Explore Mutual Fund Collections

Name | Plans | 5Y Returns (%) | Expense Ratio | AUM (Cr) |

FAQs

The Net Asset Value (NAV) is the price per share of any particular share at any given time. This does not include any brokerage or overheads you may pay for the share. It is updated every day at the close of the market day.

-

Returns on Invested Money:

FDs have a guaranteed return whereas in mutual funds there is no guarantee on the returns on the investment as it is dependent on the market. Although, in the long run, they earn much higher returns than FD. -

Liquidity:

Corporates and Individuals. -

Tax Liability:

The bank FD returns are taxed as per your income bracket upon maturity. On the other hand, mutual funds enjoy the tax benefits as well as fixed indexation rates of tax on the returns. -

Risk:

The biggest benefit of a FD is the fixed and guaranteed returns in the form of interest. In mutual funds there is no such guarantee and the profit and loss moves as per the market’s volatility.

- It is not a flight by night scheme and no one is going to run away with all your money. They are completely safe as mutual funds companies are regulated and supervised by Securities and Exchange Board of India (SEBI) as well as the Association of Mutual Funds in India (AMFI).

- The strategy behind them is to earn higher returns that are also tax efficient. They do not guarantee capital protection or even fixed returns but provide higher returns than traditional investment instruments. They result in greater market exposure as well as are managed by professional finance managers. They are tax efficient as they are taxed in a way that does not touch the returns earned on them. They are best for long term investments, but short term also reaps this tax benefit.

- The risk can be managed very well as the portfolio is usually diverse with a mix of equity and bonds as well as debts. Each promises different financial goals.

These are a highly liquid asset and hence, can be withdrawn at any time. While sale and purchase can take place at any time of the day, the money is transferred out generally at the close of the market day.

-

Investment Value:

In a mutual fund the investment is generally in lump sum whereas in SIP it is done on a monthly or quarterly basis. -

Investment Form:

In a mutual fund the investment is made in both debt and equity funds, while SIP trades in mutual funds. -

Market Trends:

They have a smaller impact on SIP. -

Cost:

Higher fees are applicable in terms of transaction amount, AMC and more as compared to SIP. -

Redemption:

Both are liquid but redemption charges are lower in SIP.

-

Tax-saving equity funds:

Under ELSS, a tax benefit upto Rs. 1.5 L is available under Section 80(C). Under this there is a lock-in period of 3 years. -

Non-tax saving equity funds:

Under long term capital gain, tax on redemption is exempted upto Rs. 1 L with 10% infection over that. - Short term capital gains like debt funds, balanced funds and SIPs are taxed at 15%.

The minimum investment possible is Rs. 100 in SIP and Rs. 1,000 in lump sum, but at the very least Rs. 500 is suggested.

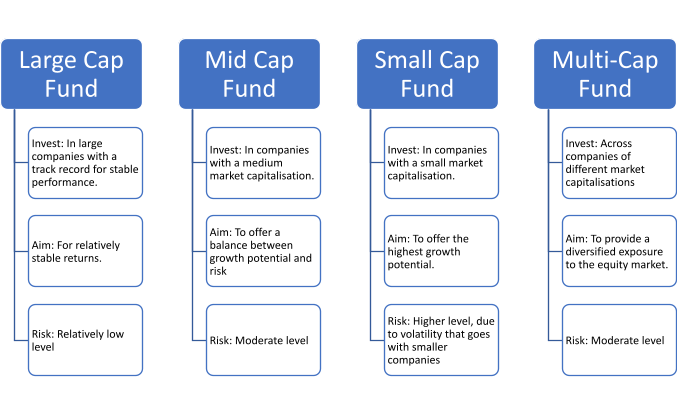

The mutual funds that are significantly volatile but offer high returns with a greater risk of loss are called high risk mutual funds. Large cap equity are less risky and give stable returns. Mid cap and small-cap companies have small capitalization and have scope for growth give high returns but have significantly high risk.

-

Make a Strategy:

Think about your financial situation, goals, timeline and risk tolerance before you select your investment. With the help of these answers, you will be able to make a choice based on size of company, style, credit quality etc. With this you can make a balance in your portfolio. -

Monitor Performance of the Company:

The performance of the stocks you are interested in should be monitored at all times periodically. Past performance alone cannot guarantee future performance. But studying it over the long term may help you narrow down your choices. -

Think about the costs:

You must look at the expense ratio of the funds you want to invest in as the costs are an important consideration. Your costs may include the management fee, distribution fee, transaction fee and other expenses. Fees differ from fund to fund, so a look into it for comparison sake would be beneficial. -

Other Considerations:

While the three above are important considerations, a closer look is always a good idea. Consider the manager you want to work with, the capabilities of the company that manages the fund, the track history of the companies selling equity, etc.

As a long term asset, mutual funds can be very beneficial. The average returns based on the top 20 performing ones over the last 20 years are annualised at 9.75%.

Upstox strives to be the best financial instruments app. You can review, research, follow and purchase and sell stock, including the best mutual fund options on both our desktop as well as our mobile app.

Mutual Funds: A Comprehensive Guide

In the present financial landscape with its different characteristics and finer nuances, mutual funds are a fundamental element. Mutual funds have gained significant popularity among investors looking for diversified investment options. If you’ve wanted to know more about what a mutual fund is and how it works, here is your comprehensive guide to know more. We glance at the concept of mutual funds, their benefits, types, and the key considerations for investors.

What is a mutual fund?

A mutual fund is an investment vehicle where money is pooled from multiple investors. This pooled money is further invested into a diversified portfolio of financial securities such as stocks, bonds, and other asset classes. Professional fund managers are optimised to manage mutual funds. Mutual funds also give investors this unique opportunity to access a broad range of investment options, and without the pre-requisite of a large capital amount.How do mutual funds work?

The elemental concept for mutual funds is to pool the resources from individual investors to then create a cohesive and larger investment fund. When an investor purchases mutual fund shares, they are effectively buying a portion of the overall fund. This also entitles the investor to their proportional share of the fund’s profits, losses, and expenses.What are the mutual fund categories?

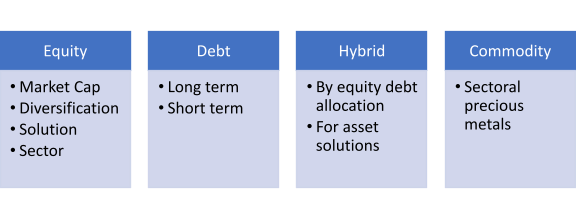

There are four main categories of mutual funds: equity funds, debt funds, hybrid funds, and commodity funds.

Equity Funds

Equity funds are a popular investment option for those seeking long-term capital appreciation. These funds invest primarily in stocks or equity-related instruments. The funds aim to generate capital appreciation over the long term by investing in a diversified portfolio of stocks across various sectors and market capitalisations. Equity funds give investors the opportunity to participate in the potential growth of the stock market while also benefiting from optimised and professional fund management.Types of equity funds

Equity funds offer a convenient way for investors to participate in the growth potential of the stock market. However, it’s essential to understand the risks involved. After considering their risk tolerance, an investor can choose funds that align with their financial goals. By conducting thorough independent research and considering these factors, investors can potentially benefit from the growth opportunities provided by equity funds.Debt funds

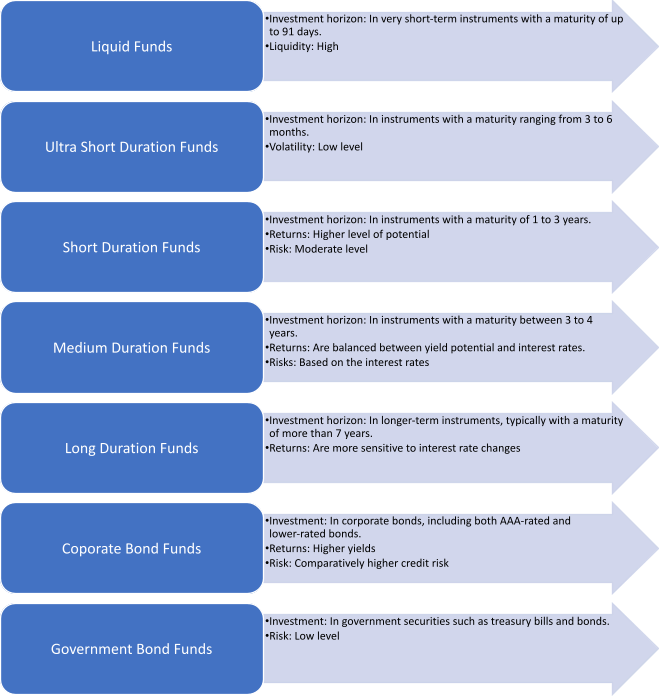

Debt funds are commonly considered by investors as a means of generating stable income and preserving capital. These funds invest in fixed-income instruments such as government bonds, corporate bonds and other debt securities. These funds are managed by professional fund managers who carefully curate and manage a diversified portfolio of debt instruments. Debt funds are relatively lower-risk investments and therefore may be considered by conservative investors seeking stable returns.Types of debt funds

Debt funds give investors a range of options to generate stable incomes while also preserving capital. With diverse investments and varying risk profiles, debt funds can cater to different investors. By understanding the types of debt funds available, assessing the risk and return factors, and by thorough independent research, investors can potentially benefit from the stability and income generation offered by debt funds.Hybrid funds

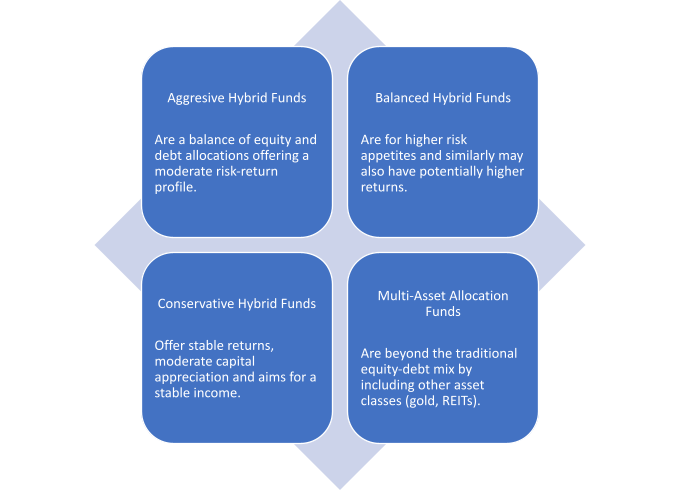

Hybrid funds are commonly considered as a blend of the best of both worlds. They give investors the opportunity for a balanced approach to wealth creation. These funds diversify their investment portfolios that includes a mix of equity and debt instruments.Types of hybrid funds

Hybrid funds combine the potential for capital appreciation and stable income generation. By diversifying across equity, debt and other asset class instruments, these funds aim to mitigate risks. If the investor keeps their goals under careful consideration and does independent research, hybrid funds may be valuable for their investment strategy.Commodities fund

A popular investment avenue for exposure to precious metals is via commodity funds. Investing in precious metals has been historically considered safe by investors, especially during times of economic uncertainty. Commodities funds give investors the opportunity to be a part of the precious metals sector, while also diversifying their portfolios. Sectoral precious metal commodity funds are a category of funds that focus primarily on investing in companies engaged in the exploration, mining, refining, or production of precious metals such as gold, silver, platinum, or palladium. These funds can be actively or passively managed, with a benchmark index tracking.Types of commodity funds

Sectoral precious metal commodity funds are a category of funds that focus primarily on investing in companies engaged in the exploration, mining, refining, or production of precious metals such as gold, silver, platinum, or palladium. These funds can be actively or passively managed, with a benchmark index tracking.

These metal commodity funds offer investors an added advantage for exposure to the precious metals sector without the risks associated with physically owning the metals. However, investors should also carefully evaluate the performance and expenses associated with such funds before making any investment decisions.

Why open a mutual fund account?

Investing is considered an essential tool for individuals to achieve their long-term financial goals and to also build wealth. A popular investment avenue is mutual funds. These funds offer a convenient way to invest in a diversified portfolio of stocks, bonds, or other securities.A note on how to open a mutual fund account with Upstox

If you are already an Upstox Demat Account Holder then you can simply visit the Upstox MF Platform page and start browsing through more than 2,000 schemes available to you. Alternatively If you are not an Upstox Demat Account Holder, then visit the “Open Demat Account” page on the Upstox website (www.upstox.com) using a web browser or mobile device.We provide a seamless platform for investors to open a mutual fund account and start investing in mutual funds. In this step-by-step guide, we walk you through the process of opening a mutual fund account and begin your investment journey with ease.

Benefits of investing in mutual funds

Investing in mutual funds has several benefits for individuals seeking to grow their wealth and achieve their financial goals. Mutual funds have a range that appeal to everyone from seasoned investors, newcomers, and those in-between.Here’s the key benefits of mutual funds:

Professional fund management

Mutual funds are managed by experienced and qualified fund managers who analyse market trends and do regular research on these trends. These fund managers are given the responsibility to make investment decisions on behalf of the best interests of their investors. A professional fund manager’s expertise and knowledge can help navigate the complexities of the market.Diversification

By pooling funds from multiple investors, mutual funds spread the investment across a variety of asset classes such as stocks, bonds, and money market instruments. This diversification reduces risk. Furthermore, investors get the opportunity to invest in a wide range of investments without having to singularly invest in each asset individually.Convenience

Investing in mutual funds is convenient for all investors via online platforms and mobile apps. The Upstox App give investors the opportunity to open an account, transact, and monitor their investment with ease.Affordability and flexibility

Mutual funds offer a place for investors with different budgets. This benefit makes mutual funds affordable for several individuals. Additionally, mutual funds offer flexibility in terms of investment options, such as lump-sum investments or systematic investment plans (SIPs). This flexibility lets investors align their financial goals and risk appetite.Transparency and regulation

Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI). These funds are required to provide regular updates on their performance, holdings, expense ratios, and other miscellaneous relevant information. SEBI strives to ensure transparency and aims to protect investors.Liquidity

Most mutual funds let investors buy or sell their units at any time based on the prevailing Net Asset Value (NAV). This liquidity feature offers investors the flexibility to exit or modify their investments per their financial requirement.Tax benefits

Certain categories of mutual funds offer tax benefits in India. For example, an Equity-Linked Savings Schemes (ELSS) provides tax deductions under Section 80C of the Income Tax Act. Investing in ELSS funds helps individuals save taxes and aims for long-term wealth creation.

Benefits of opening a mutual fund account with Upstox

Upstox is remarkable for being reliable and technologically sound. We offer a seamless investment experience with regard to mutual funds. Upstox is the smart choice for investors looking to maximise their investment potential.The mutual fund platform offers:

A wide range of mutual fund options

Gain access to a vast array of mutual funds, including equity funds, debt funds, hybrid funds, and more. With over 2,000 mutual funds to choose from, investors have the flexibility to choose funds that align with their risk appetite, investment goals, and time horizon. Our extensive selection empowers investors to create a well-balanced investment strategy.User-friendly platform

Our investment platform is user-friendly and intuitive. We make it easy for investors to navigate the various investment options. The platform gives detailed information about each mutual fund, including its performance history, expense ratio, holdings, and investment objectives.Paperless and convenient account opening

We have simplified the account opening process by providing a paperless experience. Investors can open a mutual fund account seamlessly by completing the online application and submitting the required documents electronically. This reduces the amount of time and effort usually an investor needs to put into account opening. We help investors begin their investment journey swiftly.Low costs and transparent fees

Our low-cost structure is an added advantage for the investor. Upstox ensures that investors can invest in mutual funds with minimal expenses. This enables investors to optimise their returns. Our platform is transparent in its fee structure. Investors have a clear understanding of the charges associated with their mutual fund investments.Robust research and analytics

We equip investors with a range of research and analytical tools to assist in making informed investment decisions. Through our platform, investors can access comprehensive research reports, performance analysis, and historical data of mutual funds. These insights help investors evaluate the past performance and future potential of funds. Overall investors are enabled to make well-informed investment choices.Security and trust

When it comes to investing, security is of paramount importance. Upstox prioritises the safety and privacy of its investors. We safeguard an investor’s financial information.

A comparative analysis between mutual funds and Systematic Investment Plans (SIPs)

When it comes to investing, mutual funds and Systematic Investment Plans (SIPs) are two popular choices. While both investment options offer potential for long-term growth, it is essential to understand their differences and benefits in order to make an informed investment decision. In this comparative analysis, we glance at the aspects of mutual funds and SIPs, especially keeping in mind, key factors such as investment approach, flexibility, cost, and risk management.| Characteristic | Mutual Fund | SIP |

|---|---|---|

| Investment Approach |

|

|

| Flexibility |

|

|

| Cost |

|

|

| Risk Management |

|

|

| Return Potential |

|

|

Both mutual funds and SIPs are avenues to invest in a diversified portfolio of securities. Mutual funds offer flexibility, a wide range of investment options, and the potential for higher returns. SIPs provide a disciplined and convenient investment approach, along with risk management benefits. Ultimately, the choice between mutual funds and SIPs is based on the individual’s investment goals, budget, and risk appetite. It is recommended to consult a financial advisor and go through independent research to make an informed decision that aligns with your investment objectives.

A comparative analysis between lump-sum investments and Systematic Investment Plans (SIPs)

Individuals have the option to invest through Systematic Investment Plans (SIPs) or make lump-sum investments. Both approaches have their own merits and considerations.What are lump-sum investments?

A lump-sum investment is about investing a certain (sometimes significant) amount of money in a single transaction. Investors who opt for lump-sum investments are may want to utilise an immediate market opportunity. These investors may also have a pre-existing amount of funds immediately available for investment purposes. A lump-sum investment It implies that substantial capital is deployed at one go.What are Systematic Investment Plans (SIPs)?

A Systematic Investment Plan (SIP) is a disciplined approach to investing. It involves investing a fixed amount at regular intervals, such as monthly or quarterly. Investors can choose their preferred monetary amount for investment. After investors decide on that figure, the money is automatically deducted from their bank account and invested in their selected mutual fund scheme. SIPs encourage regular savings and benefit from rupee-cost averaging.In this comparative analysis, we explore SIPs and lumpsum investments with their key characteristics.

| Feature | SIP | Lump-sum |

|---|---|---|

| Risk Mitigation |

|

|

| Investment Discipline |

|

|

| Market Timing |

|

|

| Diversification |

|

|

| Flexibility and Liquidity |

|

|

Choosing between a lump-sum investment or an SIP is underlined by different factors. It is advisable to consult with a financial advisor to evaluate your specific financial situation and goals to determine the most suitable investment strategy tailored for you.

Understanding how returns are calculated for mutual funds

While mutual funds are a popular investment avenue due to their potential to generate attractive returns, as an investor, it is also elemental to understand how mutual fund returns are calculated. In a way that makes the process easier, ee briefly glance some methods used to calculate mutual fund returns.Time-Weighted Return (TWR)

Is the most commonly used method to calculate mutual fund returns. It measures the performance of the fund over a specific period, but does not consider the investor inflows or outflows during that period. Therefore, the TWR provides a fair representation of the fund’s performance by omitting the impact of timing and investment flows.Formula for TWR: [(Ending NAV/Beginning NAV) - 1] x 100

Point-to-Point Return

Calculates the returns of a mutual fund by considering the change in the Net Asset Value (NAV) of the fund between two specific dates. This method is useful while analysing the performance of a fund over a particular investment horizon.Formula for Point-to-Point Return: [(Ending NAV/Beginning NAV) - 1] x 100

Annualised Returns

Provide the compounded return rate of a mutual fund over a specific period, typically expressed on an annual basis. It helps investors understand the long-term performance of the fund.Formula for Annualised Returns: [(Ending NAV/Beginning NAV)^(1/number of years)] – 1

Rolling Returns

Measure the fund’s performance over various overlapping periods within a specific time frame. It helps investors assess the consistency of returns across different market cycles.Calculation of Rolling Returns:

- Select a specific time period (e.g. 3 years) and calculate returns for all overlapping periods within that timeframe.

- Calculate the average returns for all overlapping periods.

CAGR (Compound Annual Growth Rate)

Is a standardised method to calculate the annualised return of an investment over a specific period, considering the impact of compounding. It provides a holistic view of the fund’s growth, especially for long-term investments.Formula for CAGR: [(Ending Value/Beginning Value)^(1/number of years)] - 1

Total Returns

Represent the overall return generated by a mutual fund, considering both capital appreciation and income earned from dividends or interest. It provides a comprehensive view of the fund’s performance, including all sources of returns.You can also get a quick estimate on your mutual fund returns by using the Mutual Fund Calculator on Upstox.

Factors to consider while evaluating mutual fund returns

Evaluating mutual fund returns requires a careful analysis of various factors beyond simply only looking at the advertised returns. Here are the key factors to consider when evaluating mutual fund returns in India.Past performance

While past performance does not guarantee future results, it is an essential starting point to evaluate mutual funds. Look for consistent returns over various time horizons (1 year, 3 years, 5 years, and beyond) to assess how the fund has performed across different market cycles. Compare the fund’s performance with its benchmark index and similar funds within the same category.Risk-adjusted returns

Evaluating returns with no context can be misleading. It is important to consider risk-adjusted returns. This takes into account the level of risk undertaken to achieve those returns. The Sharpe ratio, Sortino ratio, and Treynor ratio are popular risk-adjusted metrics that can help assess the fund’s ability to generate returns relative to the amount of risk it assumes.The fund manager

The knowledge and experience of the fund manager has a significant role in a mutual fund’s performance. Evaluate the fund manager’s track record, including their ability to deliver consistent returns and their investment strategy. Fund managers who have demonstrated skills in managing funds through various market conditions, can be considered mutual fund experts.Expense ratio

These are the fees charged by the mutual fund company for managing the fund. It directly impacts the fund’s returns. Lower expense ratios mean more of the fund’s returns are passed on to the investors. Compare the expense ratio of the fund with its peers to avoid paying excessive fees that can impact returns over the long term. Portfolio composition Is crucial in understanding the risk and return potential for the mutual fund. Analyse the asset allocation across different sectors, the concentration of holdings, and the fund’s investment style, growth and value. A well-diversified portfolio can help mitigate risks and generate consistent returns.Fund size and liquidity

The size of a mutual fund can impact its ability to manage investments effectively. A fund that becomes too large may face challenges in maintaining its performance due to limitations in finding suitable investment opportunities. Additionally, consider the fund’s liquidity, especially in case investments need to be redeemed during periods of market volatility or other contingencies.Investment objective and time horizon

Different funds have varying risk-return profiles. It helps an investor if they align their investment goals with the fund’s objective.Investor preference

An investor should evaluate whether the mutual fund aligns with their risk tolerance and investment preferences. Considering factors like risk appetite and financial goals will determine an investor’s preferences. Choosing a mutual fund should be based on an investor’s individual requirements.Evaluating mutual fund returns requires a holistic analysis of the different factors involved. This helps an investor make informed decisions that align with their financial goals. A note to remember that investing in mutual funds carries inherent risks. It is essential to conduct independent research and seek professional advice.

DDT and other charges for mutual funds

While investing in mutual funds offers many opportunities to grow wealth in the long term, it is also essential to understand the charges and fees associated with mutual fund investing. We glance at the Dividend Distribution Tax (DDT) and other charges applicable to mutual funds. This information will help an investor make informed financial decisions.Dividend Distribution Tax (DDT)

DDT is a tax levied on the dividend distributed by mutual funds to their investors. It is deducted at the source by the mutual fund company before the dividend is paid out to the investor. Historically, mutual funds were subject to DDT, while the dividend received by the investor was tax-free. After the Union Budget 2020, DDT was revised. At present, the tax liability is shifted upon the investors. Since April 1, 2020, dividend income from mutual funds is now taxable in the hands of the investor as per their applicable tax slab.Expense ratio

This ratio represents the fees charged by the mutual fund company for managing the fund. It includes various expenses such as fund management fees, administrative costs and trustee fees. The expense ratio is expressed as a percentage of the fund’s average assets under management (AUM) and is deducted from the fund’s returns.Entry load and exit load

These are charges imposed by mutual funds for investing in or redeeming units of the fund. As of August 2009, the Securities and Exchange Board of India (SEBI) banned entry loads for mutual funds. This was done by the regulator to ensure that investors do not have to pay any upfront charges. However, the exit load, is a fee charged when investors redeem their units before a specified period, known as the exit load period. The exit load percentage varies across different mutual funds.Securities Transaction Tax (STT)

STT is a tax levied on the purchase or sale of securities, including equity-oriented mutual funds, in India. It is calculated as a percentage of the transaction value and is borne by the investor. The rates of STT vary for different types of transactions, such as equity-oriented funds, debt-oriented funds, and equity shares. STT is applicable on the sale of units of equity-oriented mutual funds when the redemption takes place on a stock exchange.Goods and Services Tax(GST)

GST is a value-added tax levied on the provision of goods and services in India. Since July 1, 2017, GST is applicable to various services related to mutual funds, such as fund management fees, custodian charges, and registrar and transfer agent fees. The rate of GST applicable to these services is currently 18%.Other charges

Additional charges may apply to a mutual fund investment, such as transaction charges and account maintenance charges. These charges vary across different mutual fund companies and should be carefully considered before investing.Understanding the taxes and charges associated with mutual funds is essential. While DDT, as of the year 2023 is banned, investors should also be aware of the tax implications of dividend income. By being mindful of the taxes and charges, an investor can evaluate mutual funds more clearly.

Tax benefits and implications for mutual funds

Mutual funds offer several tax benefits that can help investors optimise their returns better. Here are some of the tax implications and benefits of investing in mutual funds.Taxation of capital gains

Mutual funds generate capital gains when the underlying securities are sold at a profit. The tax treatment of capital gains in mutual funds depends on the holding period.Short-term Capital Gains (STCG)

If mutual fund units are sold within three years of purchase, the gains are considered short-term capital gains. STCG from equity-oriented funds are taxed at a flat rate plus applicable surcharge and cess. However, for debt-oriented funds, the gains are added to the investor’s income and taxed at their respective income tax slab rates.Long-term Capital Gains (LTCG)

If mutual fund units are held for more than three years, the gains are considered long-term capital gains. For equity-oriented funds, LTCG up to Rs. 1 lakh is exempt from tax. Any LTCG above Rs. 1 lakh is taxed plus applicable surcharge and cess. For debt-oriented funds, LTCG is taxed at a rate with indexation benefits.Tax benefits of Equity-Linked Saving Scheme (ELSS)

ELSS is a type of mutual fund that offers tax benefits under Section 80C of the Income Tax Act. Investors can claim a deduction of up to Rs. 1.5 lakh from their taxable income by investing in ELSS funds. ELSS has a specified lock-in period. The returns generated are tax-free.Dividend Distribution Tax (DDT)

As of April 1, 2020, dividend income from mutual funds is taxable for investors. The tax rate for dividend income depends on the investor’s income tax slab.After consulting with a tax advisor or financial planner, an investor can receive personalised guidance. By understanding the tax implications, investors can make informed financial decisions and optimise on the full potential of mutual fund investments.

What is an ELSS?

An ELSS is an acronym for Equity Linked Saving Scheme (ELSS). This type of mutual fund scheme provides tax-saving benefits and also doubles up as a tool for wealth creation tool. ELSS primarily invests in equity or equity-related instruments. It is designed to help investors save taxes under Section 80C of the Indian Income Tax Act. With a lock-in period of three years, ELSS has the shortest lock-in period among all the tax-saving investment options.ELSS benefits

ELSS investments are eligible for a deduction of up to Rs. 1.5 lakh per financial year under Section 80C of the Income Tax Act. An investor has a dual benefit of both tax-savings and an opportunity for wealth creation. With a lock-in period of only three years, an ELSS offers investors a chance to liquidate as required to fit their requirement. Investors have the flexibility to invest in ELSS either through a lump sum investment or via an SIP.ELSS is a tax-efficient investment option and provides investors the opportunity for wealth creation through equity investments. Consulting a financial advisor can also provide valuable insights in building a an investment portfolio that includes ELSS.

What is an index fund?

An index fund is a type of mutual fund that aims to replicate the performance of a specific stock market index, such as the Nifty 50 or the BSE Sensex, by investing in the same securities that make up the index. These funds passively track the index, meaning they do not rely on active fund management or frequent buying and selling of stocks.Benefits of an index fund

Index funds typically have lower expense ratios compared to actively managed funds. Also while index funds do not aim to outperform the market, they aim to match its performance. This consistency can be beneficial for long-term investors who prioritise steady growth over time. As Index funds disclose their holdings regularly, this lets investors clearly understand where their money is invested. However, it is important to note that index funds are subject to market risk.What should be considered before investing in mutual funds?

Before venturing into mutual fund investing, it is elemental to understand some factors that can significantly impact your investment journey. First, an investor should define their investment objective and assess their risk tolerance. Investment objectives can range between wealth creation to capital preservation. Risk tolerance refers to the investor’s degree of ability to withstand market fluctuations.Here’s a few more fundamental factors to consider. These may help an investor choose the right mutual fund that aligns with their investment strategy.