Markets rebound after slump to end week in green

-

Key benchmark indices closed higher for the second straight day on Friday.

-

Combined market valuation of BSE listed companies swelled ₹3.24 lakh crore in a single day to ₹368 lakh crore.

-

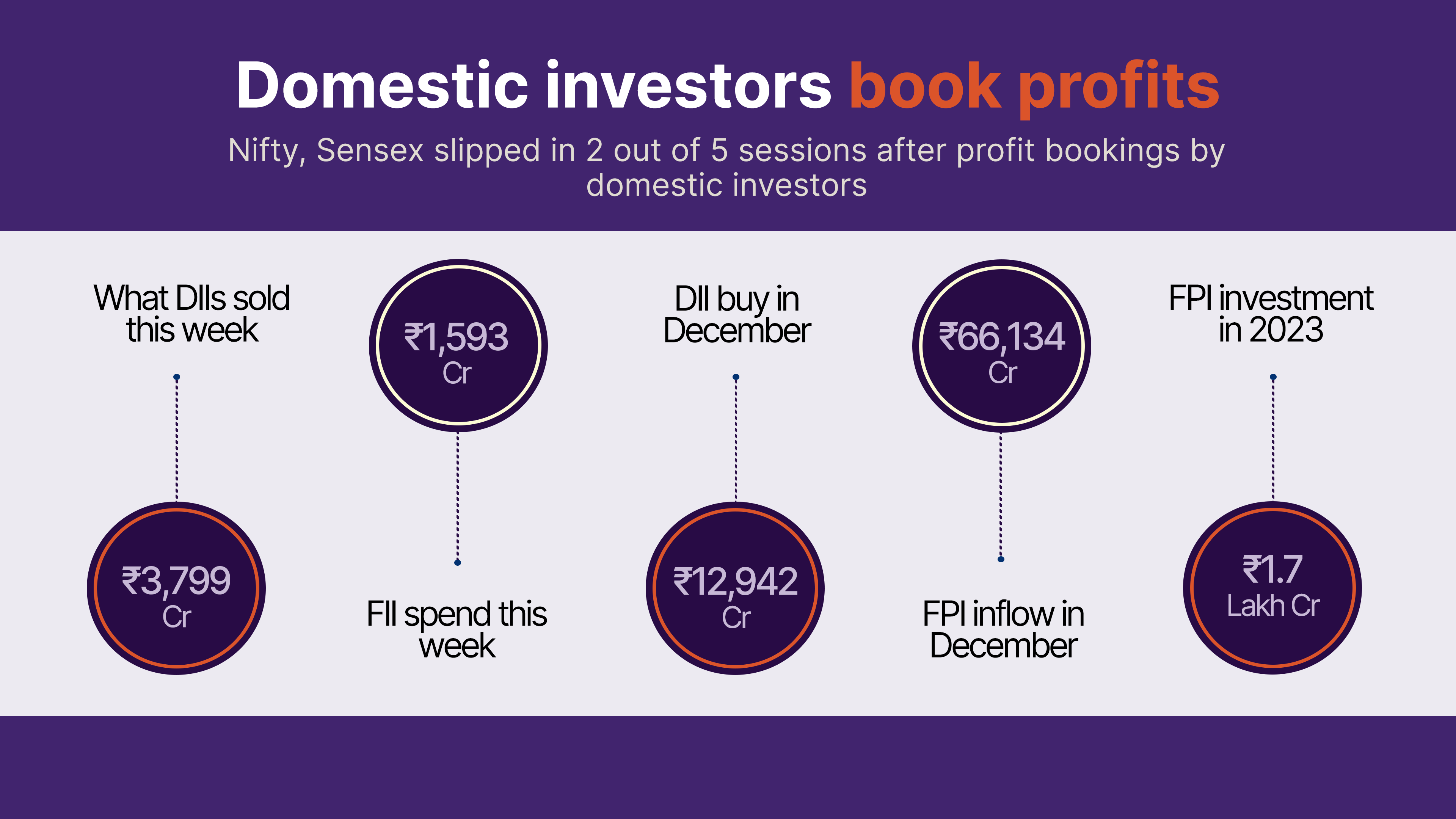

Domestic investors sold shares of more than ₹3,700 crore this week.

-

FIIs purchased shares of more than ₹1,500 crore this week.

Hi folks! Hope you had a great start to the new year. Let’s dive right back in for a quick recap of the stock markets.

The benchmark indices witnessed volatility in the first week of 2024 after weeks of upward movement.

Following a record-breaking rally in 2023, it was a reality check for the key benchmark indices. With valuations of Indian stocks soaring high, investors resorted to profit-taking at the start of 2024. This led to significant fluctuations.

Sensex and Nifty closed the first trading day of 2024 with modest gains despite scaling record highs in intra-day trade. Sensex touched an all-time intraday high of 72,561.91 points while Nifty scaled a new peak of 21,834.35.

The indices fell for the next two sessions due to profit selling in index heavyweights such as HDFC Bank, TCS and Infosys. Sensex retreated below the 72,000 level. Nifty traded near its support levels of 21,500 mid-week after suffering a hit of around 1% in the two days.

Global uncertainties and macro data reflecting a slowdown in economic activity back home weighed on investor sentiment.

However, monthly business updates by banks such as HDFC Bank showing strong credit growth fuelled value buying in index majors.

Key indices recouped around 1% in a single day on Thursday. Investors became richer by ₹3.24 lakh crore in a single day with the market valuation of BSE listed companies soaring to ₹368 lakh crore.

Sensex and Nifty, however, closed the first week of 2024 on a weak note**.** Sensex closed the week higher at 72,026.15, up 178.58 points or 0.25%. Nifty ended flat at 21,710.80, up 52.20 points or 0.24%, on Friday. The benchmark indices closed in green for the second straight day riding on the heavy buying in IT stocks.

DIIs hit brakes, FII inflows soar

Domestic institutional investors preferred to book profits in the first week of 2024. For the past five months, since August, DIIs were buyers of shares on a net basis, which means they bought more shares than they sold. Buying by DIIs has been a key factor in stock markets breaching new highs while Foreign Institutional Investors (FIIs) hitting the pause button amid rising bond yields in the US market last year.

DIIs sold shares of more than ₹3,700 crore in the cash segment this week.

FIIs, on the other hand, purchased shares of more than ₹1,500 crore this week. Foreign Portfolio Investors (FPIs) had put in more than ₹66,000 crore in Indian equities in December alone.

Adani Group shares make hay after Supreme Court booster

Adani Group shares were back in demand this week after a Supreme Court booster. The apex court, on January 3, ruled out any new investigation into allegations against the group made in the Hindenburg report. The court directed market regulator Securities and Exchange Board of India (SEBI) to complete probes in the remaining two out of 24 cases.

Adani Energy Solutions, Adani Green Energy, Adani Total Gas, NDTV, Adani Ports, Adani Enterprises, Ambuja Cements, and Adani Wilmar advanced with some of these stocks hitting the 52-week highs.

Gains in Adani shares took the combined market valuation of 10 Adani-listed companies to over ₹15 lakh crore.

Broader market beat benchmark indices

Broader market indices such as Nifty Midcap beat the benchmark indices. It was caused by retail investors continuing to hunt for multibagger stocks.

Nifty Midcap surged past the 47,000 mark for the first time this week. Realty shares gained momentum after reports suggested that luxury housing demand remained robust in major cities.

The week ahead

As economic activity remained robust, value buying at dips suggests dominance by the bulls in the stock market. The current sentiment suggests a Nifty trajectory towards 21,850. Expectations of strong earnings for the December quarter are likely to keep the mood upbeat next week.