, make money more available to people so that they consume and invest more.

Business fundamentals may have changed little. However, stimulus packages announced by governments or even breakthroughs in vaccine technologies have managed to create optimism in the markets. This sentiment is infectious too. For example, on days when the US markets rise, there’s a carryover effect, and most global indices, including Indian markets, rally on cue. This has, in large part, kept the indices on their upward trajectory.

- New investors entered the market

CDSL figures show that Indians opened 1.98 million new demat accounts between March and June. The work-from-home life during the pandemic has given investors more time to research and understand the stock market. This has encouraged more people to dabble in equities and various investment instruments. There are many first-time investors, who have turned to trading as an alternate source of investing. Collectively, Indian markets raised over ₹2 lakh crore capital during the April-June quarter. The spike in demand for stocks is one of the reasons for rise in stock indices.

- Investors are looking for better returns

Edging over 7%, inflation threatens traditionally safe investment options such as fixed deposits, which offer anywhere between 4% and 6% depending on the tenure. Thus, with traditional investment methods, investors stand to make a net loss if the current inflation rate persists. Equities, on the other hand, are a riskier investment option but can provide relatively higher returns. Understandably, investors (both domestic and international) are putting their money into the stock markets for better returns on their capital. This increase in demand is one of the factors pushing the markets upwards.

- Big companies impact the markets more than smaller ones

It is important to note that just as the stock indices don’t accurately reflect the state of the economy, they don’t reflect the state of the entire market either. An index tracks some of the largest companies listed on the stock exchange. Further, few of those companies are assigned a higher weightage than others. It is possible that a couple of high-weightage companies perform exceptionally well and pull up the index, while the other companies could still be struggling.

Conclusion

The stock market rally we witnessed is a result of collective optimism coupled with increased liquidity. Further, governments across the globe have used policy measures to make money more easily available to the public.

Government intervention along with lacklustre returns from traditional investment instruments have directed investors to the stock markets. Finally, strong growth in large, tech-based companies skews the relationship between the stock market and the actual economy. This results in a divergence between the markets and the economy.

Sources:

https://tradingeconomics.com/india/unemployment-rate

https://ww1.cdslindia.com/publications/DPArchive.html

Disclaimer:

The above article is purely academic in nature and aims to provide knowledge about basic trading concepts & should not be construed as an opinion or advice to invest or trade.

Investments in the securities market are subject to market risks; please read all the related documents and/or consult your investment advisor before investing.

Past performance of an investment asset does not guarantee future returns.

Companies mentioned in the article are purely for illustrative purposes and are not meant as a recommendation to buy or sell any security.