Campus IPO – All you need to know

In 2017, global private equity player TPG was looking to make additions to its investment portfolio. And the global investor, which has been investing in India for about two decades, settled on the footwear brand Campus. Around four years later, TPG’s bet seems to have paid off.

Today, Campus is the largest sports and athleisure footwear brand in India in terms of value and volume. As of FY21, it had a market share of 17% in the branded sports and athleisure space.

And now, the footwear maker is launching its public issue in a bid to hit the bourses. The Campus IPO is all set to be launched soon.

Here are the key details about the Campus Shoes IPO:

Offer details

-

**Start date:**26 April 2022

-

**End date:**28 April 2022

-

Price band:₹278-₹292 per share

-

Minimum investment:₹14,892

-

IPO size:₹1,400 crore

Timeline

-

**Allotment:**4 May 2022

-

**Refund:**5 May 2022

-

**Credit of equity shares:**6 May 2022

-

**Listing:**9 May 2022

All about the IPO

Campus is one of the few established homegrown brands in the sports and athleisure segment, which is dominated by global players. It has an extensive product portfolio including 1,433 active styles for men, 241 active styles for women and 485 active styles for kids and children. In FY21, it launched 583 designs.

Through this large product portfolio, it caters to consumers across different demographics and price range (entry to premium). It covers more than 85% of the total addressable market for sports and athleisure footwear in India.

Campus Activewear also has a large network of 425 distributors, which fulfil orders of more than 19,200 retailers across India. The company also sells its products through direct-to-consumer online channels such as Flipkart, Myntra and Fynd.

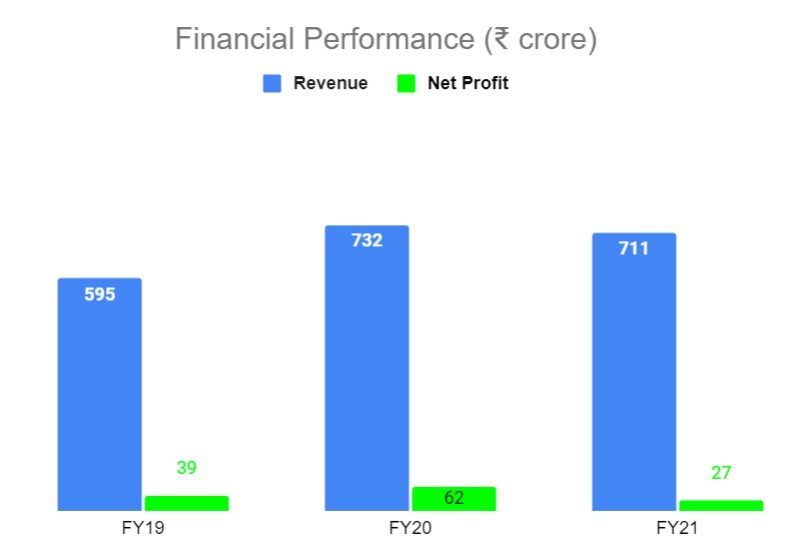

Financials

Revenue: 9.3%; Net Profit: -16.7% (FY19-21 CAGR)

Strengths

-

Sells products across price points – entry-level (at or below ₹1,049), semi-premium (between ₹1,050 and ₹1,499) and premium (at or above ₹ 1,500)

-

The sales contribution from its premium segment has increased to 40% in the nine months ended December 2021 from 31% in FY19

-

Offers a wide range of style, colour, size and functionality options

-

Owns and operates five manufacturing facilities across India with an installed annual capacity for assembly of 2.8 crore pairs

-

Has a diverse presence across retail formats, including 85 exclusive brand outlets

Risks

-

Operates in a highly competitive sector which includes global brands such as Adidas, Puma and Nike

-

Pandemic like events could adversely impact the sales

-

A significant portion of the revenue comes from the Northern part of India

-

Trade receivables, which is the amount owed to the company, stood at ₹122 crore as of December 2021

Good to know

India’s sports and athleisure footwear market is highly underpenetrated. This space is estimated to grow at a 25% CAGR between 2021 and 2025. Being a major player in this segment, Campus could benefit from this double-digit growth.

FAQsHow can you pre-apply for the Campus IPO?

Pre-applying for the Campus IPO means applying for this public issue before it goes live. Click ** here** and follow these steps to pre-apply for the Campus IPO on Upstox.

When does pre-apply for the Campus IPO open and how can you pay for it?

You can pre-apply for the Campus IPO from 25 April 2022. Once the IPO goes live, you will receive a UPI mandate. Accept this to block the IPO application amount and successfully place your bid.

How can you apply for the Campus IPO?

Click ** here** to apply for the Campus IPO on Upstox. You can also download our app. Then click ** here** and follow these steps.

When does the Campus IPO open and close for the subscription?

The Campus IPO launch date is 26 April 2022. The Campus IPO will open for subscription till 28 April 2022.

What’s the lot size and minimum investment needed for the Campus IPO?

The lot size for the Campus IPO is 51 shares and the minimum investment required is ₹14,892.

What is the price band for the Campus IPO?

The price band for the Campus IPO is ₹278-₹292 per share.

What’s the size of the Campus IPO?

The size of Campus IPO is ₹1,400 crore.

How many bids can I place for the Campus IPO?

You can place up to three bids for an application.

Can these bids be placed at different times during the Campus IPO subscription period?

No, the bids have to be placed at one go. If you want to add an additional bid, then you would have to delete your application and re-apply.

When will Campus shares be credited to your demat account?

If the shares are allotted, then they will be credited to your ** demat account** on 6 May, 2022. Click ** here** and follow the steps to check the allotment status.

Which exchanges will Campus list on?

Shares of Campus will list on BSE and NSE.

When will Campus list on the exchanges?

Shares of Campus will list on 9 May 2022.